Water: one of the vital ingredients of creating life. While water covers approximately 71% of the earths surface, much of this is not safe for consumption by humans. Conversely, freshwater, which is generally safe for consumption, accounts for approximately 2.5% of global water stocks. Of this fraction of total water resources, glaciers and ice caps account for 68.7% of freshwater, while groundwater accounts for 30.1%. Lakes, rivers, and other surface water accounts for just 1.2% of total freshwater resources.

Another statistic: approximately 70% of the worlds fresh water consumed goes towards agricultural production. As populations grow, so to does the need for further water consumption. The increasing demand for water as a whole has resulted in a new term being minted to refer to the vital resource: blue gold. It’s also resulted in the latest issue on the Canadian Securities Exchange: Dominion Water Reserves Corp (CSE: DWR).

Currently focused largely on the Quebec water market, Dominion Water’s primary business is the acquisition and management of natural spring water sources. While setting up its operations within Quebec, the firm currently has its sights on expansion with the intent of securing a leadership role within the North American natural spring water market. With the completion of its go public transaction, the company is targeting the acquisition of certain water rights stateside. Let’s take a closer look.

The Quebec Market

Dominion Water came to be in late 2015, when environmentally conscious entrepreneurs set their sights on consolidating the natural spring water market within the Province of Quebec. The intent at formation was to preserve and respect the resource, while taking a leadership role within the industry.

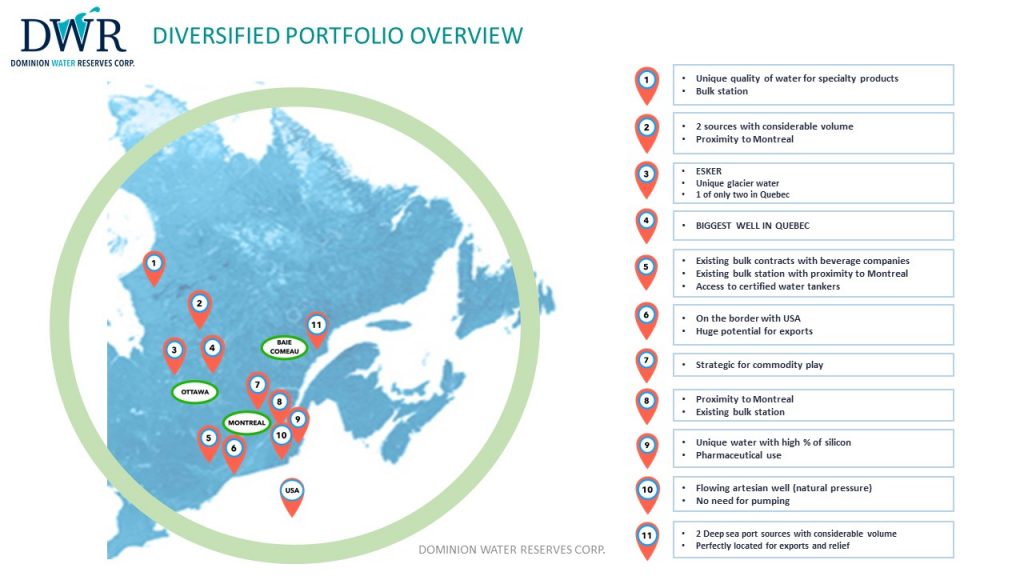

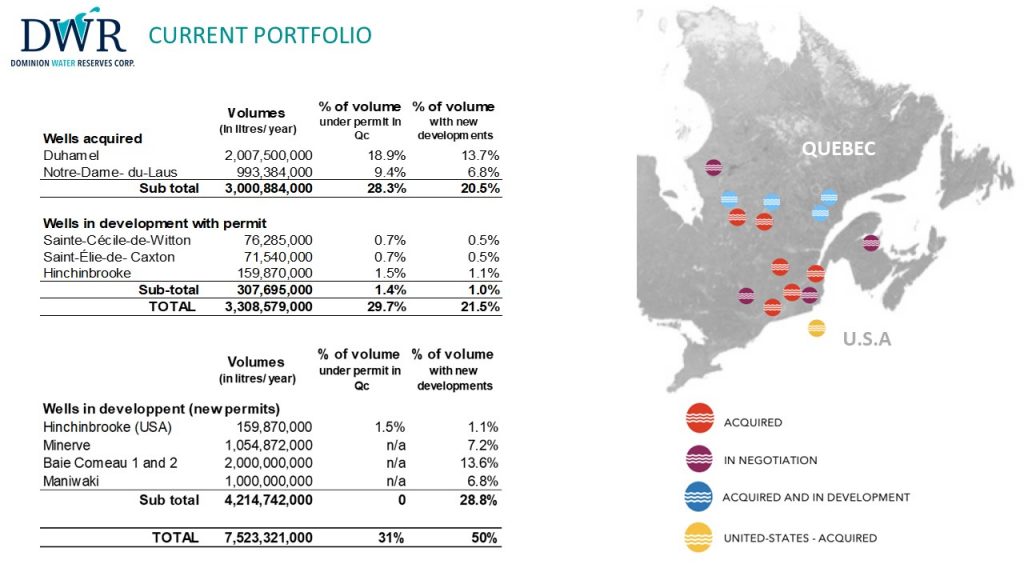

Fast forward several years, and Dominion has secured the water rights to two primary water sources, known as Duhamel and Notre-Dame-du-Laus. Collectively, these two water sources account for a total of 28% of the total percentage of volume under permit in the Province of Quebec when it comes to natural spring water. Further, the company has also secured the rights to acquire two additional water sources: the Sainte-Cecile-de-Witton and the Saint-Elie-de-Caxton, which each represent approximately 1% of the total percentage of volume under permit within Quebec.

Astoundingly, in numeric terms, this represents access to over 3 billion litres of natural spring water on an annual basis, over 261 land acres, or approximately 30% of all permitted volume of natural spring water within the province – with a path in place to expand that figure to over 50%. In the case of Duhamel and Notre-Dame-de-Laus, the company currently has 100% ownership of both of these water sources, while the company has the option to acquire 100% of the other two sources mentioned.

Duhamel itself represents the largest volume spring within the Province, at over 2 billion litres per year of overflow. As a result Dominion Water will pursue the development of this resource, for which it has authorization, to withdraw groundwater intended for sale or distribution as bottled water. The company is also focused on developing Notre-Dame-du-Laus, for which it has similar authorization.

The Business Strategy

Looking to the future, the current strategy of Dominion Water is to acquire water rights for approximately 70% of total spring water volume under permit within Quebec. This consolidation will enable the company to become the main provider of water within Quebec, while capitalizing on the anticipated imbalance in water demand and supply as a result of the growing global population.

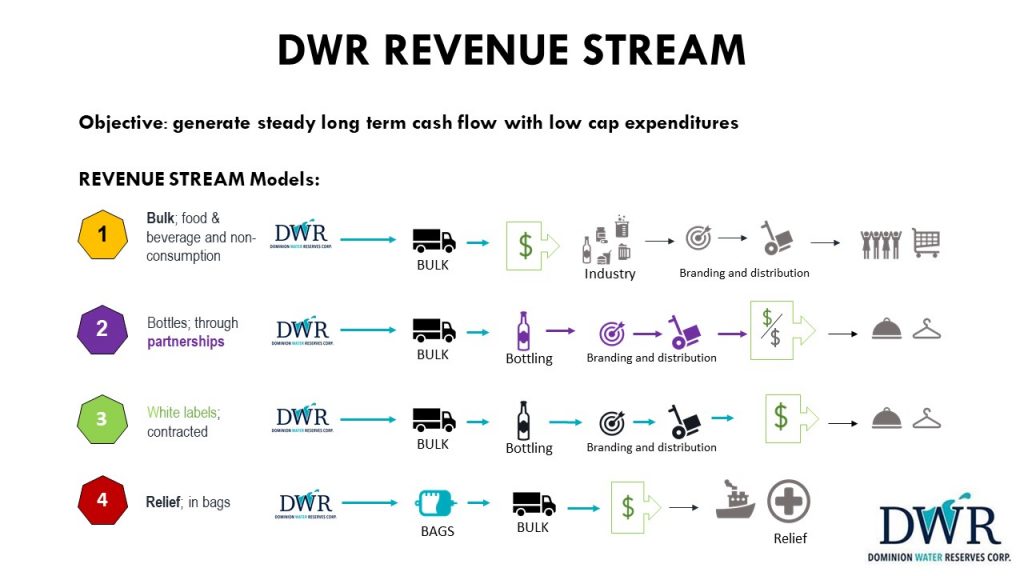

This expansionary vision is expected to be supported via deriving steady revenues from the sale of bulk water in high volume to bottlers. While no bulk agreements are currently in place, Dominion is heavily focused on developing springs located in strategic geographical locations, which are close to urban centres throughout the province. Given that one of the largest expenses in relation to bulk water is the cost of transport, the proximity of its reserves to these major centres is expected to provide a strategic advantage over that of current competitors within the space.

To this end, the company currently has wells nearly surrounding that of Montreal, some of which have existing well bulk stations already in place. The company also controls the largest well in Quebec, which is located just northeast of Ottawa, along with access to one of only two eskers in the province, which provides unique glacial water that is a rarity within Quebec.

Further, the focus on the sale of bulk water enables the company to keep its capital expenditures low while generating long term positive cash flow. Current revenue streams outlined by the company, while all in the form of bulk sales, focus on obtaining clients focused on bottling water, bulk food & beverage producers and non-consumption (i.e. used in manufacturing), white label producers, and relief in the form of bags.

Acquisition Targets

While focused on the acquisition of additional water rights to expand their presence within both Quebec and North America, Dominion Water currently has two pending acquisitions as previously addressed. Both Sainte-Cecile-de-Witton and the Saint-Elie-de-Caxton are currently subjects of option agreements for their complete acquisition by that of Dominion Water.

The two water sources currently contain permits for the production of 76.2 million and 71.5 million litres of water per annum, respectively, with each individually accounting for approximately 1% of the total water volume drawn within the province per year.

In addition to these two, the company currently is in negotiation to purchase four more wells, two of which are already in operation for bulk water supply. Further information was not provided on these potential acquisitions.

Finally, is the wells owned by the company that are in development that require new permits. While not acquisitions per se, they present future opportunity for the company once development is completed. These consist of Hinchinbrooke (USA), Minerve, Baie Comeau 1 and 2, and Maniwaki. On a combined basis, these news wells once completed are slated to produced 4.2 million litres of water in volume per annum.

While diluting current capacity of Dominion’s existing wells on a total volume under permit basis, once completed, these four new wells will account for approximately 28.8% of water volumes within Quebec. Combined with the then-diluted 21.5% from existing operations, it means that Dominion Water Reserves will control approximately 50% of all water volumes within the province.

Share Structure

As with any public issuer, one of the most important aspects is the share structure. Dominion Water, in this respect, has kept things tidy. Here’s a simple breakdown of what things look like:

| Non-Diluted | Fully Diluted | |

| Total Public Float | 49,230,174 | 51,720,687 |

| Held By Insiders | 18,476,389 (27%) | 16,293,733 (24%) |

| Total Outstanding | 67,706,563 | 68,014,420 |

In terms of convertible securities, special warrants for 596,000 common shares currently exist, along with finders warrants for a total of 307,857 common shares. Presently, there are no outstanding options for the issuer.

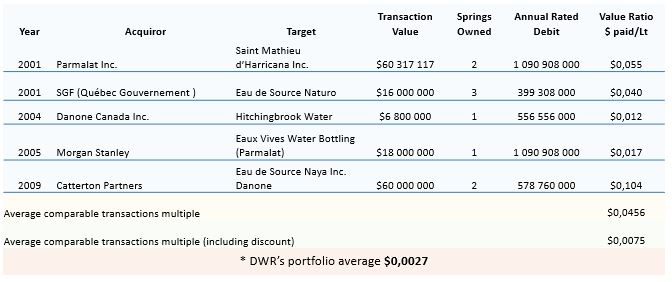

The current share structure of Dominion is notable, given that it has utilized common shares as a currency to acquire certain of its assets, and will be required to issue additional shares in connection with the water rights options it has acquired. As of the present date, the company has paid the equivalent of $0.0027 per litre of water it has acquired the rights to. In comparison, the average comparable transaction figure amounts to $0.0456 per litre of water rights.

Conclusion

While we have only dipped our toes into the story behind Dominion Water Reserves, it can be said that it presents a unique opportunity relative to other issuers currently listed on Canadian securities exchanges. While others are focused on finding metals, Dominion set its sights on something entirely different: blue gold. Watch for our company profile on the firm, where we’ll dig deeper into this unique story.

FULL DISCLOSURE: Dominion Water Reserves Corp is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Dominion Water Reserves Corp on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.