FULL DISCLOSURE: This is sponsored content for Element 29 Resources.

Peru. The land of Cusco, Machu Picchu, and the ancient Incan empire that was nestled within the Andes.

It’s a nation built upon the export of its raw materials – minerals to be exact. These minerals are the lifeblood of the country, making up the bulk of it’s exports at over 60% and 10% of GDP, providing the hard currency Peru needs to finance their imports and external debt payments.

When it comes to mining, Peru is an international powerhouse. The country in 2019 was second globally in terms of copper, silver and zinc production, third in lead production, fourth in tin and molybdenum, and eighth in gold production.

In short, the country has minerals, and isn’t afraid to extract it. Or at least they weren’t, until protests began at the start of the year over a slew of political issues that ultimately reduced mining investment by 18% in 2023.

But the government now in power, led by Dina Boluarte, has vowed to reduce red tape in the mining sector and increase investment, with the minister of mining publicly stating “One of the objectives of this government is to unblock all mining projects.”

And what that means is opportunity. Especially after a year of under investment.

One such opportunity is Element 29 Resources.

Let’s dive in.

Who is Element 29?

Originally founded by GlobeTrotters Resource Group, a premier project generator focused on Peru, Element 29 is a potentially undervalued explorer focused on advancing two large porphyry copper projects found within the Andes mountains near the coast.

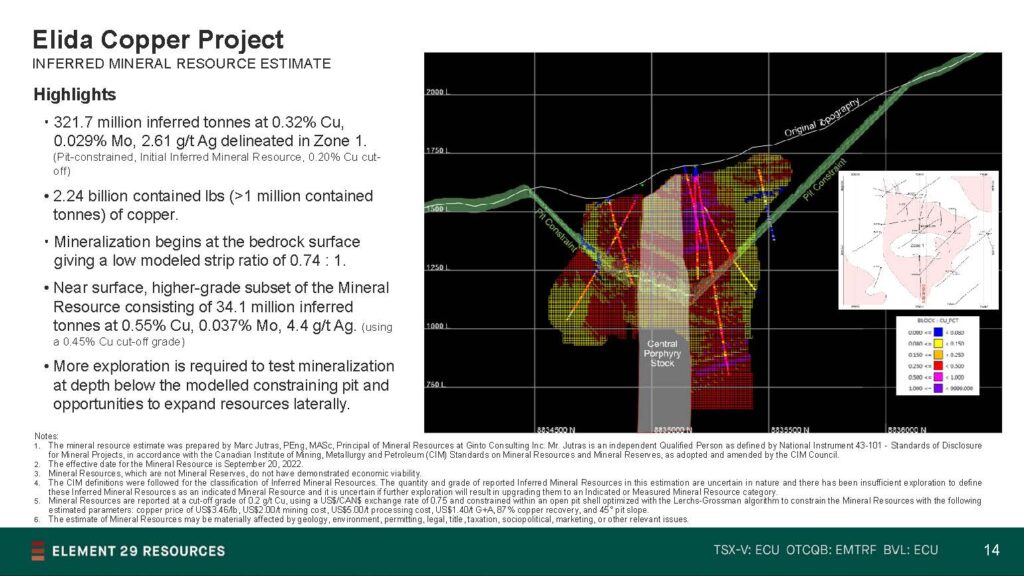

Porphyry systems represent the largest of all copper deposits – and Element 29’s properties prove it. The Elida project, located north of Lima, in 2022 saw its initial mineral resource estimate amount to 321.7 million tonnes of inferred resource at 0.32% copper.

That works out to an estimated 2.2 million pounds of contained copper. Its also estimated to contain 205.7 million pounds of molybdenum, and 27 million ounces of silver. Which on a relative basis, puts Element 29 amongst the cheapest of it’s copper peers, in terms of dollar per pound of copper equivalent. And that doesn’t even include a phase 2 drill program that had a 404 metre hit of 0.45% copper either.

Not bad for an initial resource.

What’s more, the estimate is based solely on Zone 1 at Elida. Geologic mapping has mapped out 5 porphyry zones within a 2.5 square kilometre area, while the project as a whole is 192 square kilometres – leaving multiple opportunities for further expansion.

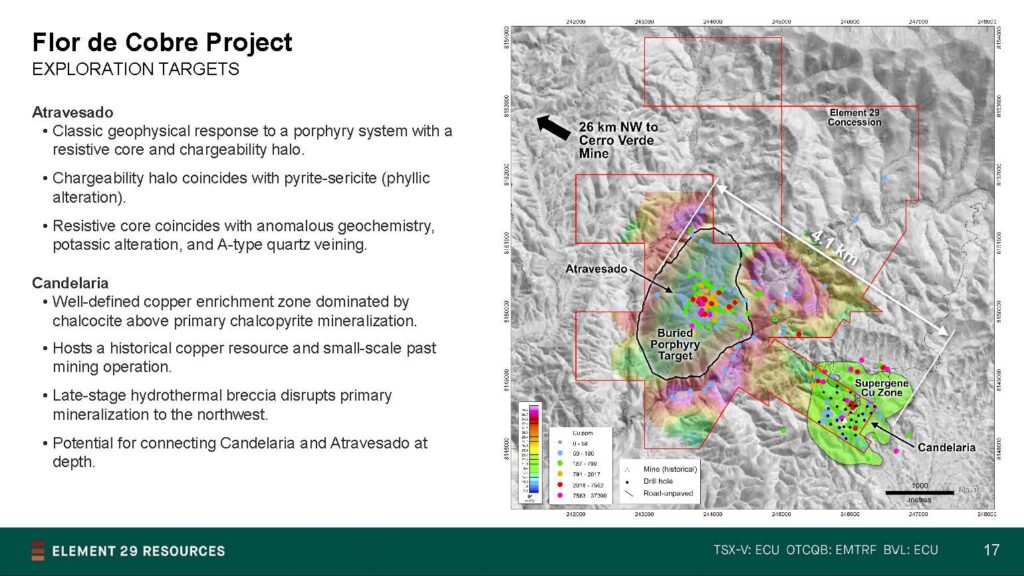

Further down the Peruvian coast, we find the Flor de Cobre project, which is centered within the Southern Peru Copper Belt – a premium global copper district, which has over 60 million tonnes of contained copper across projects such as the Cerro Verde mine operated by Freeport McMoran or the Quellaveco mine being put into operation jointly by Anglo and Mitsubishi. Quellaveco is expected to pull 300,000 tonnes of copper out of the ground. Every year. For the next ten years. Just to give you a sense of the opportunity here.

Slightly less developed than Elida, Flor de Cobre contains two highly prospective porphyry copper targets, known as the Candelaria and Atravesado zones.

The Candelaria zone is particularly noteworthy, with a 2022 drill program hitting 349 metres of 0.77% copper – including an interval of 1.42% copper over 123 metres. The zone contains a historical resource estimate from when Phelps Dodge was developing it, consisting of 57.4 million tonnes of 0.67% copper.

Why copper? And why now?

All right. If you’ve made it this far, you’re asking one of two things. Why copper, and who’s behind the company?

Let’s start with copper. A key piece in the green energy revolution.

Here’s some quick facts about that transition, courtesy of copper.org.

- A typical onshore wind installation can use up to 7,766 pounds of copper. Offshore installations use triple that amount at 21,067 pounds.

- Solar power is estimated to use 12,154 pounds of copper per megawatt.

- A typical ICE vehicle – i.e. gas – uses 48 pounds of copper. Hybrids use 88 pounds. And your typical full-bore EV uses 183 pounds.

Those figures also don’t include the infrastructure required for the grid itself – which the IEA estimates at 10 million tons of copper annually by 2040.

The headline figure from BloombergNEF is 427 million tons of copper is required by 2050. Thats 21 times today annual production, just to update the grid for net-zero targets. Today the world produces around 22 million tonnes of copper annually. Bloomberg expects supply of copper to fall short of demand between 2023 and 2027 by as much as 4.6 million tons per year – which it expects to result in a 20% price surge by ’27. Goldman Sachs anticipates up to an 8.2 million ton supply gap by 2030.

4/ Mine supply is running at approx. +2% while refined supply has been tracking at +5-6% globally (+14% in China). As noted earlier, Chen Yunian, VP at Jiangxi Copper, China’s biggest copper producer, has already flagged the increasing challenge in securing copper concentrate.

— Robert Friedland (@robert_ivanhoe) November 20, 2023

And then there’s Robert Friedland, founder of Ivanhoe Mines. While he may be a little biased, he’s also in-the-know on the topic of copper. And he’s reporting right now that we are experiencing hours of visible inventory. Not years, not months, not days, but hours. This is following 1.5% of global production coming offline at First Quantum’s Cobre Panama mine, and union issues at Las Bambas leading to a further 2% reduction in global supply.

The short of it: the world needs more copper. Right now.

Who’s behind Element 29?

Back to Element 29. So who’s behind the company?

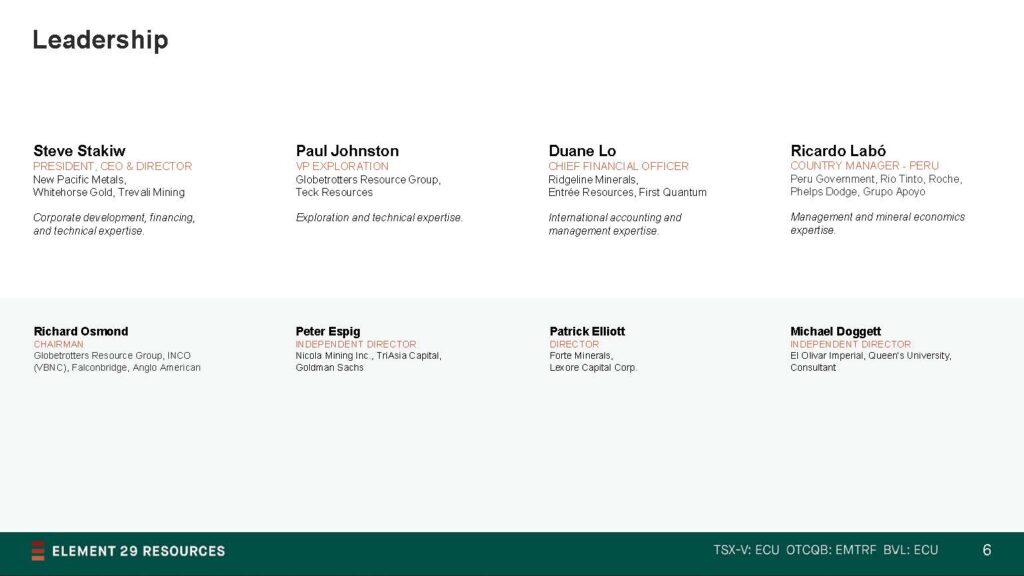

Element 29 is led by Steve Stakiw, a mining exec with over two and a half decades of experience. He previously served as a Senior VP of New Pacific Metals, who has a large silver deposit in Bolivia, and assisted with the spinout of Whitehorse Gold, now Tincorp.

The company also has the backing of GlobeTrotters Resource Group, with its President, Richard Osmond, formerly of Inco, serving as the Chairman, while Paul Johnston, a technical advisor to GlobeTrotters, serving as a VP Exploration of Element 29.

The leadership team as a whole has a laundry list of notably names they’ve been involved with, including Teck Resources, Rio Tinto, Phelps Dodge, Nicole Mining, Trevali Mining, First Quantum, and more. While the in-country manager, Ricardo Labo, was most recently in the Peruvian government.

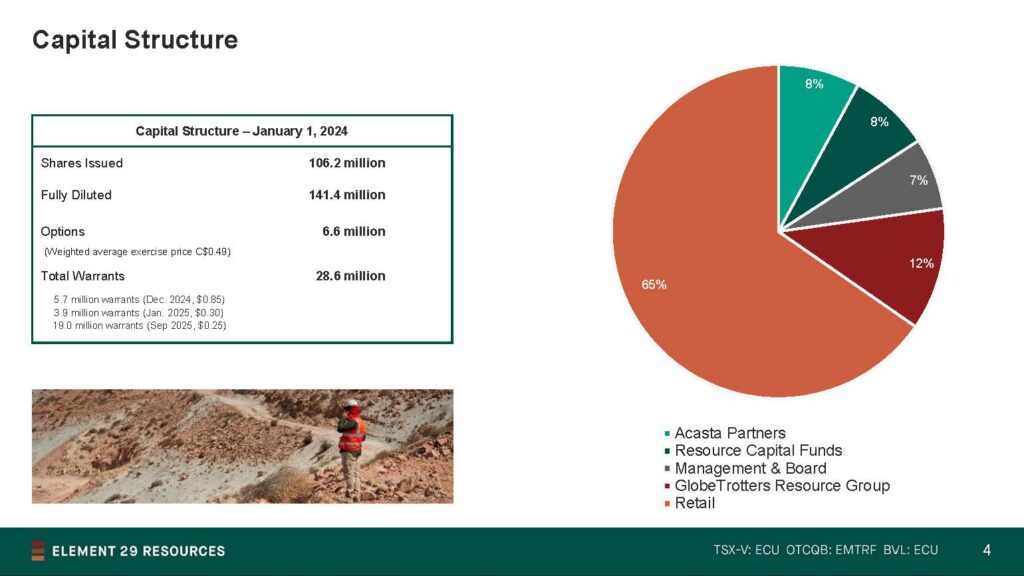

In terms of ownership, Acasta Partners, and Resource Capital Funds each own an 8% stake in the fund, while management holds about 7%. GlobeTrotters is the largest shareholder at 12%, leaving about 65% of shares to retail investors.

In Conclusion

Let’s wrap it up.

The world has a copper problem. It’s a key ingredient to the ongoing green energy transition. Yet we simply don’t have enough being produced, with shortages being a problem today.

Copper mines globally are experiencing shutdowns over environmental concerns and populism protests. The Peruvian government has committed to reducing red tape in the mining sector and unblocking any mining projects, where mining makes up a large majority of its foreign exports and 10% of its GDP.

While Element 29 may be early stage, its properties show potential for large copper porphyry deposits, located at low elevations, close to the coast, and near infrastructure. Mixed with the positive macro indicators for copper, it just might be the recipe for success.

FULL DISCLOSURE: Element 29 Resources is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Element 29 Resources. The author has been compensated to cover Element 29 Resources on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.