Last week, Eguana Technologies (TSXV: EGT) announced that they received their first order worth $3.6 million for Hawaii’s Virtual Power Plant Program, this means that Eguana will be providing their Evolve systems under the program. The state is to subsidize up to $850 per kW for homeowners that agree to discharge their solar battery for two hours each day into the grid at peak evening periods. For this, a virtual power plant system was required, which is where Eguana comes in.

Eguana currently has one analyst covering the name with a 12-month price target of C$0.85, or a 140% upside. In Stifel-GMP’s note on July 7th note, they reiterate their buy rating and slightly lower their 12-month price target to C$0.85.

Their analyst, Ian Gillies, believes that this contract for 240 units, “is the first piece of a much larger order to meet statewide demand.” Gillies says that Eguana signaled to them that out of the 10,000 systems Hawaii needs, only two companies, Eguana and another, offer products that are suitable under the program.

Gillies believes that if Eguana could capture half of the units it would equate to U$115 million in revenue. He adds, “there is significant incremental wallet share to be captured from this program.”

In the short term, Gillies believes that the supply chain issues will create speed bumps that will slowly be negligible by 2022. He expects the second and third quarters to be affected materially, with the company experiencing delays in receiving products at port due to significant congestion.

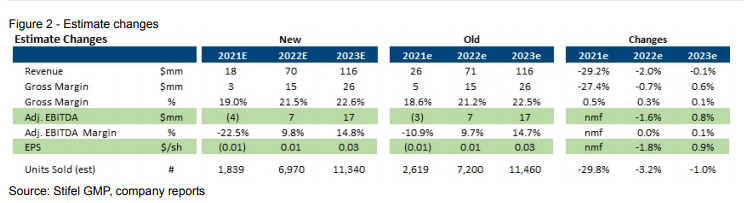

Below you can see Stifel-GMP’s new 2021 and 2022 estimates.

FULL DISCLOSURE: Eguana Technologies is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Eguana Technologies on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.