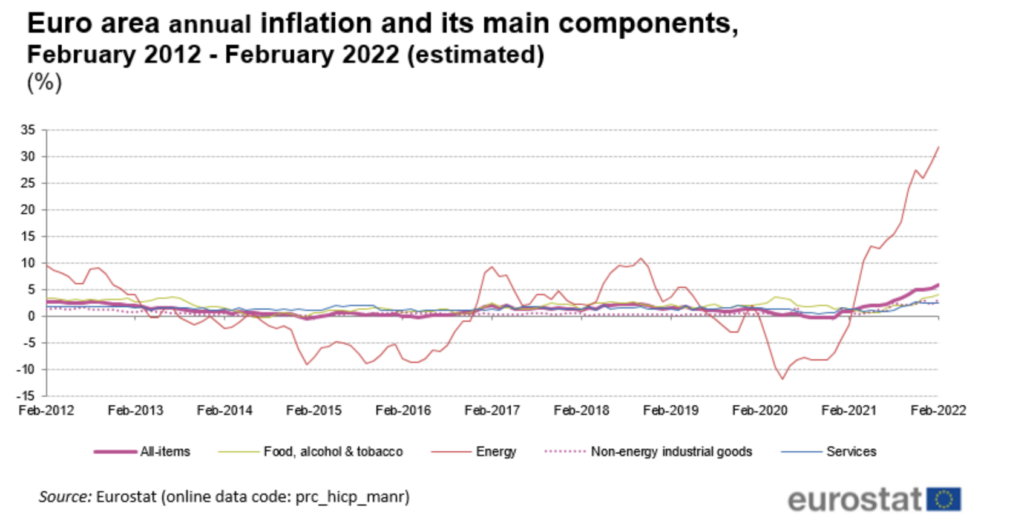

Eurozone inflation soared to the highest on record last month, fuelling fears that the Russia-Ukraine conflict could push consumer prices even higher, and further adding pressure on the European Central Bank to rapidly adapt its monetary policy.

According to latest data from Eurostat, annual inflation across the eurozone jumped by a record 5.8% in February, up from a reading of 5.1% in the prior month, to substantially above the 5.4% forecast by economists surveyed by Reuters. Last month’s jump in the cost of living puts Europe’s central bank in a difficult position, dividing policy makers between those wanting to scale back ultra-accommodative monetary policy and those that want to await potential economic implications stemming from the Russia-Ukraine crisis.

The Eurostat data pointed to sharp increases in the price of energy and food, as well as surging costs for manufactured goods and services. Energy prices were up by a record 31.7% in February, while the cost of unprocessed food jumped 6.1%. Core inflation, which does not account for volatility from energy, food, alcohol, and tobacco products, rose from 2.3% in January to 2.7% last month.

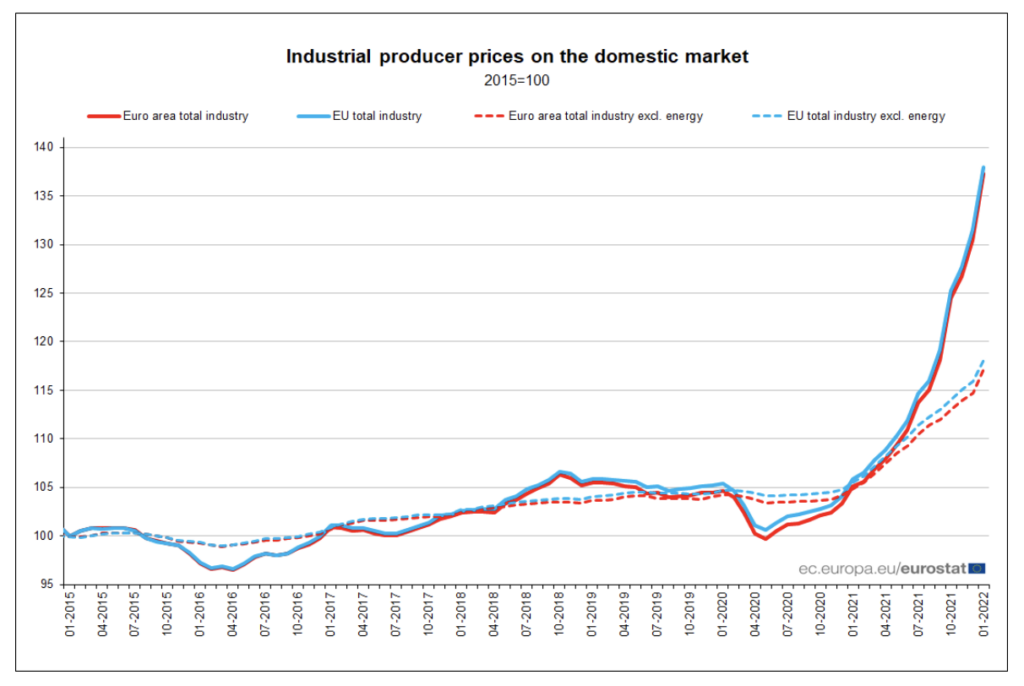

To make matters worse, new data from Eurostat published on Thursday showed that industrial producer prices skyrocketed by a record 5.2% month-over-month in January— almost double that of economists’ forecasts. Compared to January 2021, producer prices were up by a staggering 30.6%, marking the highest on record and a substantial increase from December’s 26.3% annual jump.

January’s increase in producer prices was largely the result of a 11.6% and 85.6% monthly and annual increase in energy prices, respectively. The sudden increase even came before Russia invaded Ukraine, thus suggesting consumer prices will likely accelerate even higher in the coming months.

Information for this briefing was found via Eurostat and Reuters. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.