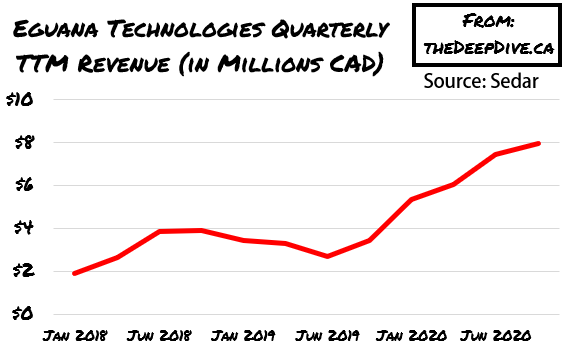

After the bell, Eguana Technologies (TSXV: EGT) released their 2020 audited annual financial statements. The company saw annual revenue grow by 132% to $7.9M for the year ended September 30, 2020. Gross margins for the year came in at just over 11% a dramatic increase from the 2% margins in 2019; demonstrating the margin improvement shareholders are looking for as the company scales.

The company burned $2.9M of cash on the year; a massive improvement from having burned over $7.6M in the previous year. In March 2020, the company saw a $5M strategic investment from Japanese based trading house ITOCHU who sits as a partner in the deployment of a potential virtual power plant. Eguana also improved their working capital constraints by transitioning their LG Chem battery supply chain to ITOCHU, enabling them to scale faster without relying on a lengthy cash cycle.

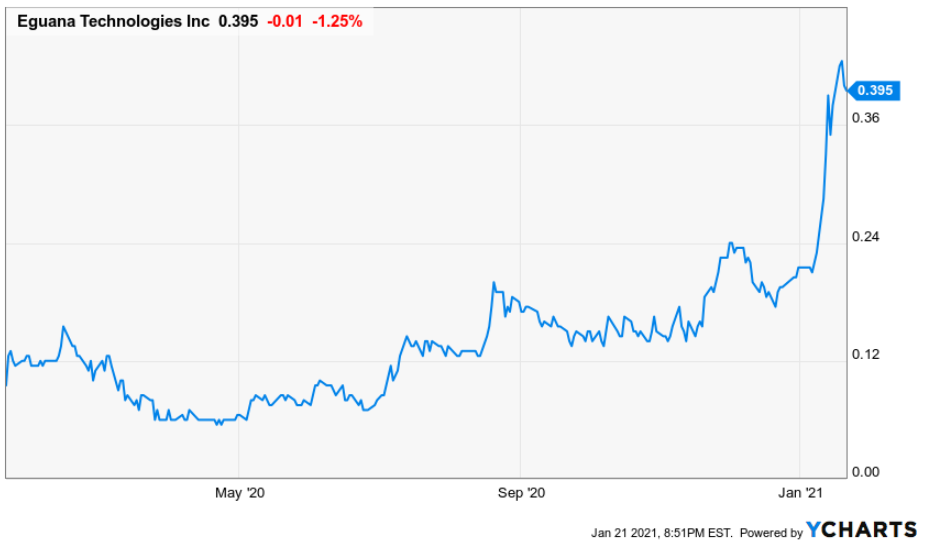

On the balance sheet side, the company likely finds itself in great shape as a result of the recent strength in its share price which last closed at 39.5c. Almost all of the company’s convertible debt, warrants, and options are now in the money; when converted or exercised they will see a balance sheet with reduced debt and an increased cash position.

CEO Justin Holland will be joining us on SmallCapSteve LIVE tomorrow to answer questions to our audience.

Eguana shares last traded at 39.5c on the TSX Venture.

FULL DISCLOSURE: Eguana Technologies is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Eguana Technologies on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.