On August 24, BMO Capital Markets raised their 12-month price target on Dollarama (TSX: DOL) to $95 from $80 while reiterating their outperform rating, saying that the stock is an “inflation stock pick” and notes that in prior times of high inflation, Dollarama remained resilient.

Dollarama currently has 14 analysts covering the stock with an average 12-month price target of $80.85. Out of the 14 analysts, one has a strong buy rating, eight have buy ratings and the last five analysts have hold ratings on the stock. The street high is now BMO Capital Markets at $95, or an upside of 16%.

BMO adds that Dollarama has a “longstanding reputation” as a value store, and while inflation is currently driving higher, they expect that this will be a major tailwind to traffic.

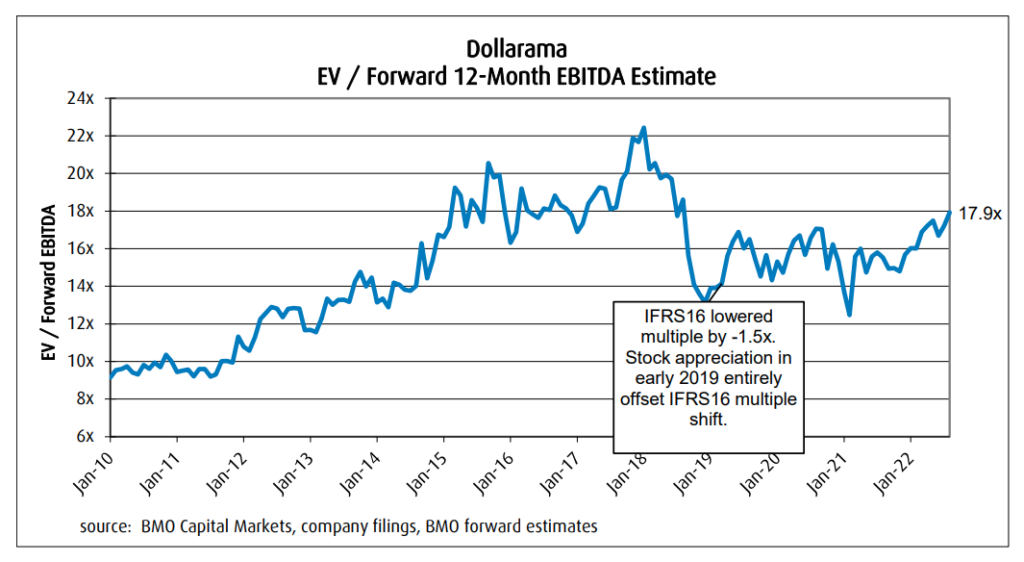

Dollarama currently trades at 18.5x BMO’s 2023 EBITDA estimate, which is to the closer end of its 14-20 times valuation range it has historically traded in. BMO believes that the stock could revisit the top of its historical range and potentially head above 20x.

Dollarama has recently rolled out its newest higher price points of $4.50, $4.75, and $5, which are slowly being implemented into more and more stores; this is a perfect storm of events as BMO believes that with consumers’ pockets squeezed, they will be more likely to trade down and find products at Dollarama. BMO provides an example: they found a shapewear product selling at $5 at Dollarama, while the same product was selling for $32.97 on Walmart’s online store.

READ: Dollarama To Repurchase Up To 7.5% Of Common Shares Under Renewed Share Buyback Program

Additionally, during the last quarterly results, BMO believes that same-store sales grew about 12% during a 5-week period and that “Dollarama is cycling against a weak comparable FQ2 last year with the ban on the sale of non-essential goods in Ontario.”

Lastly, BMO believes that same-store sales could keep this momentum, and Dollarama could report an 11% growth in same-store sales for the quarter.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.