Last week, Enthusiast Gaming (TSX: EGLX) announced that they closed a $58.7 million bought deal. After the bought deal closed, Canaccord raised Enthusiast Gaming’s 12-month price target to C$8.75 from C$7.50 and reiterated their buy rating on the company.

Enthusiast Gaming currently has six analysts covering the company with a weighted 12-month price target of C$6.83. This is up from the average at the start of last month, which was C$4.75. Three analysts have strong buy ratings, while the other three have buy ratings.

Robert Young, Canaccord’s analyst, says that after the multiple transactions have closed, “We believe these are positive developments which underscore Enthusiast Gaming’s maturation as a public company.”

With the bought deal closing, Young believes the company has now “mitigated a key investor risk,” which was their balance sheet. Young also believes that direct sales and subscriptions will drive margin this quarter. He writes, “We believe that incremental margins on subscription revenue are high.”

Young adds that the M&A pipeline remains robust as the company continues to target small content creators. He writes, “This target market remain extremely fragmented given low barriers to entry, and EGLX has the necessary information and resources to acquire suitable targets. A proposed U.S listing in H1/2021 would provide the company with significant investor access and potentially resources to make bigger acquisitions in the future.”

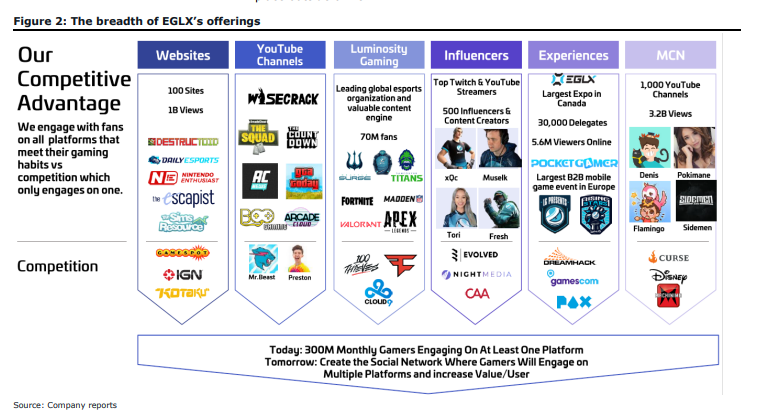

Below you can see all of Enthusiast Gaming’s current offerings, as arranged by Canaccord.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.