On August 4, Endeavour Mining (TSX: EDV) reported its second quarter financial and production results. The company announced that they produced 409,000 ounces of gold at an all-in sustaining cost of $853 per ounce. The company reported revenue of $753 million, EBITDA of $363 million, and operating cash flow of $286 million.

Only one analyst raised their 12-month price target after the financial results, with the average 12-month price target raising to $44.83 from $44 before the results. The street high sits at $55 from National Bank while the lowest comes in at $36 from Credit Suisse. There are only 12 analysts covering the stock, 3 have strong buy ratings and the other 9 have buy ratings.

BMO Capital Markets reiterated their $39 price target and outperform rating on Endeavour, calling the second quarter results solid. The company beat all of BMO’s estimates due to strong performances from almost all of their operations, specifically Houndé, Ity, Karma, and Sabodala-Massawa, while Boungou was the only mine to miss estimates.

BMO says that the companies $833 million of cash on hand is solid, especially since the company repaid $120 million of its credit facility during this quarter. With its large cash position, the company is on track to beat the 2021 minimum dividend of $125 million. The company announced a $70 million dividend for this quarter.

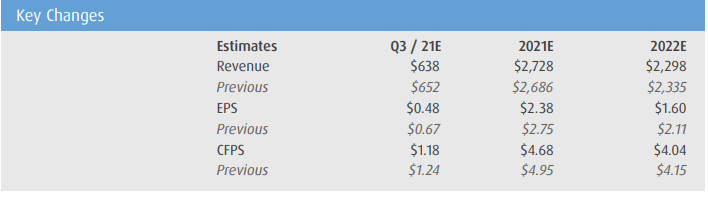

Below you can see BMO’s updated third quarter, 2021, and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.