On July 26, Canoo Inc. (NASDAQ: GOEV), a start-up electric vehicle (EV) manufacturer, appointed Ambassador Josette Sheeran as president of Canoo, the second-highest ranking member of the company’s management team. We consider the elevation of Ambassador Sheeran, who was already a board member of Canoo, to be somewhat surprising.

Notably, Josette had no significant manufacturing or automotive industry experience prior to joining Canoo’s Board of Directors in December 2020. Despite this, Canoo’s ability to meet manufacturing deadlines and promised production quantities of its flagship Lifestyle Vehicle will be a key determinant of the company’s success.

Canoo is one of three EV manufacturers formed via the Special Purpose Acquisition Company (SPAC) process — Nikola Corp. and Lordstown Motors Inc. are the other two — that are being investigated by the U.S. Securities and Exchange Commission (SEC). The SEC is probing Canoo’s “operations, business model, revenues, strategy, customer agreements, and earnings.” No timetable regarding the investigation has been announced.

Canoo hopes to begin producing its Lifestyle Vehicle in 2022. In its May 17 earnings release, Canoo said that production could reach 15,000 units in 2023. Its targeted starting sales price is US$34,750 to US$49,950. In May 2021, Canoo launched official preorders for the Lifestyle Vehicle. Preordering requires a refundable reservation fee of US$100.

Canoo’s 1Q 2021 Cash Burn was US$66 Million

A key issue facing Canoo is its cash burn rate. In 1Q 2021, the company’s operating cash flow deficit was about US$54 million, and its capital expenditures were around US$12 million, for a total quarterly cash burn of US$66 million. As of March 31, Canoo had cash of US$642 million and only US$21 million of debt.

| (in thousands of U.S. dollars, except for shares outstanding) | 1Q 2021 | Full Year 2020 | Full Year 2019 |

| Operating Income | ($97,070) | ($199,718) | ($173,660) |

| Operating Cash Flow | ($53,948) | ($107,054) | ($171,452) |

| Cash | $641,925 | $702,422 | $29,007 |

| Debt – Period End | $21,063 | $20,205 | $99,757 |

| Shares Outstanding (Millions) | 237.5 | 235.8 | 108.8 |

Projections Have Been Scaled Back

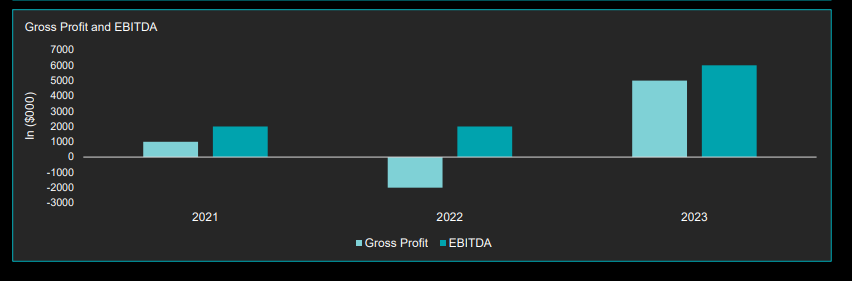

In its initial Investor Presentation published in August 2020, Canoo projected revenues/EBITDA of US$1.4 billion/US$188 million; US$2.3 billion/US$520 million; and US$4.1 billion/US$964 million in 2024, 2025 and 2026, respectively.

Note that in the above table, the company had projected just a year ago that 10,000 Lifestyle Vehicle units would be produced in 2022 and 25,000 in 2023.

On June 17 at Investor Relations Day, Canoo projected that EBITDA could be only around US$2 million in 2022 and US$6 million in 2023.

If the SEC were to conclude its investigation into Canoo without significant adverse findings, Canoo shares would likely react positively. In addition, investors currently are reasonably enthusiastic — albeit less so than six months ago — about the future sales prospects of EVs. That sentiment could allow EV stocks as a group to begin to perform better, which could potentially lift Canoo’s shares as well.

Canoo is a well-capitalized company; its March 31, 2021 cash balance comprises about one-third of its stock market capitalization, and it has negligible debt. Nevertheless, its valuation relative to 2023 cash flow projections is very high — Canoo’s US$1.3 billion enterprise value compares with company-projected 2023 EBITDA of only about US$6 million. In addition, the SEC’s investigation into the company could continue to weigh on the shares until it is concluded.

Canoo Inc. last traded at US$8.13 on the NASDAQ.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

The Gross Profit and EBITDA are example numbers and not actual numbers. In the presentation, they’ve mentioned this is what the soon-to-be-released model will look like. Using the model, Analysts can make the own projections.