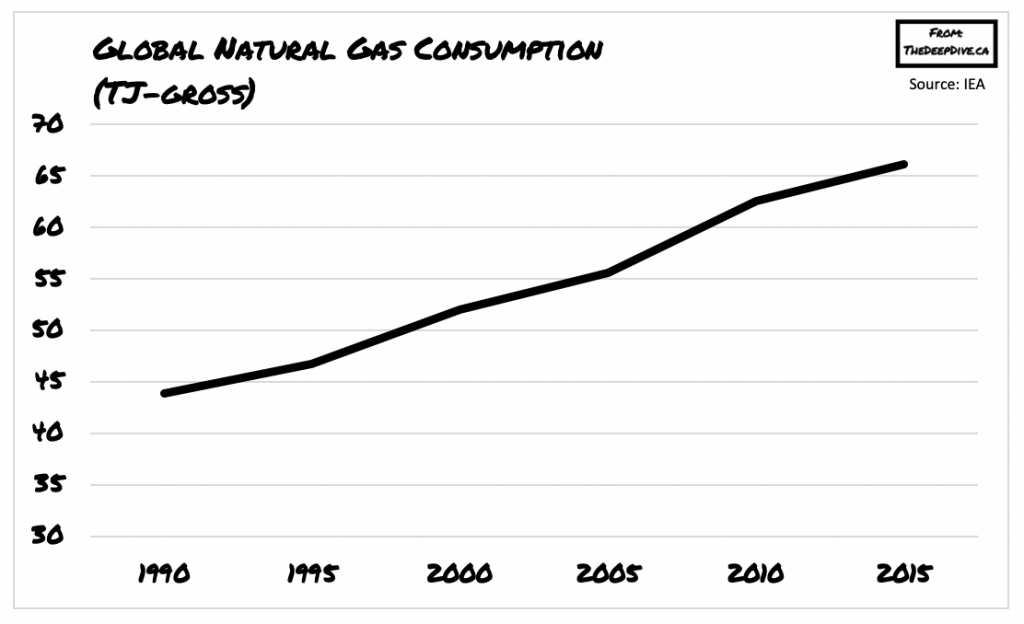

Amid the growing economic chaos surrounding the coronavirus pandemic, there appears to be an emerging trend that could have a significant impact on the future of the crude oil industry. As emission rules around the world are becoming increasingly strict, many large transport companies such as containerships are looking for diesel alternatives. LNG, which is natural gas in its liquid state has been a promising alternative and as a result the demand for LNG-fueled container ships has skyrocketed over the past year.

As many shipping companies around the world have become increasingly receptive to the idea of fueling ships via LNG, orders for LNG-fueled vessels have been skyrocketing. Eastern Pacific Shipping, which is one of the largest ship owners in the world, has recently received its first delivery of the first ever LNG-powered Very Large Containership. However, this order is the beginning stages of a new demand for crude oil alternatives in the shipping industry.

Recently, the International Maritime Organization has tightened the rules on maximum emission requirements, prompting many LNG producers to increase their capacity in anticipation of the new demand. However, the coronavirus pandemic soon crushed the demand for fuels around the world, causing crude oil prices to plummet to record-lows. Nonetheless, LNG producers still continue to have an upper hand in the fuel supply industry; according to SEA-LNG, which is a multi-industry body, new orders for LNG-fuelled ships skyrocketed by 50% over the past 12 months, as the LNG-powered ship fleet is anticipated to double over the next decade.

According to a recent Reuters report, there are a total of 80,000 registered ships around the globe, but less than 400 of them are powered by LNG. However, at the current pace of new orders, the fleet of LNG-fuelled ships is expected to rise to 1,000 by 2030. Currently, the industry leader in utilizing LNG-powered ships is Europe, but as Singapore and Malaysia look to increase their demand for cleaner fuel, the shipping industry will soon undergo some significant changes in the coming years.

However, a large factor that will ultimately predict the success of the shipping industry’s transition towards LNG-powered fleet will largely depend not only on evolving emission standards, but price as well. As new emission-reducing rules continue to be explored across many countries, an increasing number of shippers will be left with minimal choices in terms of fuel, such as low-sulfur fuel oil, sulfur scrubbers, or LNG.

Although LNG appears to be the dominant choice for many shipping companies looking to evolve their fleet, the liquid natural gas is not much better than diesel fuel in terms of environmental impacts. In fact, some studies have found that LNG is actually dirtier than diesel because it emits significantly more methane, which in turn is more potent than carbon dioxide. However, once methane is released into the atmosphere, it dissipates much quicker, thus making its negative effects last for a shorter duration.

Despite some of the negative environmental concerns, more and more shipping companies are getting onboard the trend towards LNG-powered vessels. In fact, mining giant BHP Billiton has added to the growing demand for emission compliance by chartering five LNG-powered bulk carriers to transport iron ore between Australia and China. Indeed, the global demand for crude oil has been significantly impacted by the pandemic, but it appears that its rebound may be further impeded as the shipping industry quietly continues to make disruptive changes.

Information for this briefing was found via SEA-LNG and BHP Billiton. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.