The European Central Bank yesterday delivered an unexpected rate hike of 50 basis points, marking the first time policy makers raised borrowing costs in over a decade as inflationary pressures become rampant and imbedded across the eurozone.

Markets and economists alike were anticipating an increase of 25 basis points, but instead the ECB signalled that its 8-year experiment of negative borrowing costs is finally over. The central bank, which is tasked with setting monetary policy for the 19 European nations using the euro currency, brought its deposit rate to zero, the refinancing operations rate to 0.5%, and the marginal lending facility rate to 0.75%.

“The Governing Council judged that it is appropriate to take a larger first step on its policy rate normalisation path than signalled at its previous meeting,” read the bank’s statement. The half percentage-point increase marks the largest rate hike since 2000, as the ECB attempts to cool soaring inflation despite mounting recessionary risks. “The frontloading today of the exit from negative interest rates allows the Governing Council to make a transition to a meeting-by-meeting approach to interest rate decisions,” policy makers wrote, albeit refraining to comment on the size of future rate increases.

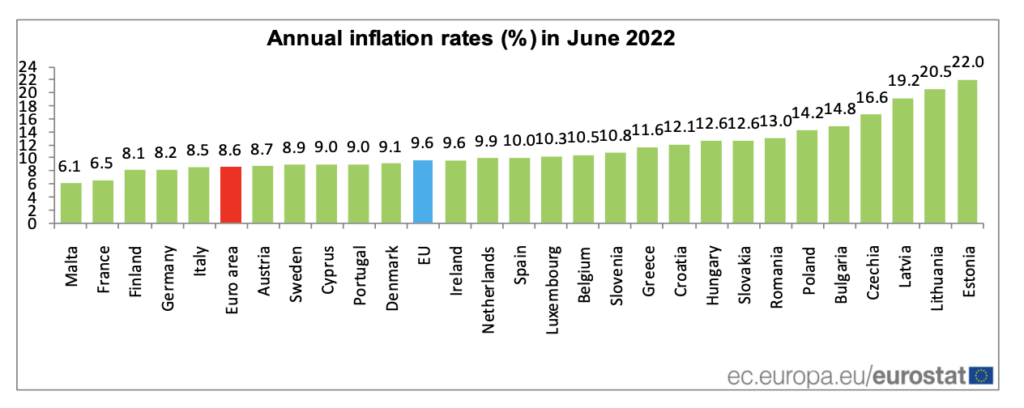

Initial readings for the month of June show that inflation across the eurozone surged to a record-high of 8.6%, while previous ECB forecasts suggest the region’s economy is set to expand by a paltry 2.1% in 2022 and 2023. “Inflation continues to be undesirably high and is expected to remain above our target for some time. The latest data indicate a slowdown in growth, clouding the outlook for the second half of 2022 and beyond,” commented ECB president Christine Lagarde following the rate decision.

Making matters worse, though, is the growing uncertainty surrounding energy supplies from Russia. The ongoing conflict in Ukraine and the West’s subsequent sanctions has prompted Moscow to weaponize its fossil fuels and threaten to cut Europe off from natural gas entirely. Since June, gas flows via Nord Stream 1 have slumped by about 60%, putting into peril Europe’s economy, which relies on Russia for about 40% of its energy needs.

“A prolongation of the war in Ukraine remains a source of significant downside risk to growth, especially if energy supplies from Russia were to be disrupted to such an extent that it led to rationing for firms and households,” warned Lagarde.

Information for this briefing was found via the ECB and Eurostat. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.