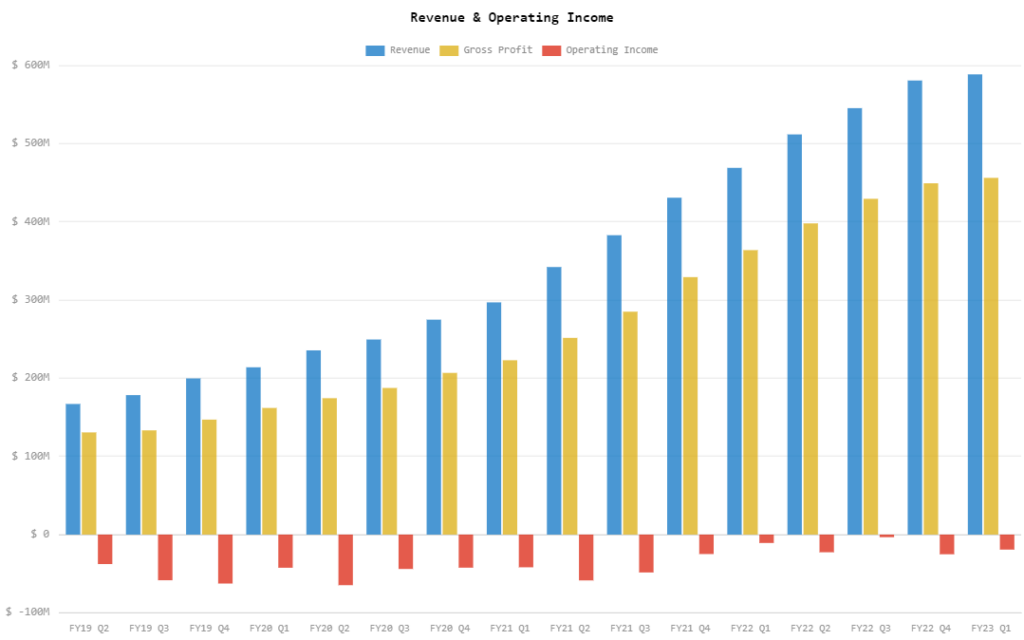

DocuSign, Inc. (Nasdaq: DOCU) announced on late Thursday its financial results for fiscal Q1 2023 ended April 30, 2022. The report highlighted a revenue of US$588.7 million, an increase from Q1 2022’s revenue of US$469.1 million and beating the analyst estimate of US$583 million.

“We delivered solid first-quarter results, growing revenue by 25% year-over-year and adding nearly 67,000 new customers,” said CEO Dan Springer. “With over a billion users worldwide, the proven value of our products, and the significant opportunity we have ahead of us, we’re confident in our ability to successfully navigate the challenges of a dynamic global environment.”

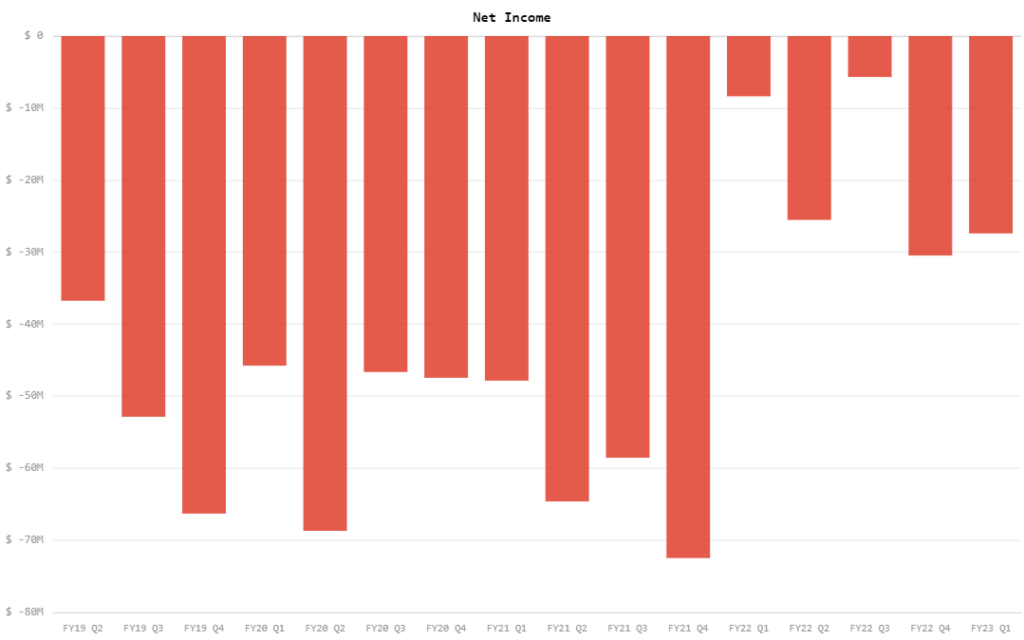

However, the bottomline tells a different story. The firm still ended the quarter with a net loss of US$27.4 million, down from last year’s US$8.4 million loss. This translates to a US$0.14 loss per share.

Calibrating for financial items, adjusted earnings per share came in at US$0.38, missing the estimate of US$0.46 per share.

Following the release, the firm’s shares plummeted by 23.86% when the market opened today.

The firm also ended the quarter with US$638.2 million in cash and cash equivalents, putting the balance of current assets at US$1.36 billion while current liabilities ended at US$1.34 billion. Total liabilities amounted to US$2.23 billion out of the company’s total assets worth of US$2.57 billion.

The San Francisco-based platform guides its fiscal Q2 2023 revenue at US$600 – US$604 million, barely beating the estimated US$601 million. For the whole fiscal year, the firm estimates the revenue to land between US$2.47 – US$2.48 billion.

Seen on WSB: $DOCU gonna DocuSign their own bankruptcy documents lol

— Market Rebellion (@MarketRebels) June 9, 2022

DocuSign last traded at US$87.36 on the Nasdaq, then down 23.86% when markets opened today.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.