Aside from consumer staples industries like grocery stores, most industries have been negatively affected by the COVID-19 pandemic. However, one industry that investors have embraced is the education technology or e-learning business.

As the pandemic began to spread worldwide in the spring of 2020, many governments enforced lockdowns that included widespread school closures. This prompted many parents to explore online education services for their children. In addition, many workers who lost their jobs or had their hours reduced, decided they needed to learn new marketable skills online.

The e-learning market, estimated to be US$250 billion in 2020 by the market research firm Global Market Insights, looks to grow rapidly for many years. According to the same source, global e-learning revenues could reach US$1 trillion by 2027, about 35% of which would be North America-based, and 26% in the Asia Pacific region.

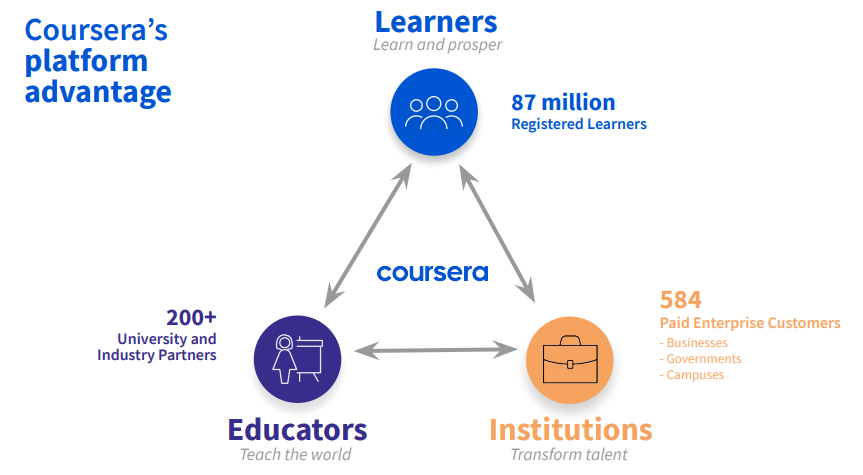

Of course, as with many aspects of the stock market, investors seem to have extrapolated far more intensity to a positive trend than seems merited. A good example of this may be Coursera, Inc. (NYSE: COUR), an online learning platform with 87 million learners as of June 30, 2021. Coursera, which became a publicly traded company this spring, carries a stock market capitalization and an enterprise value (EV) of about US$5.2 billion and US$4.4 billion, respectively.

Coursera Trades at an EV-to-Revenue Multiple of 11x, a Very High Multiple

Coursera recorded US$102 million of revenue in 2Q 2021, implying that its revenue per “learner” in the quarter was only around US$1.17. The company’s adjusted EBITDA in the quarter was a shortfall of US$2.9 million.

More importantly, Coursera issued full year 2021 revenue guidance of US$402-US$410 million and adjusted EBITDA guidance of a loss of US$38 million to a loss of US$44 million. Surprisingly, the company’s operating cash flow shortfall is projected to widen in 2H 2021 even as revenue grows.

Coursera trades at an enterprise value-to-2021E revenue ratio of nearly 11x, a very high figure for any growth company. A ratio of the company’s EV-to-EBITDA cannot be computed because EBITDA is negative.

| (in thousands of US $, except for shares outstanding) | Full Year 2021 Company Guidance | 2Q 2021 | 1Q 2021 |

| Revenue | $406,000 (A) | $102,089 | $88,362 |

| Operating Income | ($45,785) | ($18,361) | |

| Adjusted EBITDA | $(41,000) (A) | ($2,872) | ($10,125) |

| Cash/Investments – Period End | $800,737 | $280,801 | |

| Debt – Period End | $23,041 | $486,942 | |

| Shares Outstanding (Millions) | 137.1 | 43.2 |

Coursera Appears Relatively Expensive Versus Comp’s

In the table below, we compare Coursera to a few North American e-learning peer companies: 1) Stride, Inc. which provides tech-enabled education solutions for K-12 and other students; 2) Chegg, Inc. which is a leading direct-to-student learning platform; and 3) 2U, Inc. which is a global leader in education technologies. It partners with many universities.

| (in thousands of US $, except where noted) | Stride, Inc. (A) | Chegg, Inc. (B) | 2U, Inc. (B) | Coursera, Inc. (B) |

| Stock Exchange | NYSE | NYSE | NASDAQ | NYSE |

| Symbol | LRN | CHGG | TWOU | COUR |

| Stock Price | $33.45 | $78.54 | $34.51 | $37.59 |

| Shares Out. (Millions) | 41.59 | 144.7 | 74.5 | 137.7 |

| Stock Market Cap. | $1,391,186 | $11,364,738 | $2,570,995 | $5,176,143 |

| Revenue | $1,536,760 | $810,000 | $940,000 | $406,000 |

| Adjusted EBITDA | $239,900 | $297,500 | $60,000 | ($38,000-$44,000) |

| Cash | $386,080 | $2,061,722 | $953,107 | $800,737 |

| Debt | $466,282 | $1,691,151 | $831,157 | $23,041 |

| Enterprise Value (EV) | $1,471,388 | $10,994,167 | $2,449,045 | $4,398,447 |

| EV/Revenue | 1.0 | 13.6 | 2.6 | 10.8 |

| EV/Adjusted EBITDA | 6.1 | 37.0 | 40.8 | N/A |

(B) Balance sheet data from 6/30/21. Income/cash flow statement projection from midpoint of full-year 2021 company guidance.

Stride and 2U, Inc. trade at much lower EV-to-revenue multiples than Coursera, while Chegg trades at even a higher ratio than Coursera. Each of the other e-learning comparables generates positive EBITDA. As noted above, Coursera is expected to record a significant EBITDA loss of ~US$40 million in 2021.

Coursera is positioned in a growing industry and seems likely to record strong revenue growth over the intermediate term. However, it trades at a high EV-to-revenue multiple on an absolute basis and relative to at least two peer companies. In addition, only about 6% of Coursera’s float is shorted, likely precluding it from qualifying for meme stock status.

Coursera, Inc. last traded at US$37.59 on the NYSE.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.