European traders are quickly shoring up diesel shipments from Russia ahead of the upcoming EU-wide ban on oil products slated to take effect in February. Meanwhile, some of Europe’s northern countries are already shunning Moscow’s supplies, with Russian-origin imports to the region falling by 90%.

Russian crude imports will no longer be allowed to enter European markets starting on December 5, followed by a ban on diesel products come February 5. As of November, Russian diesel accounted for about 44% of Europe’s total imports of the fuel, up from 39% the month before. Indeed, with very little cost-effective substitutes, some countries are rushing to fill their tanks before they are forced to pay substantially more from alternative sources.

Meanwhile, ahead of the forthcoming EU sanctions on Russian crude, European energy traders must prove to ICE Futures Europe that all low-sulphur gasoil entering tanks in the ARA region is not of Russian origin ahead of January delivery. The ARA tanks can still get filled with Russian gasoil throughout December, but will need to be transferred to other storage facilities that cannot facilitate deliveries. Nonetheless, the gasoil will likely be sold or used up swiftly due to backwardation in ICE gasoil futures, whereby future value will be lower than current prices.

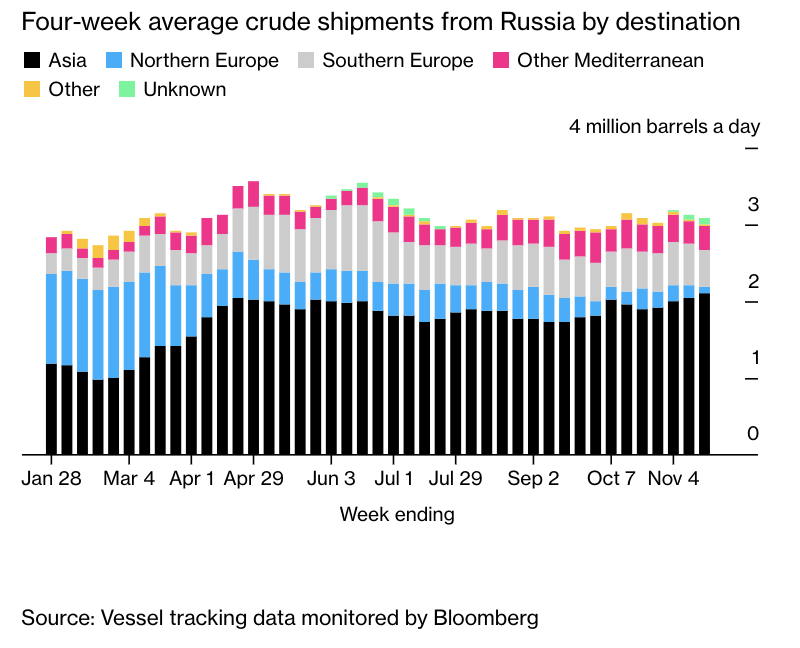

Still, the EU will need to come up with around 500 to 600 thousand barrels per day to make up for the soon-to-absent Russian shipments, which it will likely have to import from the US and the east of Suez, including India and the Middle East. Russia, for its part, is already feeling the pressure of the forthcoming EU sanctions, losing about 90% of its market share across Europe’s northernmost countries. According to data compiled by Bloomberg, Russian seaborne deliveries of crude into Rotterdam stood at just 95,000 barrels per day in the four weeks ending on November 18— a substantial decline from the 1.2 million barrels per day shipped to the port in February 2022.

However, the EU’s sanctions on Russian diesel and crude imports won’t deter other countries from taking advantage of the displaced shipments. China, India, and Turkey have purchased a record 2.35 million barrels per day as of November 18, upending traditional trade flows and giving new purpose to oil tankers that were otherwise slated for the scrapyard.

Information for this briefing was found via Bloomberg and Reuters and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.