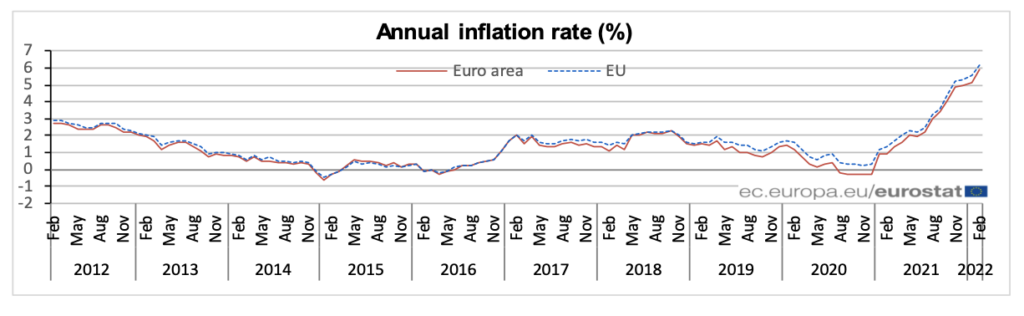

Consumer prices across Europe soared by the most on record in February, and will likely continue increasing amid food and energy shortages in the wake of Russia’s war in Ukraine.

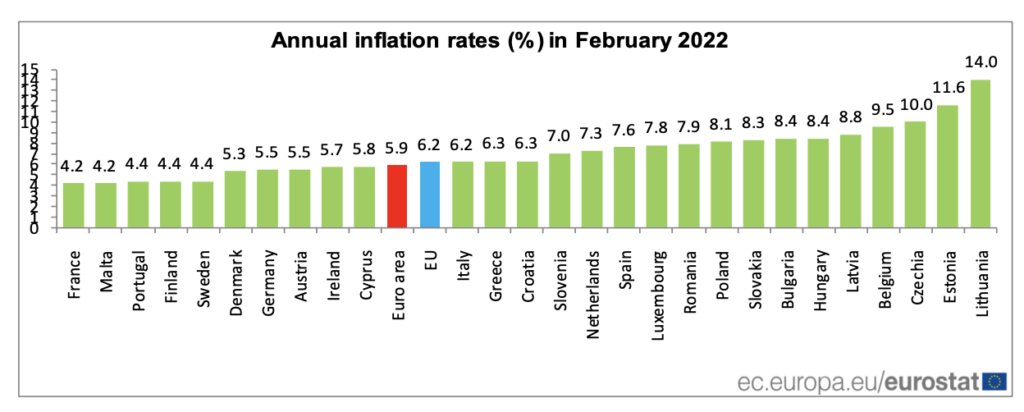

Latest Eurostat data showed that European consumers paid a record 5.9% more for goods and services last month, up from January’s 5.1% annual increase. The energy sector accounted for most of the gains, followed by services, food, alcohol, and tobacco.

Prices jumped across 25 EU member states, and only subsided in two. Consumers in Lithuania, Estonia, and the Czech Republic paid the most for purchases in February, where inflation spiked by 14%, 11.6%, and 10%, respectively.

Even though February registered the sharpest annual increase in prices on record, consumers will likely face even harsher economic conditions in the coming months. Earlier this month, German-based energy provider GASAG warned that German citizens will likely see their gas bill rise by as much as 26% come May, just as Russia begins retaliating against EU sanctions by axing exports of numerous goods, including telecom, medical, auto, agricultural, electrical, and tech equipment until the beginning of 2023.

⚡️UN: War in Ukraine could raise food prices by 20%.

— The Kyiv Independent (@KyivIndependent) March 11, 2022

Disruption to agricultural activity could “raise international food and feed prices by 8-22%.”

If the war affects the harvest, UN predicts that 8-13 million more people could suffer from malnutrition in 2022-2023.

In fact, Russia’s war has already sparked massive panic among European consumers, who have begin hoarding various staple goods that are imported from the continent’s bread basket. As the Financial Times reports, cold war flashbacks have sparked a cascade of panic buying, leaving supermarket shelves bare merely two years following pandemic-related shortages. In northern Italy, grocery stores are sold out of pasta, while Norway is nearly sold out of iodine tablets, which are used to prevent thyroid damage in the event of radioactive exposure.

Information for this briefing was found via Eurostat, the Financial Times, and Twitter. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.