On December 22, Eskay Mining Corp. (TSXV: ESK), a precious and base metals exploration company focused on a prolific region of British Columbia’s Golden Triangle region, confirmed that two of its projects, TV and Jeff, are precious metal-rich volcanogenic massive sulfide (VMS) deposits. VMS deposits, particularly those containing significant gold/silver, are rare and potentially very valuable structures.

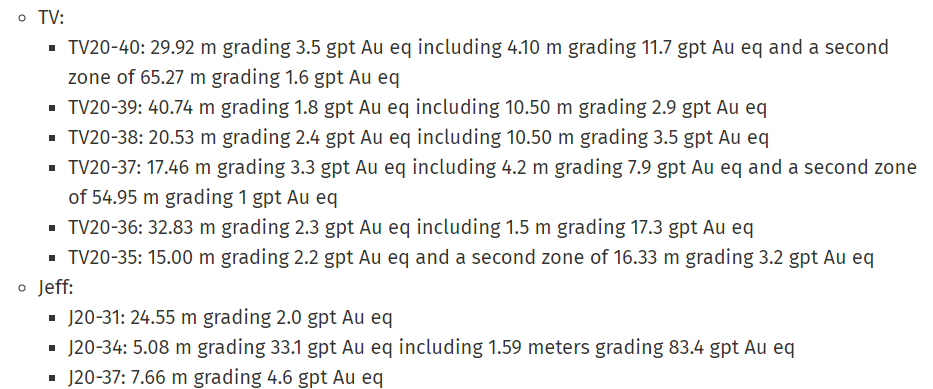

Assay results on 9 of 20 holes drilled from August through October have been analyzed by Eskay and are shown just below. Two separate intervals in distinct holes were extremely encouraging: a 5.1-meter span with a concentration of 33.1 grams of gold equivalent per tonne (g/t); and a separate 4.1-meter span with an 11.7 g/t equivalent composition. Assay results from the other 11 holes should be returned next month.

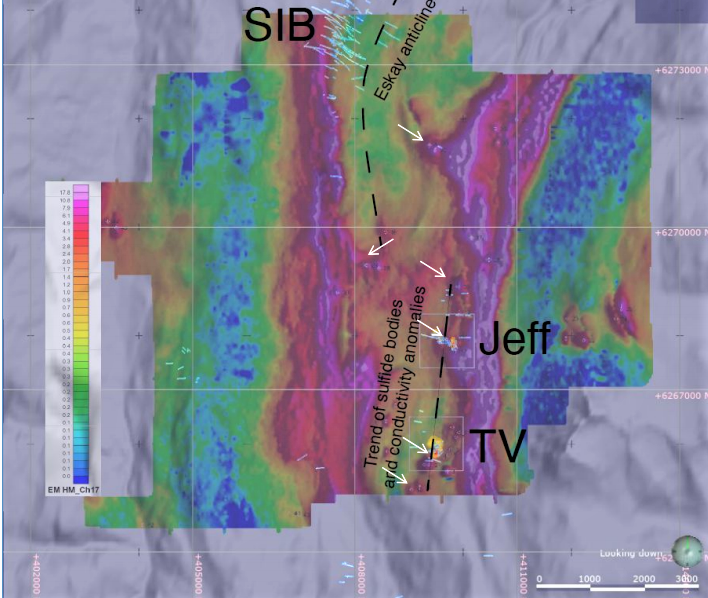

TV and Jeff are located only 1.8 kilometers apart, so it is possible they are part of one system. Both deposits are open in several directions, including along strike.

VMS Deposits

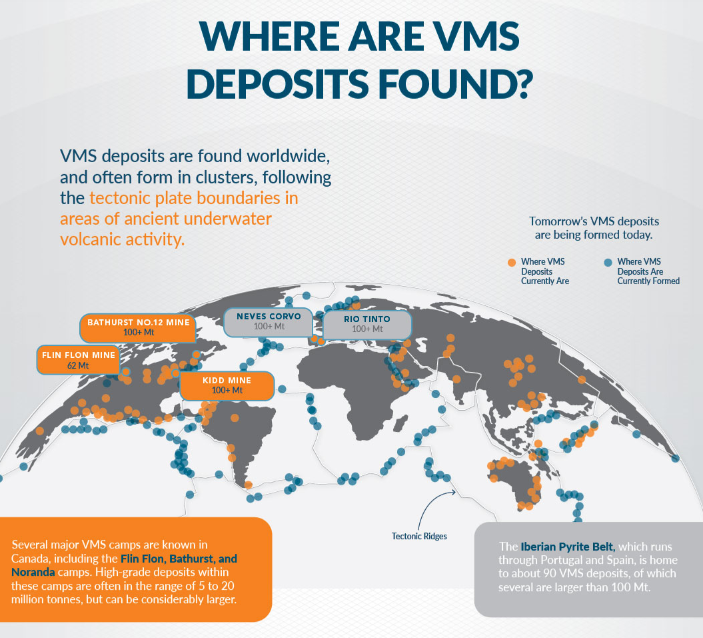

VMS deposits are rich in base metals such as copper, zinc or lead, and in some cases, precious metals such as gold and silver. They are quite rare and potentially massive in size. Significant VMS exploration activity is ongoing in the remote Canadian artic region.

According to Cormark, VMS deposits worldwide average about 17 million tonnes in size, with 1.7%, 3.1%, and 0.7% copper, zinc, and lead content, respectively. The largest VMS deposit is the Glencore-owned Kidd mine in Ontario, which since 1966 has produced 9 million tonnes of zinc; 3.4 million tonnes of copper; and 12,000 tonnes of silver. Other large Canadian VMS deposits include the Flin Flon, Bathurst and Noranda mines.

VMS deposits form over a long period of time and can be reactivated frequently. Typically, the deposits contain bodies of ore that are thick in the middle – sometimes hundreds of meters thick – and thin at the edges. The ore body may extend meters along the strike. This shape makes VMS deposits ideal for cheap open pit mining methods because a large amount of ore can be removed while minimizing waste rock removal. In contrast, the mining of ore hosted in narrow veins is much more expensive, as significantly more waste must be discarded.

Debt-Free Balance Sheet — But Cash Flow Losses Starting to Build

A pre-revenue company, Eskay’s operating and cash flow losses started to build in the quarter ended August 31, 2020, as drilling programs began. As these negative cash flows are likely to persist for some time, Eskay raised $13.8 million of equity this month in a private placement. When factoring in this additional cash, the company’s balance sheet is in reasonable shape. At the end of August, the company had $4.3 million of cash and no debt.

| (in thousands of Canadian $, except for shares outstanding) | 2Q FY21 | 1Q FY21 | 4Q FY20 | 3Q FY20 | 2Q FY20 |

| Operating Income | ($2,690) | ($396) | ($650) | ($303) | ($135) |

| Operating Cash Flow | (2,418) | (29) | (331) | (46) | (27) |

| Cash | 4,343 | 889 | 177 | 179 | 104 |

| Debt – Period End | 0 | 0 | 0 | 0 | 0 |

| Shares Outstanding (Millions) | 140.7 | 118.3 | 118.3 | 114.7 | 113.3 |

All exploration programs are inherently risky, and the encouraging early results that Eskay has shown at TV and Jeff may not be replicated in future drilling programs. Also, even if a substantial quantity of resources is ultimately determined to be present, the costs to mine it could prove to be uneconomic. Under almost any scenario, the generation of any significant mining cash flow is still years away.

Conclusion

Eskay’s TV and Jeff VMS projects are located in a region characterized by significant gold discoveries. This, combined with the unique nature of VMS deposits and Eskay’s other high-potential projects – most notably another potential VMS deposit called the SIB/Lulu project – makes the company look like an interesting speculative junior miner. In addition, Eskay’s balance sheet is debt-free, and it has shown the ability to raise equity capital to fund its drilling capital requirements.

Eskay Mining last traded at $1.95 on the TSX Venture Exchange.

Information for this briefing was found via Sedar, and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.