The bad news just keeps coming for DionyMed Brands (CSE: DYME). Following the announcement earlier this week that it had attempted to restructure its debt, it seems that certain creditors were not satisfied with the result. Flow Capital Corp (TSXV: FW) last night announced that it has commenced legal proceedings against the firm.

The legal case is a result of overdue royalty payments owed to Flow Capital. The firm was an early-round investor in DionyMed, with whom they have a US$1.0 million royalty agreement with. In total, Flow Capital alleges that they are owed close to $2.7 million in overdue royalty payments and late payment fees. Flow Capital is also wishing to recover its initial investment, which is included in the claimed sum.

The news is the second of the week in relation to DionyMed and bad debts. On Thursday, the firm announced that it had secured an additional $3.2 million from a syndicate of investors with whom their senior secured debt facility is currently in default. In that same release, DionyMed indicated that Gotham Green had requested the return of its $2.2 million investment as well, which was only acquired at the end of July.

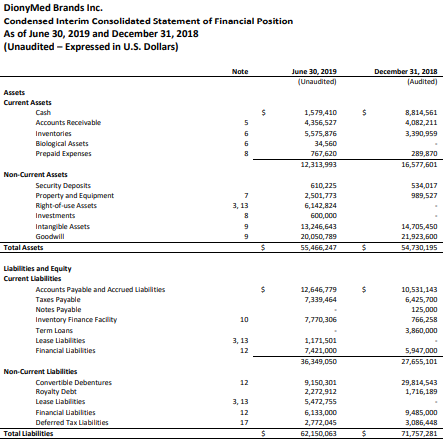

It’s a precarious position to be in right now for DionyMed, who’s liabilities outnumber its assets by close to $7.0 million. The firms current accounts payable alone comes in higher than current assets, with the former being $12.6 million, versus total current assets of $12.3 million. While total assets come in at $55.4 million for the firm, close to a majority is in the form of goodwill and intangible assets at a combined $23.2 million – something that is nearly impossible to take to the bank.

Investors for what its worth, have appeared to have caught wind of the dire situation DionyMed currently finds itself in. The equity has fallen from $0.56 to that of $0.17 over two trading sessions – a 69.64% decline. What’s worse, is the equity hit a September high of $1.26 on the third, representing a decline of 86.05% within the last several weeks.

The latest news is doubtful to create any buying action, which has noticeably been absent over numerous sessions.

Information for this briefing was found via Sedar, Flow Capital and DionyMed Brands. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.