Eldorado Gold (TSX: ELD) has extended the mine life of its Lamaque Complex. The extension follows a new plan being released as it relates to mineral reserves, while the company at the same time has released a preliminary economic assessment that provides the potential for a further life of mine extension which is based on inferred mineral resources.

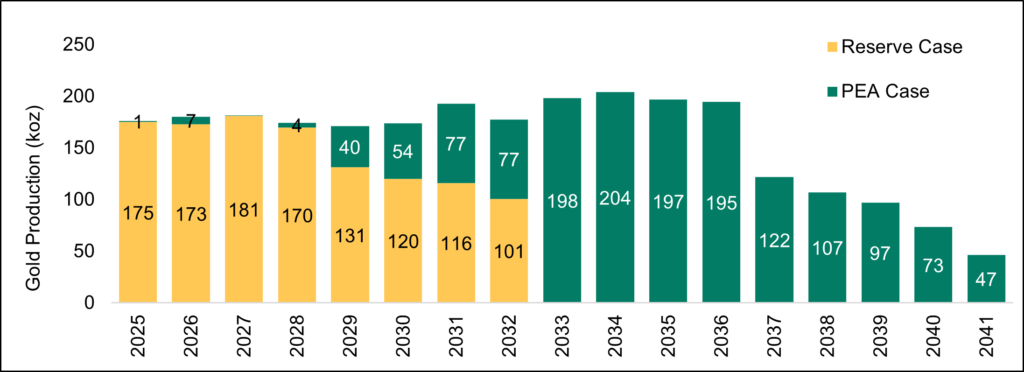

The mine life of the complex has been extended to eight years, which is in increase from the prior five year estimate. The extension is based on the production of 1.2 million ounces of gold through to 2032, with average annual production to top out at 175,000 ounces through to 2028.

Life of mine all in sustaining costs for the reserve case meanwhile are expected to remain low at $1,176 an ounce. At a gold price of $2,000 an ounce, the reserve case is said to present a net present value of $555 million, using a 5% discount rate on an after-tax basis. That NPV jumps to $1.1 billion at $2,600 gold.

The preliminary economic assessment meanwhile posits that the life of mine could be extended by a further nine years based on inferred resources contained at the Triangle and Ormaque mines. This estimate suggests 1.5 million ounces of incremental gold production is possible through to 2041, which would boost annual production to 185,000 ounces a year through 2036.

Life of mine all in sustaining costs would actually come down in this scenario, dropping to $1,149 an ounce.

Overall, the PEA outlines an after-tax net present value of $623 million at a gold price of $2,000 an ounce and an IRR of 43.5%. That figure jumps to $1.1 billion at $2,600 an ounce gold, with these numbers being in addition to the figures presented for the reserve case.

“After acquiring this asset in 2017, we successfully brought the Triangle deposit into commercial production in 2019, and it has since produced nearly one million ounces of gold. With the development of the Ormaque deposit, we will be adding a second underground mine to the Lamaque Complex, which provides operational flexibility and efficiency as we leverage the existing plant and infrastructure,” commented CEO George Burns.

Eldorado Gold last traded at $21.78 on the TSX.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.