On February 17th, Eguana Technologies (TSXV: EGT) saw a second analyst begin covering the stock, with Raymond James giving the equity a C$0.75 12-month price target, or an 85% upside to the current stock price, and an outperform rating. This comes after Stifel-GMP initiated earlier last year with a C$0.85 12-month price target and buy rating.

Raymond James calls Eguana an emerging integrated energy storage system leader, saying the primary features of Eguana’s products are “flexible capacity and scalability, easy installation, remote diagnostic / update capabilities, and remote battery recovery.”

Eguana’s flagship product is called Evolve, which is an energy storage system designed for residential use in North America. They currently have a white label agreement with Duracell to produce a minimum amount of 10,000 systems over three years, which is estimated to be $185 million in revenue. There are currently 1,700 Evolve units installed, primarily in Hawaii and California.

They believe that this deal will also help with the companies ability to be competitive in the market as there are a number of other larger firms such as Tesla, Enphase, Generac, and SolarEdge competing. Raymond James says that “Duracell represents a unique opportunity with a highly recognized battery brand to make an entry into this market.”

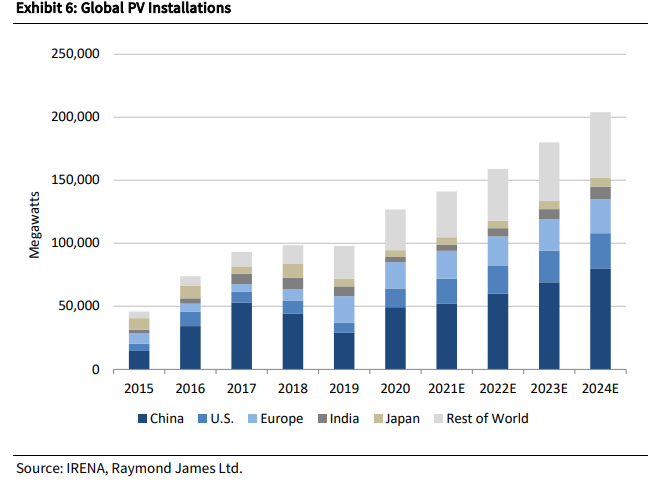

Raymond James provides an outlook for the solar power industry saying that the sector is “exhibiting secular growth in electricity market penetration despite the volatile margins seen across the value chain.” They believe that demand is evolving with the European Union and the majority of the United States is expected to be getting into the electricity market.

Additionally, they note that the power storage industry is also seeing a strong surge in demand. They expect global grid-scale power storage installations to reach close to 100GWh BY 2025, dominated by “behind the meter” systems which are systems deployed by the end-users or individual households.

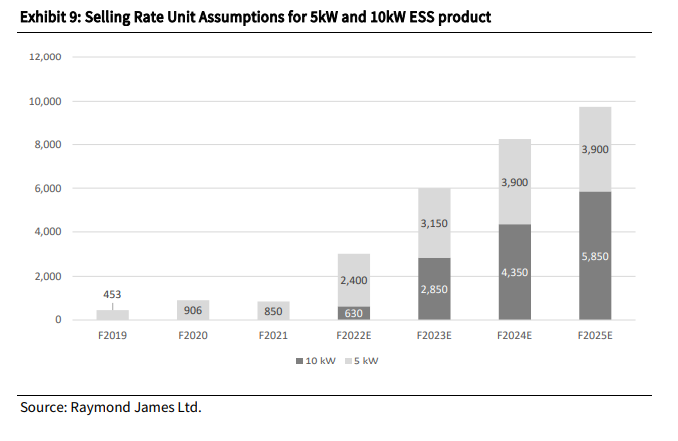

For the financial estimates, Raymond James expects Eguana to sell 630 10kW and 2,400 5kW Evolve products this year putting total units sold at 3,030 for the year, eventually hitting 5,850 10kW and 3,900 5kW Evolve products, or 9,750 units, in 2025.

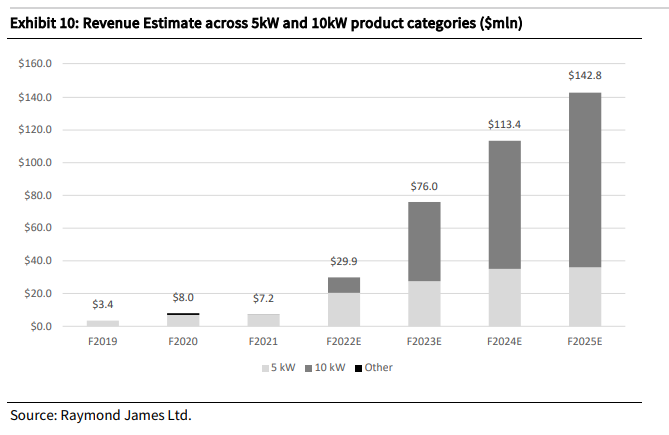

They expect Eguana to sell the 5kW and 10kW at $8,000 and $15,000 per unit, respectively, which places the company’s estimated revenue at $142.8 million in 2025, from $29.9 million in 2022. They write, “As revenue builds, we are anticipating that the operating leverage inherent in the business model will begin to manifest in the results.”

Though they believe that Eguana is not immune to the current supply chain issues plaguing other parts of the economy. They believe that the company is seeing a shortage of components “that could be considered much less specialized in nature.” Though they note that Eguana’s has a competitive advantage as it can redesign or re-engineer to help find workarounds or replacements to the shortages.

With Eguana having $4.6 million in cash on hand as of September 30th, they believe that it will dip just below $2 million in the first fiscal quarter of 2022, which is a December 31 end. They believe that the demand from Duracell and the companies growth curve, will result in the firm looking to raise capital in the near term. Raymond James modeled that the company will raise $25 million at $0.40 cents per share during their second fiscal quarter. They believe that this amount of money will be sufficient to fund growth and working capital requirements.

FULL DISCLOSURE: Eguana Technologies is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Eguana Technologies on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.