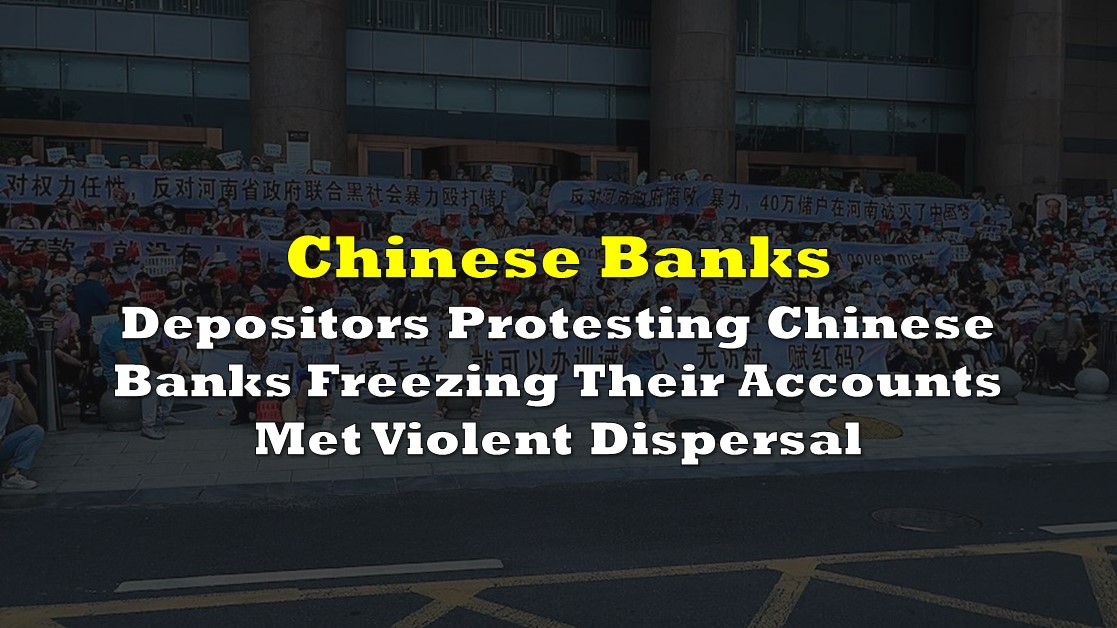

Instead of withdrawing their money, depositors of major rural banks in the Chinese city of Zhengzhou received violent dispersal by security personnel instead, with some sustaining injuries.

Around 1,000 protesters gathered before the Zhengzhou branch of China’s central bank, demanding access to their respective accounts. In April 2022, Yu Zhou Xin Min Sheng Village Bank, Shangcai Huimin Country Bank, and Zhecheng Huanghuai Community Bank all froze deposit accounts due to internal system upgrades.

According to Chinese media, the frozen deposits could be worth up to US$1.5 billion.

CITIZENS STORM BANK OF CHINA IN ZHENGZHOU OVER FROZEN ASSETS pic.twitter.com/DDrKaKTCbF

— FXHedge (@Fxhedgers) July 10, 2022

“They did not say they would beat us if we refused to leave. They just used the loudspeaker to say that we were breaking the law by petitioning. That’s ridiculous. It’s the banks that are breaking the law,” one of the protesters surnamed Zhang told Reuters.

The protesters originally planned to gather in front of the banking institution a month ago, but they were prevented from doing so as their health passes were changed to “no travel” status. The passes tied to Chinese citizens’ phones have been the government’s way of monitoring movement during the pandemic. This led to the depositors believing that the banks are in collusion with the government authorities.

“I can’t do anything, I can’t go anywhere. You’re treated as though you’re a criminal. It infringes on my human rights,” said another protester surnamed Liu to Reuters.

“They are putting digital handcuffs on us,” added another depositor from Sichuan province surnamed Chen.

While deposits are frozen, some bank clients report that they can access the account if they’re depositing money but not through withdrawals.

This is huge. Don't know how this will end. Henan bank is NOT the only one that is having problems with liquidity. All four Chinese banks are having the same issue. Some depositors found they can save and can NOT withdraw money with their bank cards. #bankrun #China #CCP pic.twitter.com/5WYYgpmIWP

— Jennifer Zeng 曾錚 (@jenniferatntd) July 10, 2022

As of today, the banks haven’t released any statement regarding the matter. According to state media Global Times, the banks are being investigated for illegal fundraising.

Information for this briefing was found via Reuters. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.