Endeavour Silver Corp. (TSX: EDR) last week reported its second-quarter production results. The company announced that it produced 1,359,207 ounces of silver and 9,289 ounces of gold, for total silver equivalent production of 2.1 million silver ounces. The company said that production continues “to outpace the 2022 production guidance of 6.7-7.6 million silver equivalent ounces” with the first half of 2022 producing 4.1 million silver equivalent ounces.

The company says that the production results were primarily driven by an increase in production at the Guanacevi mine, noting that the “El Curso orebody has led to significantly higher grades than planned, allowing for production targets to be met during a period of decreased plant throughput.”

Endeavour Silver currently has 7 analysts covering the stock with an average 12-month price target of C$6.87, or an upside of 70%. Out of the 7 analysts, 2 have buy ratings and the other 5 have hold ratings. The street high price target sits at C$11.04 which represents an upside of 170%.

In BMO Capital Markets’ note on the production results, they reiterate their market perform rating and C$4.50 12-month price target, which equates to roughly an 11% return. They say that the company beat their estimates and that they believe the company is on track to meet or beat their full-year production guidance.

On the results, BMO was expecting Endeavour to produce 1.121 million ounces of silver, with the company beating their estimate by 21%. While gold production came in 12% higher than their 8,300-ounce estimate.

BMO says that the beat was primarily driven by higher grades at El Curso even as throughput came in 16% lower than the first quarter. Endeavour said that the grade from El Curso was 465 grams per tonne versus BMO’s estimate of 335 grams per tonne, producing 1.194 million ounces of silver versus BMO’s estimate of 0.994 million ounces.

Additionally, Endeavour’s Bolanitos mine processed 107,000 tonnes of ore, beating their 97,000 tonnes estimate by 10%. While silver production also beat their estimates, coming in at 165,100 ounces versus BMO’s estimate of 127,500 ounces.

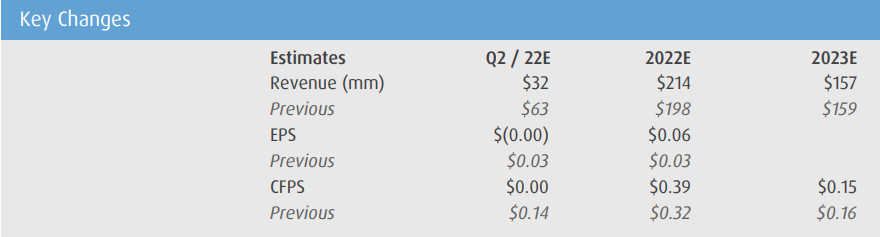

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.