You may be able to literally pay for your everyday purchases with bitcoin soon.

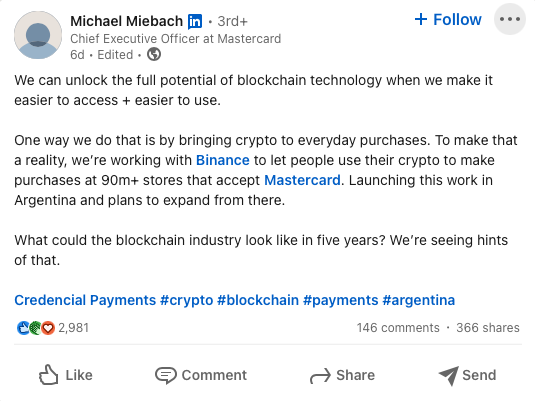

Mastercard (NYSE: MA) announced that it is working with Binance to enable using crypto assets as payments through its network. CEO Michael Miebach posted on his LinkedIn account that the payment gateway is aiming to “let people to use their crypto to make purchases at 90m+ stores that accept Mastercard.”

“We can unlock the full potential of blockchain technology when we make it easier to access + easier to use. One way we do that is by bringing crypto to everyday purchases,” Miebach wrote.

The long-awaited move follows the company’s announcement in February 2021 of allowing certain cryptocurrencies on its payment network.

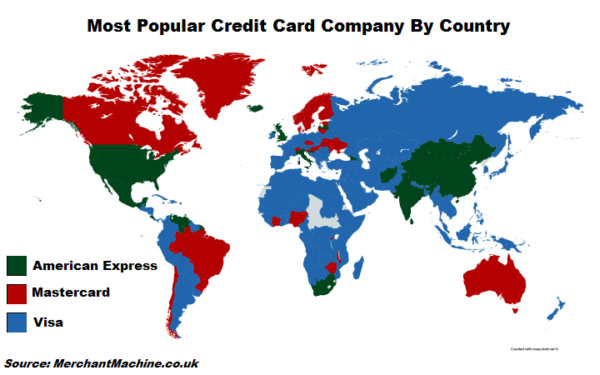

Mastercard’s leading competitor, Visa (NYSE: V), is also reportedly working on integrating the cryptocurrencies to its network. In January, Visa said there’s around US$2.5 billion in transactions through its crypto-linked cards in Q1 2022—more than half of all Visa’s crypto volume for 2021.

But Mastercard is taking one step ahead–the global payment platform launched its Binance crypto card in Argentina. The card allows Argentinians to transact using their crypto assets that will be changed to fiat currency at point of sale.

Binance Card pilot starting in Argentina. Details here: https://t.co/UbAONYcJ3j

— Michael Miebach (he/him/his) (@MiebachMichael) August 23, 2022

#Binance card launch party in Argentina 🇦🇷!! Attendees got a chance to win binance merch and dummy cards.

— Spidey_ElonFan (@spideycyp_155) August 29, 2022

Binance parties are 🔥 @cz_binance how do I earn merchandise. pic.twitter.com/IxnTlsuVJV

Adaptability has been one of the key issues in adopting cryptocurrency. The ease of doing everyday transactions using crypto coins would push the industry further as an acceptable mode of payment.

Mastercard’s crypto card is set to support 14 cryptocurrencies, including the U.S. dollar-pegged stablecoin tether, bitcoin, ethereum, BNB, cardano, solana, and XRP, among others.

Mastercard last traded at US$327.22 on the NYSE.

Information for this briefing was found via Forbes. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.