Global markets have rallied over the last few days on hopes for a soft economic landing in 2023 as opposed to a more pronounced downturn. Many stock strategists and economists currently doubt this “rosy” scenario, and the U.S. Federal Reserve seems intent on risking a deep economic downturn by continuing to raise short-term interest rates; however, recent European data may offer hope of a shallow downturn.

Importantly, if Europe, which is beset by greater inflation problems than the U.S. and Canada and has implemented more modest rate hikes to combat rising prices, can avoid a sharp downturn, perhaps the odds that the U.S. does so as well may be higher than most expect.

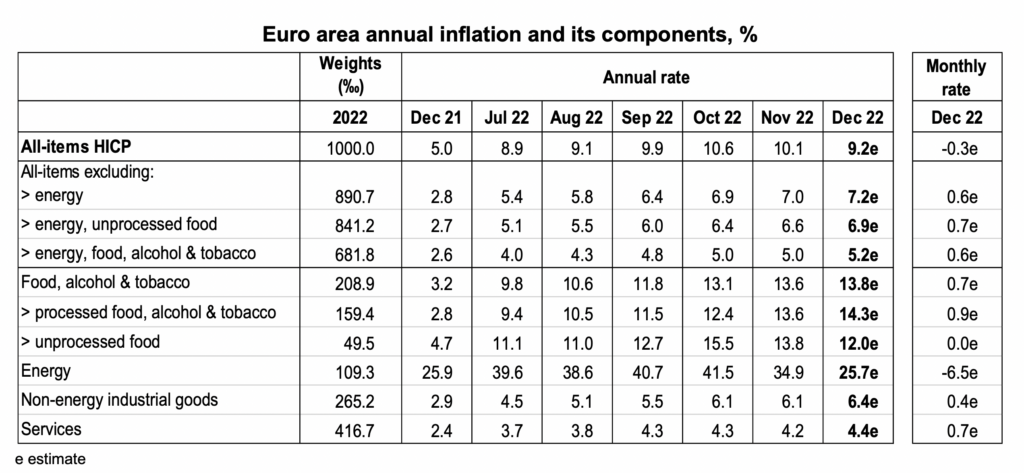

On January 6, Eurostat, the statistical office of the European Union, estimated that the annual inflation rate on the Continent fell to 9.2% in December, down significantly from 10.1% in November and 10.6% in October. One caveat in this report was that core inflation, excluding food and energy, rose slightly in December, reaching an annual pace of 5.2%, up from 5.0% in November.

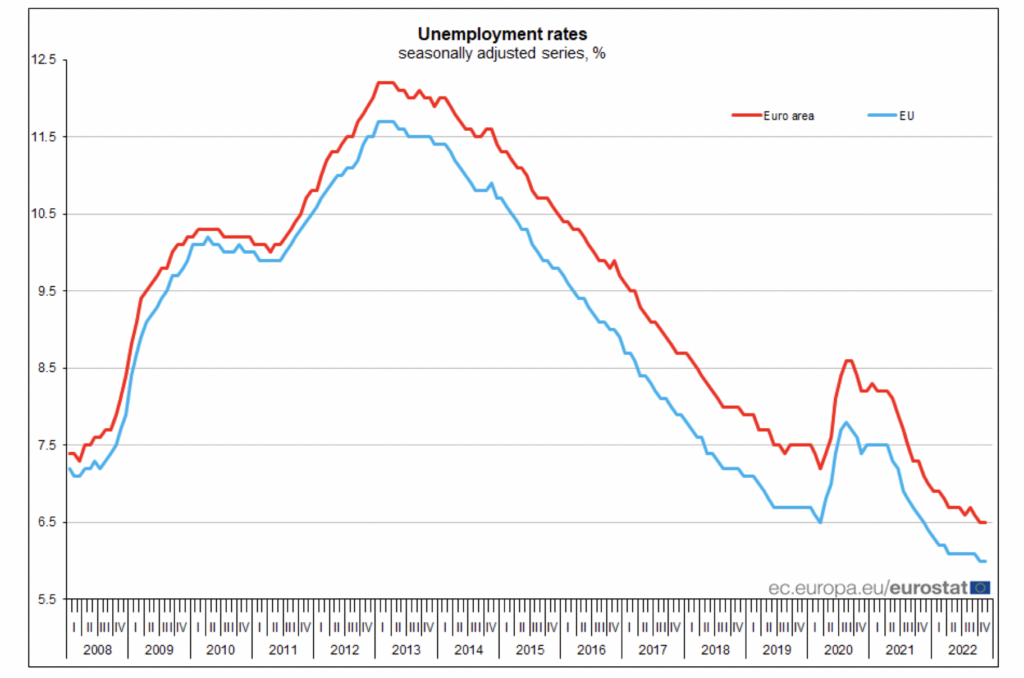

Eurostat released similarly constructive data on Euro area unemployment on January 9. Unemployment in November 2022 held steady at 6.5% versus October. Unemployment rates remain at their lowest level since at least 2007.

The European Central Bank is expected to raise interest rates by 50 basis points when that body meets on February 2. This increase would bring its benchmark deposit rate to 2.50%.

Interestingly, the ECB published an Economic Bulletin on January 9 saying that wage growth across Europe should be “very strong compared with historical patterns” over the next few quarters as labor markets have remained resilient. Nevertheless, the ECB expects real wages to continue to decline as nominal wage hikes will trail the inflation rate.

The ECB’s bulletin could be interpreted as minimizing wage concerns, a stance quite different than the Fed, which continues to emphasize such fears. As such, the number of ECB rate increases after February 2 may be an open question.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.