Another day, another headline related to Elon Musk. The Tesla (NASDAQ: TSLA) chief executive has made headlines in the media yet again, this time related to an exclusive story published today by the Wall Street Journal, wherein its stated that Musk is again being probed by the Securities and Exchange Commission.

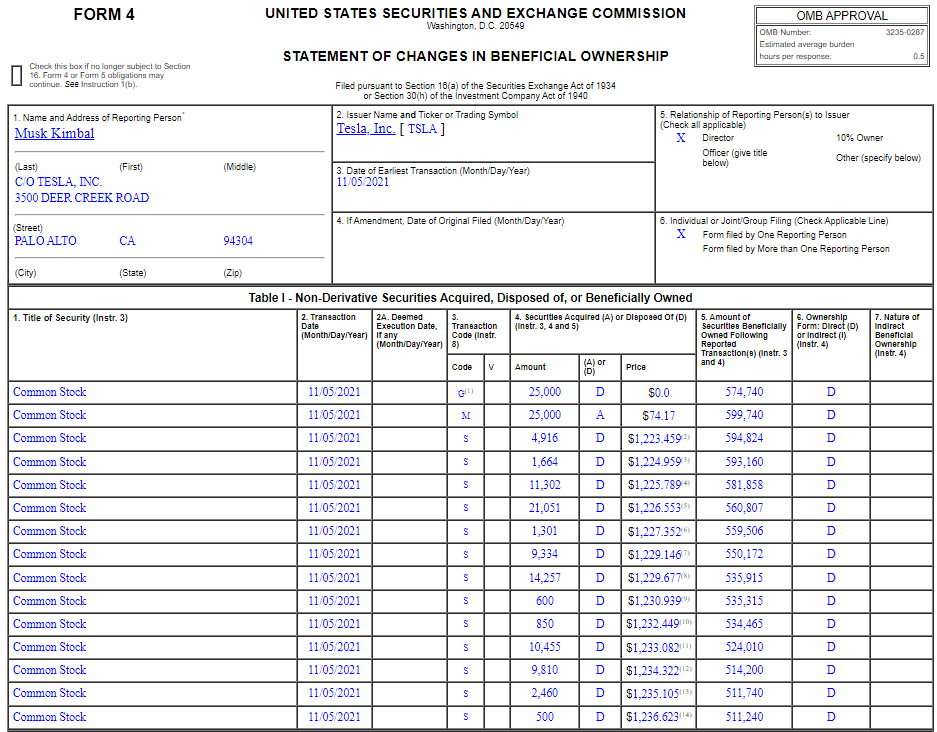

The latest probe however appears to be related to insider trading. The SEC is reportedly investigating Elon as well as his brother Kimbal, a director of Tesla, on whether certain stock sales by Kimbal were made on material non-public information, thereby breaking insider trading rules. The trades in question relate to Kimbal’s sale of 88,500 shares on November 5, 2021, which grossed proceeds of $108.7 million as per SEC filings.

The date of the share sale is significant, with Elon the following day tweeting his infamous Twitter poll, wherein he asked his followers whether they supported the sale of 10% of his holdings to pay taxes. The question it seems is whether he had informed his brother of the oncoming tweet, or if it was just poor timing from a public relations aspect.

Much is made lately of unrealized gains being a means of tax avoidance, so I propose selling 10% of my Tesla stock.

— Elon Musk (@elonmusk) November 6, 2021

Do you support this?

The poll, as many now know and as can be seen above, showed 57.9% of respondents were in support of Musk selling his shares. Musk then proceeded to unload billions worth of Tesla equity, and is partially responsible for bringing the equity down from $1,222.09 on November 5, the day before the poll, to $774.14, where it trades at the time of writing. The company had notably hit an all time high of $1,243.49 on November 4.

Tesla last traded at $774.14 on the Nasdaq.

Information for this briefing was found via Edgar and the Wall Street Journal. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.