Energy Fuels (TSX: EFR) has struck a significant deal, solidifying its position as a leading producer of uranium, Rare Earth Elements (REEs), and vanadium. The company last night announced the execution of a definitive scheme implementation deed with ASX-listed Base Resources Limited, outlining the acquisition of 100% of Base Resources’ issued shares.

The transaction, valued at approximately A$375 million ($331 million), marks a pivotal moment for both companies and their shareholders.

Under the proposed scheme, each Base Resources shareholder would receive 0.0260 Energy Fuels common shares and A$0.065 in cash through a special dividend, totaling A$0.30 per Base share. This represents a hefty premium of 173% over Base Resources’ 20-day average price. After the acquisition, Energy Fuels and Base Resources shareholders would respectively own about 83.6% and 16.4% of Energy Fuels.

Mark Chalmers, President and CEO of Energy Fuels, expressed enthusiasm for the acquisition, referencing it as “a monumental leap forward for the company.”

Central to the transaction is Base Resources’ Toliara project in Madagascar, described as a world-class, advanced-stage, low-cost, and large-scale heavy mineral sands project.

Initially focused on Ilmenite and Zircon production, the project contained a net present value (10% discount) of US$1.0 billion on an after-tax basis based on a prefeasibility study. Further analysis revealed that Monazite, a rich source of REEs, could be extracted alongside existing production with minimal additional cost. This expanded the project’s net present value to US$2.0 billion, with an after-tax return rate of 32.4%.

Energy Fuels plans to utilize Toliara’s Monazite to produce REE oxides and recover uranium, enhancing its supply chain. The processing of monazite is expected to produce an estimated 75,000 pounds of U3O8 per year. Although development was temporarily halted in Madagascar due to negotiations, progress suggests a positive outcome expected in 2024, potentially unlocking further value from the project.

The offer has received unanimous approval from Base Resources’ Board of Directors and major shareholders, signaling confidence in the transaction’s potential. Energy Fuels also anticipates expanding its REE production capacity, with plans for Phase 2 REE separation infrastructure to meet growing demand.

Base shareholders are expected to vote on the proposal in late July or early August 2024, with the transaction set to finalize in the third quarter of 2024, subject to meeting all requirements.

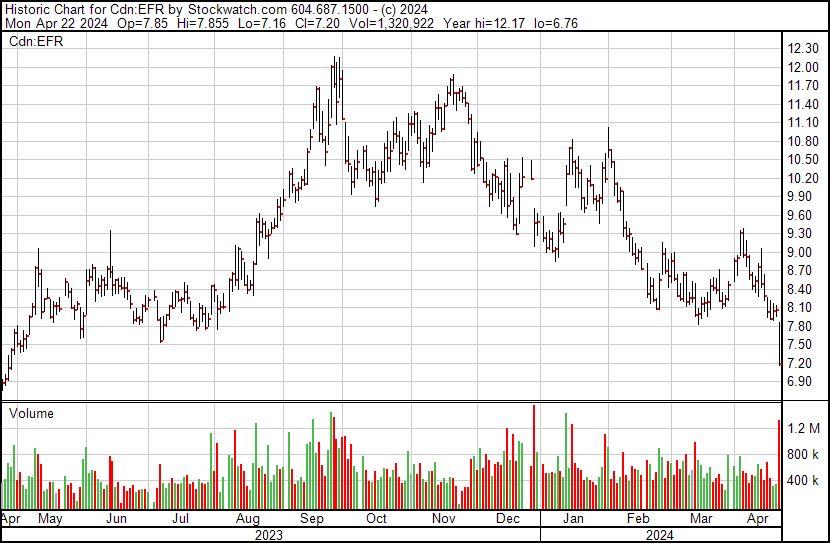

Energy Fuels has fallen as much as 10.7% today on the news, last traded at $7.20 per share.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.