As the coronavirus pandemic continues to wreak havoc across many countries and even making a resurgence in some, the global economic recovery phase continues to be pushed back even further.

According to a recent warning by Deutsche Bank CEO Christian Sewing, it is going to take significantly longer for the world economy to recover from the pandemic than previously anticipated. Speaking at a Handelsblatt Banking Summit in Frankfurt, Sewing noted that although an economic recovery will eventually happen, it will do so in phases and not across all industries. Many parts of the economy will not have the means to operate in full, and will instead be lowered to 70-90% capacity at most. In fact, some companies will have no other choice but to suffer with reduced sales for a long period of time.

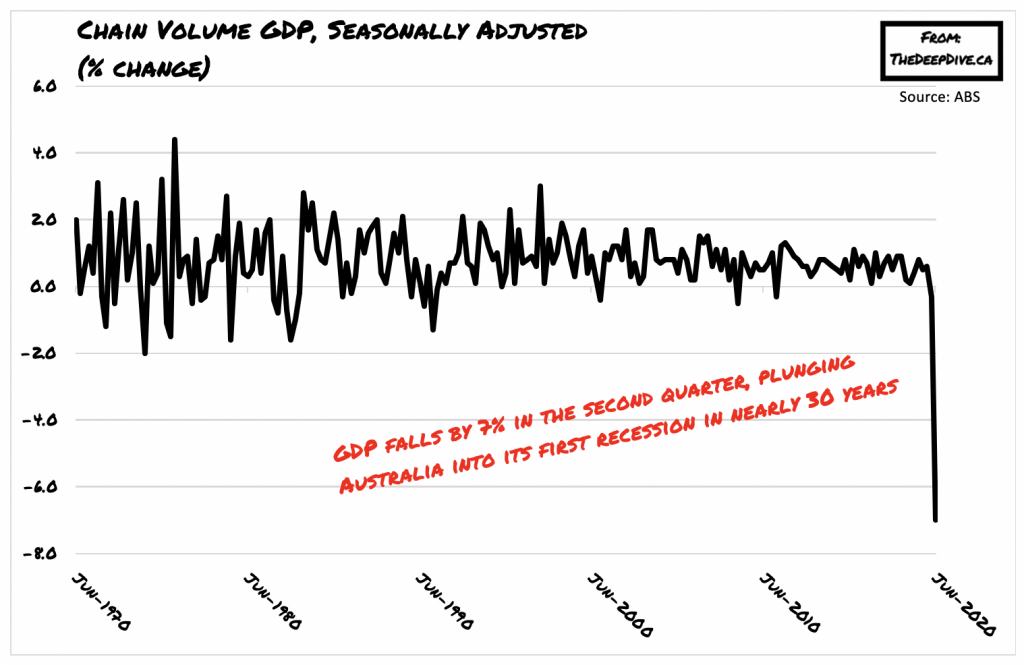

With the pandemic not going away anytime soon, there continue to be more and more countries crumbling under the weight of economic strain, and ultimately collapsing into a recession. Australia, which was immune to economic fluctuations for nearly thirty years – even avoiding the 2008 financial crisis – finally gave way and entered the growing list of countries that have been embattled by the pandemic.

Sewing also noted that the optimism surrounding a rebound in Europe is beginning to fade. Compared to the US, which has been deeply struggling to contain the spread of the virus, American companies are more adaptable to sudden changes than European companies. European firms have a higher tendency to wait for government aid, which in turn increases the likelihood of the emergence of “zombie” companies. According to Creditreform, which is a German credit agency, approximately one-sixth of Germany’s companies are at risk of turning into “zombies.”

Companies that have higher debt servicing costs relative to their profits, but manage to stay afloat as a result of relentless borrowing, are considered “zombie” companies. According to a previous Deutsche Bank Securities analysis, the US is not immune to the emergence of “zombie” firms. In fact, an increasing number of such companies have been emerging in the US recently, and approximately one in five companies could become “zombies” as a direct result of the pandemic.

Information for this briefing was found via Deutsche Bank and the Australian Bureau of Statistics. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.