Can the cryptocurrency save El Salvador, or is it the other way around?

In Bitcoin Republic Pt. 1, The El Salvador Bitcoin Bro, we looked into how El Salvador ended up with its young, tragically hip, proud entrepreneur of a president Nayib Bukele. Bukele has given the tech and business media reason to pay attention to El Salvador for the first time in ages, with a splashy plan for a bitcoin-financed libertarian city-state of sorts.

The young president’s aggressive pitch is the type we’re used to hearing from an acquaintance at a golf club, who’s found a deep value small cap stock that’s going to put us all on easy street. It’s fired up a whole sub-genre of mostly American anarcho-capitalists trying a bit too hard to be original, but the Salvadorans he’s been elected to represent are trying to get their point across by setting fire to the bitcoin ATMs. An economy built for the Winkelvoss twins doesn’t interest them.

Could it work, though?

The two main components that a nation’s government can use to influence its own economic fate are fiscal policy; its management of its assets, income and debt, and monetary policy; its management of its currencies. Strong currencies like the euro and the US dollar give their masters a lot of power in international markets of all sorts. The currencies of export-dependent nations like Canada and Australia can be managed in such a way that they’re cheap in terms of the international settlement currencies in times that the exporting country needs to stimulate its economy.

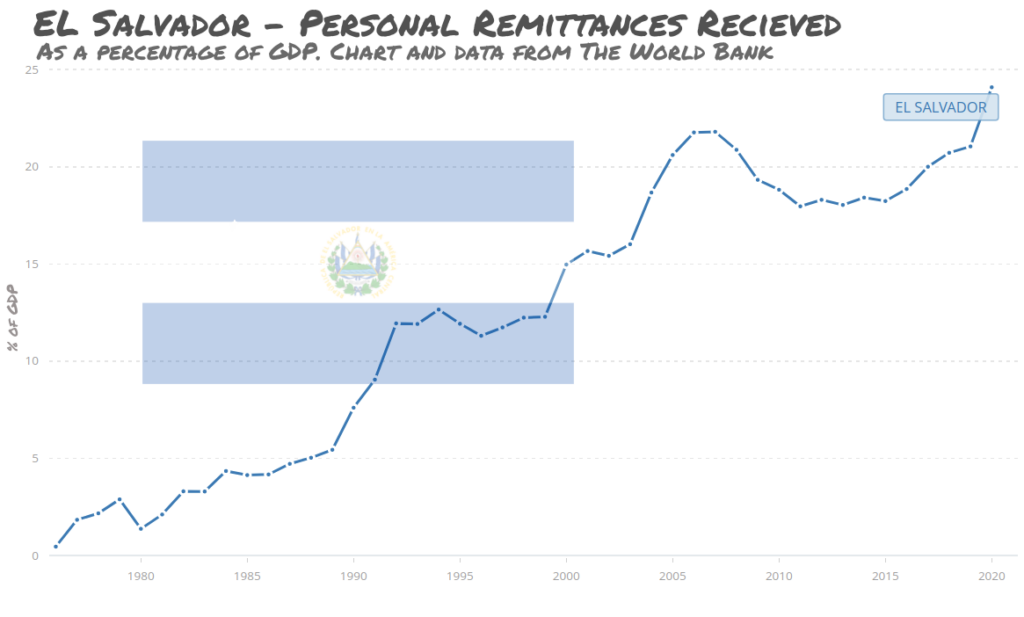

El Salvador, since 2001 when it adopted the US dollar as its legal-tender currency, effectively has no control at all over its monetary policy. As we learned in Bitcoin Republic Pt. 1, El Salvador’s economy got a slow start to industrialization, then had its economic growth stunted by a 12 year civil war, and is now a sort of hollowed out services economy dependent on multi-national outpost operations that does about $22 billion per year in GDP, and $6 billion per year in exports. There is no reason or even ability for it to issue a currency of its own.

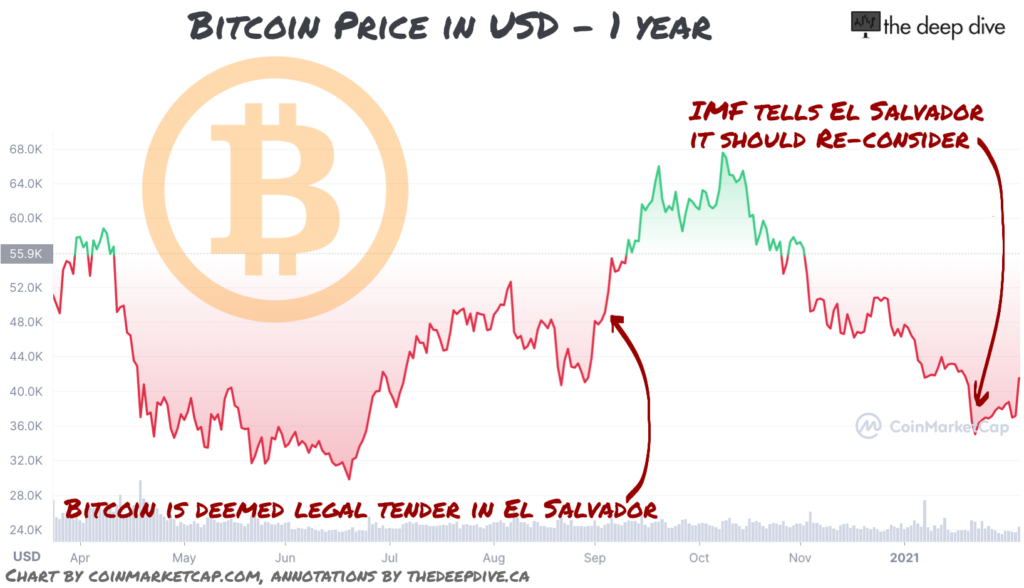

But it isn’t as though adopting bitcoin as a legal currency limits or removes any kind of ability that El Salvador already had. And if a de-centralized, unregulated cryptocurrency that nobody controls can go from nothing to $70,000 / BTC in a decade, and there’s only ever going to be 24 million bitcoins, there’s no reason it can’t go to $170,000 / BTC in the near term. And if Salvadorans could access that sort of alpha, both as a country and as people and businesses, it would sure beat perpetual, crippling poverty.

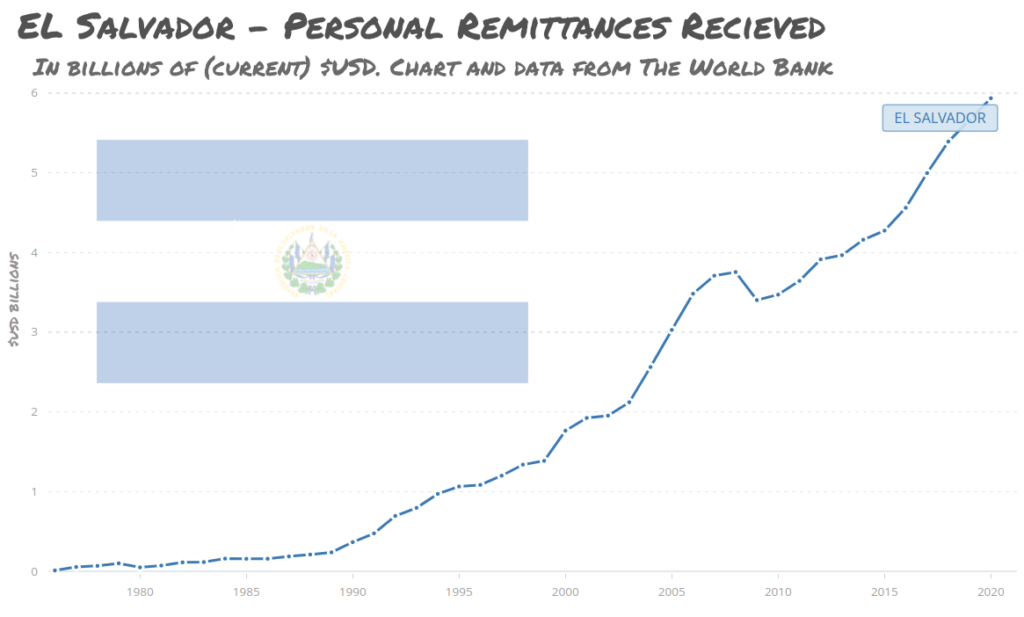

It could be said that El Salvador’s largest export, presently, is labour. More than $6 billion was sent home by Salvadorans working abroad in 2020. A country whose people rely so heavily on foreign remittances might appreciate a digital currency with a built-in transfer and payments feature. Only 30% of the population over 15 years old had a bank account or money-services account in 2017.

But seamless and practical blockchain money transfer isn’t available quite yet and, if it ever is, it will be after BTC’s volatility settles down a bit.

It isn’t clear whether converting legal-tender bitcoin to also-legal-tender USD in El Salvador is considered the sale of a security or not, the way it would in the US or Canada, but if the country does take a liberal taxation approach to profits made trading BTC, it may set itself up as an offshore tax haven for the neuveau-crypto-riche, which doesn’t figure to be of any material help to the economy either.

So far, the plan is looking more like a stunt than a bet, and it isn’t even a very big bet. El Salvador’s total bitcoin stash is 1,801 BTC – about $66 million, or 2% of its total national reserves. Renegade US software company MicroStrategy, by contrast, held 124,311 BTC at last count.

So far, the stunt has earned Bukele a public warning from his lenders and inspired protests at home. But with no significant stake, it’s difficult to call it a failure, and too soon besides. That isn’t a whole lot of exposure, so if Bukele is a true believer he’s going to need more coins than that in the treasury. Converting the currency reserves would surely anger the lenders, so buying them is out. And when you consider the alternatives, this starts to make more sense, on paper.

It needs to be right on the vent

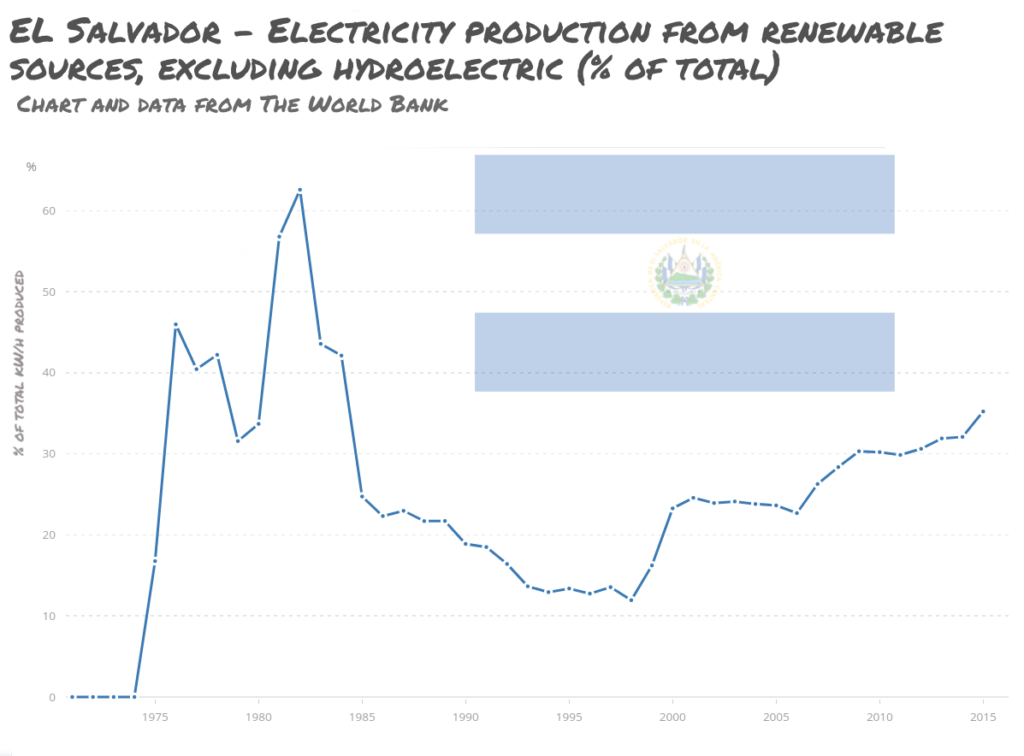

The “land of volcanoes” has tremendous untapped potential for geothermal energy. ES has 20 active volcanoes, and Bukele is fond of talking up the potential for carbon free bitcoin mining from power generated by the earth’s natural heat.

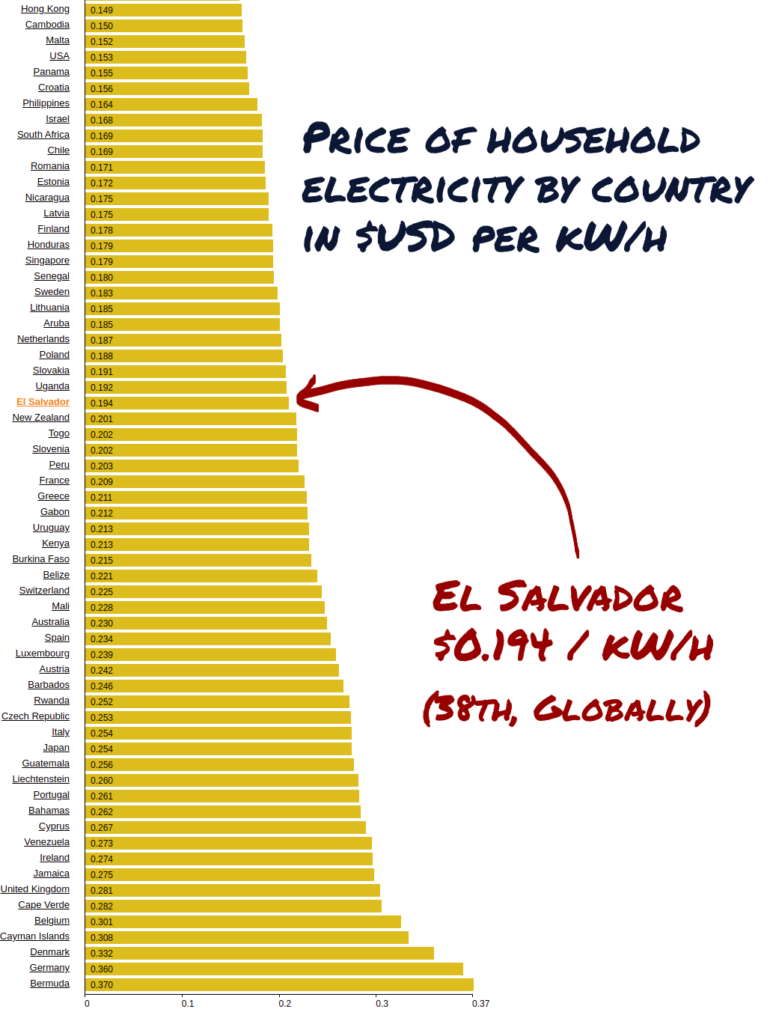

As a practical matter, the concept makes more sense than it’s getting credit for. The reason nobody has bothered to develop much geothermal power in El Salvador is that there are only so many places to sell it. Impoverished countries with limited industry aren’t in any position to build large-scale power projects. El Salvador only got electrical service to 100% of its population in 2019, and the rates are among the highest in the world; $0.194/KwH for households, according to globalpetrolprices.com.

In the fall of 2020, thinkgeoenergy.com made the installed geothermal capacity in El Salvador at 104 megawatts, and the total potential capacity at 644 megawatts. The article mentions another 80 megawatts under development. Much of the cost in power projects is in the transmission lines and substations that get the power to where it needs to go, and a significant engineering headwind is line-loss: the power lost to the resistance in those transmission lines. Since mining operations can be set up anywhere, there’s potential for them to be set up right at the generation plant, ahead of any line-loss and transmission costs. Carbon-free bitcoin might even command an ESG premium some day.

But if on-site bitcoin mines do produce regular yields of a bitcoin-of-the-future that retains its non-fiat value as advertised, all the messy and expensive power lines and substations that would get the unused power to the people of El Salvador who live outside of the immediate vicinity of the generation station might seem like an un-necessary expense. Ultimately, it amounts to less power available for the miners.

Any promoter worth his expense account has to have an un-wavering belief in his own bullshit, and President Bukele is all-in on this one in as loud a voice as he can manage.

In November of 2021, Bukele held a launch event for “Bitcoin City” that could have been produced by Tesla. The notion is for a circular urban development to be built up around a geothermal energy hub at the foot of a volcano. The republic plans to sell a “Bitcoin Bond” to raise $1 billion some time in 2022 to finance it, and begin building something that sounds like a ponytailed libertarian’s fever dream.

Some three months after the announcement, buoyed by the encouragement of ponytail-guy flat-tax advocates everywhere, Bukele is enacting legal reforms that will set up the exact kind of “freedom” that US commercial interests are quite happy to tolerate in Latin America: freedom of capital.

I’m sending 52 legal reforms to congress, to remove red tape, reduce bureaucracy, create tax incentives, citizenship in exchange for investments, new securities laws, stability contracts, etc.

— Nayib Bukele 🇸🇻 (@nayibbukele) February 20, 2022

The plan is simple: as the world falls into tyranny, we’ll create a haven for freedom.

Last week, Bukele made a show out of clowning on Canadian Finance Minister Chrystia Freedland, whose government froze the funds of backers of the Canadian Truck convoy that besieged Ottawa for the first three weeks of February, telegraphing the notion that he’d never do anything of the sort.

Are these the people who like to give lessons to other countries about democracy and freedom?

— Nayib Bukele 🇸🇻 (@nayibbukele) February 15, 2022

This is one of the top ranking countries in the “democracy index”?

Your credibility on these topics is now worth 0.pic.twitter.com/wCjh9bXwDt

Conveniently, the Salvadorans who mount protests against Bukele’s cryptocurrency-based development strategy don’t have much money to seize. Should the bet pay off, the extent to which the wealth it brings is able to benefit one of the poorest countries in the world will determine whether this new president will be celebrated as a national hero, or forced to double up on the US military aid and hire some mercenaries to keep a mob from burning Bitcoin City down.

The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.