With no end in sight to the coronavirus pandemic, the demand for air travel remains subdued. As a result, airlines across the US continue to struggle to remain afloat as they look for new means of raising liquidity.

Delta Airlines has recently announced that it plans to borrow up to $6.5 billion backed by its frequent-flyer program platform SkyMiles in order to increase its liquidity position. The airline will sell senior secured notes as it enters a new term loan, with a portion of the $6.5 billion allocated towards its reserve account. Last week, Delta noted that it has been burning through approximately $27 million per day since the onset of the pandemic.

The airline, along with many of its rivals have been turning to ulterior programs as means of gaining more resilient liquidity during a time when air travel is at a historic-low. Back in April, the CARES Act did set aside $25 billion to go towards airline employee’s payroll, but several airlines in the US have decided to refrain from tapping into the government-funded support. Although the bailouts would most likely have been an easier route to pursue, the $25 billion payroll support would prohibit airlines from administering job cuts until at least October 1 – something that perhaps the airline companies did not want to abide by.

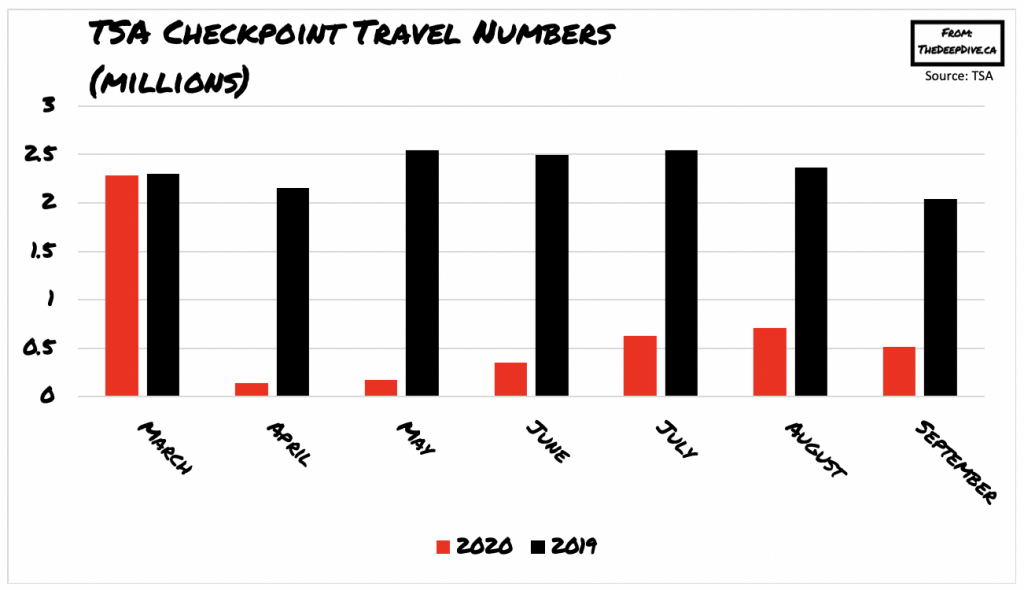

To further attest to the dilemma that many US airline companies are facing as a result of the pandemic, the latest numbers released by the TSA suggest that the demand for air travel is going to remain subdued for a longer period of time than initially anticipated. When countries around the world imposed strict lockdown measures in order to curb the spread of the virus, air travel across the US fell by a staggering 94% between March and April. However, as the US began to lift restrictions in May, airports began to see an optimistic uptake in numbers that progressed for the remainder of the summer.

However, as the summer travel season begins to wind down, many airlines will revert back to facing an alarming decline in demand. In the first week of September, the number of travellers passing through TSA checkpoints fell by 27% compared to August, causing air travel to fall by a staggering 74% from the same time a year prior. As the US government continues to fail at containing the spread of the virus, many Americans are growing increasing worried of infection risks – something that even air travel incentives won’t be able to mitigate.

Information for this briefing was found via Delta Airlines and the TSA. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.