Dollarama Inc (TSX: DOL) reported its first-quarter financials on June 9th. Dollarama reported revenues of $954 million with a gross profit of $403 million, or 42.3%. The companies earnings per share came in at $0.37, with a net income of $114 million and ~12% net margin. The stock dropped roughly 4% in early morning trading on the 10th before rebounding to only being down 1% as of noon. The company’s stock dropped due to missing analyst consensus.

Analysts had a mixed view on the results with Scotiabank and CIBC lowering their price target while National Bank raised their price target on the company. The company now has a 12-month price target of C$61.21, down from C$61.71 before the results.

In BMO’s note to investors, their analyst Peter Sklar says that the results came in slightly below their estimates but the underlying trends still remain strong. He reiterated their C$59 price target and market perform rating on Dollarama. He adds that the company will be facing tougher comparisons of 5-7% in 2Q/3Q of 2021 but that Dollarama’s 15x FY2022 EBITDA is at the lower end of its 14x-18x range, and he “sees more opportunity in deeper cyclical discretionary name.”

Sklar believes that the slight miss for Dollarama should not alarm anyone, as there has been a lot of uncertainties in Canada right now with a potential “third wave” coming and that there have been various retail restrictions put in place. He believes that with Ontario reopening in-person selling of non-essential goods on Friday, June 11th, their stores will see pent-up demand that lasts into the second half of the year.

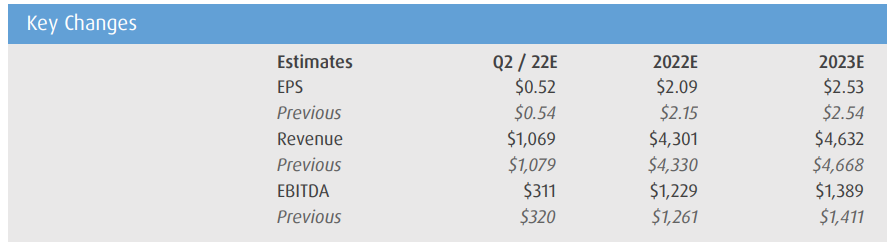

Below you can see the key changes Sklar made to his estimates which impact 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.