On April 22, Stockholm, Sweden-based auto supplier Autoliv, Inc. (NYSE: ALV) reported disappointing 1Q 2022 earnings. Autoliv produces and sells safety-related parts which are standard equipment in all vehicles, such as airbags, seatbelts and steering wheels, to many leading global car manufacturers.

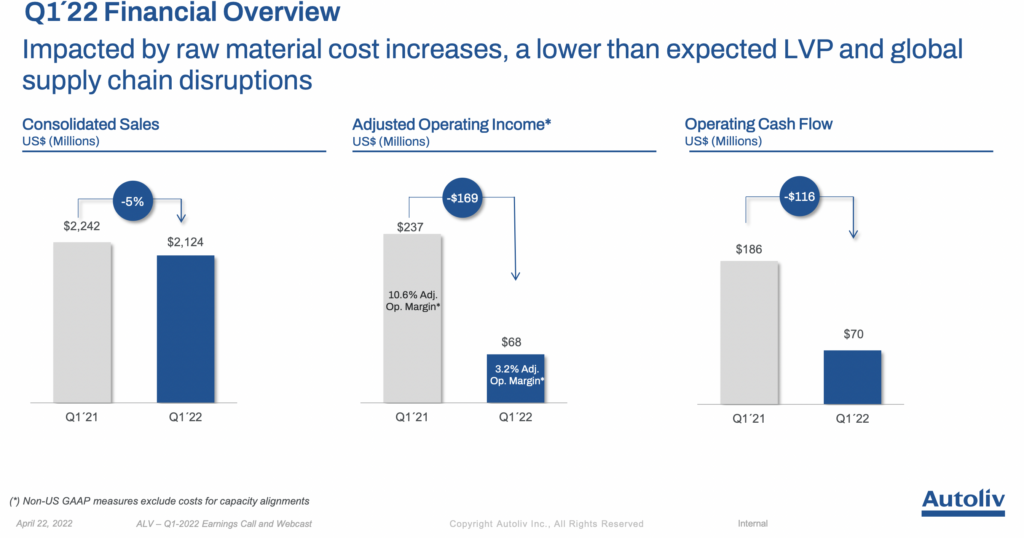

The earnings miss at Autoliv, a relatively little-known mid-cap company (US$6.3 billion stock market valuation), is an unwelcome development for Autoliv shareholders; but, more importantly, it may have broader negative implications for the major automakers as a group, including electric vehicle OEMs. Autoliv’s sales of necessary safety equipment declined 5.3% to US$2.1 billion in 1Q 2022 from 1Q 2021 levels. According to the company, global light vehicle production (LVP) fell 4% in 1Q 2022.

In contrast, on April 20, Tesla (NASDAQ: TSLA) reported strong 1Q 2022 results, which included a 68% year-over-year increase in vehicle deliveries. These results may have obscured the difficult environment faced by automakers. Indeed, part of Tesla’s 1Q 2022 success may be due to the premier position it is accorded by parts suppliers. Still, CEO Elon Musk said on Tesla’s earnings conference call that the company’s record 1Q 2022 results were achieved, “despite a lot of chip shortages, many logistics challenges, and an overall difficult quarter.”

Autoliv also reported that its adjusted operating income and operating cash flow plummeted 71% and 62%, respectively, in 1Q 2022 versus the year-ago period. The principal culprits for the decline: higher raw materials costs and supply chain disruptions.

If these issues are dramatically affecting the results of a parts supplier, auto OEM’s could logically feel a similar impact. However, based on the contract terms that Autoliv has with most OEMs, the full effect might not be felt until perhaps mid-2022. Autoliv says it is having “focused discussions with our customers regarding cost inflation claims. …. We believe our price increases will begin to offset the cost inflation from around mid-year.”

The first indications of the degree to which rising costs and supply chain issues are affecting carmakers may come out on April 26 and April 27 when General Motors Company (NYSE: GM) and Ford Motor Company (NYSE: F), respectively, release 1Q 2022 results.

The marked declines in Autoliv’s operating income and cash flow in the first quarter could represent a warning sign for the entire auto industry. Not only may acquiring the necessary parts be difficult, the costs of those parts may translate into disappointing financial results.

Autoliv, Inc. last traded at US$71.94 on the NYSE.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Views expressed within are solely that of the author. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.