This week Digimax (CSE: DIGI) announced they have executed their merger with DataNavee. DigiMax is a CSE issuer focused on raising capital using cost effective block chain technologies. They will be adding DataNavee so clients can upload their own data sets to receive predictive analytics using AI.

DataNavee provides clients with custom reports after they upload their own data sets. The custom reports are created utilizing predictive analytics as a service. This approach will allow clients to avoid expensive inhouse scientists producing highly sophisticated predictive analytics at a fraction of the cost of custom in-house solutions.

The transaction will see DigiMax, currently at 60.6M shares outstanding, issue an additional 55M shares to the existing shareholders of DataNavee. The shares will be unlocked in 11.25M share block increments, with the first block already free trading. Each additional block will unlock after each consecutive 4 months period for the next 12 months. As of the company’s most recent investor deck (August 2020), DigiMax/DataNavee is looking to raise $1.25M at 5c. Bringing the total share count to approximately 165.6M share outstanding (178.1M fully diluted).

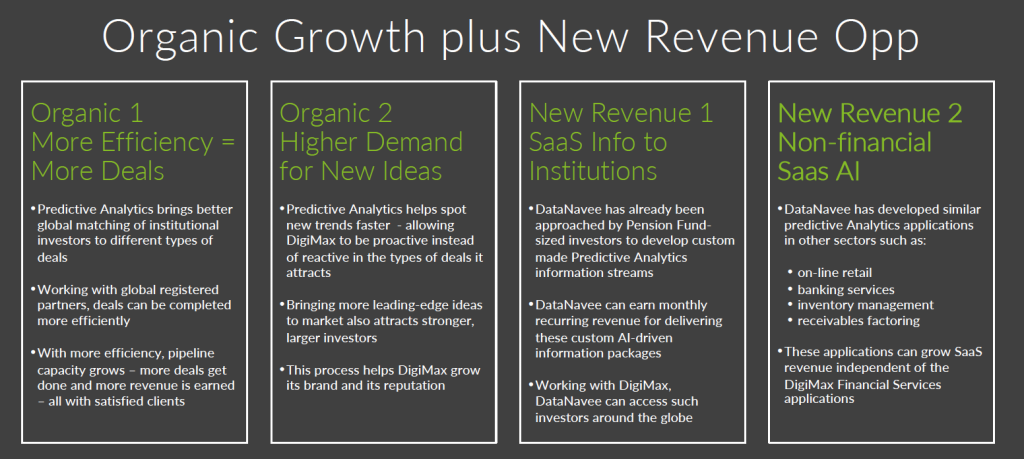

The strategy for DigiMax is to create a capital raising platform that combines predictive analytics to cost effective blockchain. The combination will create an opportunity for increased deal flow for areas such as: online retail, banking, inventory management, and receivables factoring. The goal is to eliminate previous inefficiencies, using AI to allow clients to raise capital in days as opposed to months at a highly reduced cost.

Digimax is an exempt market dealer registered in the Province of Ontario. Exempt Market Dealers (EMDs) are fully registered securities dealers who engage in the business of trading in prospectus exempt securities, or any securities to qualified exempt market clients. Effectively a license to raise money in Canada for both public and private deals.

DigiMax last traded at 6c on 743k shares volume as of market close on September 5, 2020.

FULL DISCLOSURE: DigiMax is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover DigiMax on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.