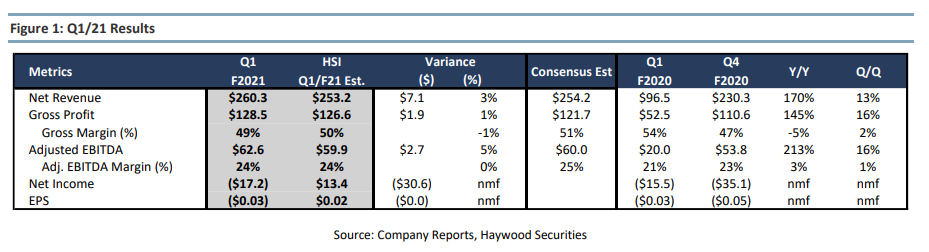

Curaleaf Holdings (CSE: CURA) reported its first-quarter results on May 10th, beating the consensus estimates for their top line. The stock is up 3.5% since reporting its earnings. The company reported $260 million in revenue, up 13.1% quarter over quarter. The company additionally reported an outstandingly high 227.5% tax rate.

Analysts seem to still be digesting this quarter’s earnings with no change in Curaleaf’s consensus 12-month price target of C$27.86. Four analysts have strong buy ratings while the other ten analysts have buy ratings. BTIG has the street high at C$34 while Cormark Securities has the lowest at C$24.

In Haywood’s analyst note, their analyst Neal Gilmer reiterates his C$28 price target and buy rating on Curaleaf and he says that the reported numbers beat their expectations. Management guidance for the second quarter of $305-$315 million indicates a very strong revenue growth for the rest of the year.

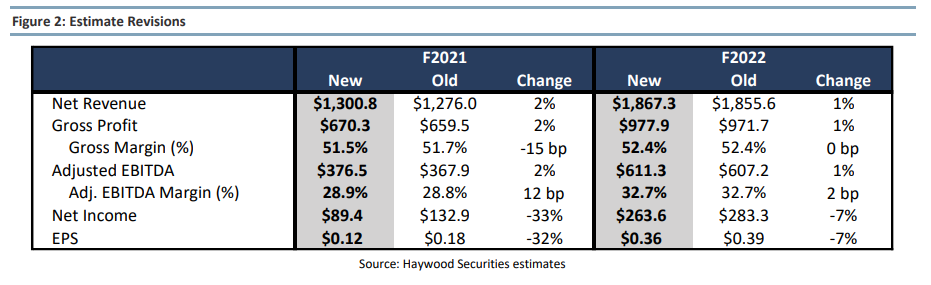

Gilmer reiterates Curaleaf as their top pick as the company, “continues to perform well across key markets in the U.S and we expect continued positive momentum in the U.S.” You can see their updated key changes for 2021 and 2022 below.

Curaleaf’s revenue came in about 3% above Haywoods $253.2 million estimate and 1% higher in gross profit. Adjusted EBITDA was the largest line-item beat with Curaleaf reporting $62.6 million, 5% higher than the $59.9 million estimate Haywood had.

Forward-looking, the revenue guidance does wonder to set the stage for a strong second half of 2021 as the $300mln+ in quarterly revenue puts the company on a good track to hit its $1.2-$1.3 billion full-year guidance. Gilmer also expects that the companies additional capacity in key states will start to turn on in the second quarter, which will help them hit their full-year guidance. He adds, “The Q1 results demonstrate evidence of continued growth in key markets as well as new product introductions.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.