Elon Musk’s role as the new owner of Twitter is getting in the way of Tesla’s (Nasdaq: TSLA) success. Wedbush analyst Dan Ives on Thursday removed the electric vehicle maker from his ‘Best Ideas’ list in the wake of what he calls the “Twitter train wreck disaster.”

Ives points out that it has been a “very nervous few months” for Tesla shareholders as the Twitter drama plays out. And with the mass layoffs and the verification chaos it seems like it’s far from over.

“More worrying is that this Twitter ‘Money Pit’ situation will never end and continue to take up money, time, and attention from Musk instead that could be focused on Tesla,” the analyst said. Musk is also CEO of privately-held SpaceX, a spacecraft engineering company, but Ives noted that Twitter is a far larger commitment to run.

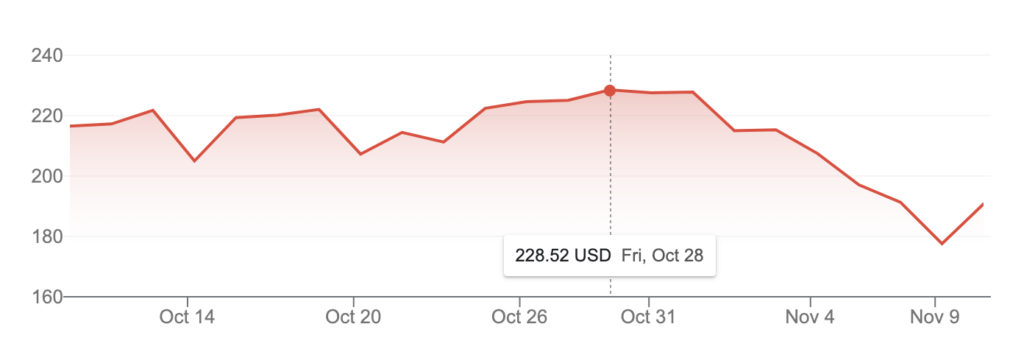

Tesla’s stock has fallen since Musk took over Twitter at the end of October, and Ives notes that the deal’s cross-contamination of Tesla is getting “worse by the day.”

The stock has gone down by as much as 30% this month, and 60% below its peak of $409.97. Its November 9 close of $177.59 was the lowest since it closed at $173.95 on Nov. 23, 2020. Recent events have eviscerated about $36 billion off Musk’s net worth since he closed the $44-billion deal with Twitter in late October.

Ives also points out that Musk has put investors in an “agonizing cycle” as he continues to sell Tesla stock to raise money to pay for the Twitter deal. Filings show that Musk sold 19.5 million shares of Tesla, equivalent to about $3.95 billion, in 38 separate transactions on November 4, 7, and 8.

The sale, along with sentiment over how Musk has been handling the takeover (spoiler: it has not been well), likely pushed down the stock, and investors have yet to see it bounce back.

“Now sitting on top of the peak of the mountain with Tesla in a massive position of strength Musk has managed to do what the bears have unsuccessfully tried for years … crush Tesla’s stock by his own doing in what we view as a purely painful dark situation,” Ives said.

Ives has also slashed Tesla’s price target from $300 to $250, but he still rates the shares at Buy.

Tesla last traded at $195.97 on the Nasdaq.

Information for this briefing was found via CNBC, Barron’s, and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.