The economic ramifications of Russia’s invasion of Ukraine continue to spread into areas that many investors would not have contemplated. For example, prior to the war, Ukraine companies manufactured around 15% of the wire harnesses used in European automobile production. It is unclear if any of this manufacturing capability is still operational.

A wire harness essentially controls the electronic components of a car, transmitting power and signals to every part of a vehicle. Harnesses consist of connectors, terminals, clamps, and sheaths that surround a core of electric wires.

Importantly, harnesses are really not solely commodity products in that the bundles of wires and connectors are unique to each car model. In other words, a harness made to fit into one BMW model would not necessarily fit into another BMW car type, and certainly not into a model made by another vehicle manufacturer. Furthermore, the know-how to build wire harnesses cannot easily be re-sourced to another parts manufacturer.

An analyst at Wells Fargo estimates that the lack of Ukraine wire harness production could mean that 700,000 fewer cars are produced in Europe in 1Q 2022 and 2Q 2022 than otherwise would be. More tangibly, the German truck maker MAN, which is owned by Volkswagen, announced on March 30 that it had to furlough 11,000 workers because of a “massive” shortage of wire harnesses. The company’s plants in Munich and Krakow have been shut since March 14, and manufacturing has been cut at three other plants.

Furthermore, shortages of this critical component have disrupted or slowed production at plants owned by Mercedes, BMW and Volkswagen.

It appears North American auto makers are not yet experiencing wire harness shortages, but perhaps this factor, along with other supply chain challenges like limited semiconductor and even neon gas supply (also due to the Ukraine conflict), are causing a rapid escalation in auto prices. Edmunds.com reports that the average price of a new vehicle in the U.S. has reached nearly US$46,000, up 13% in just a year.

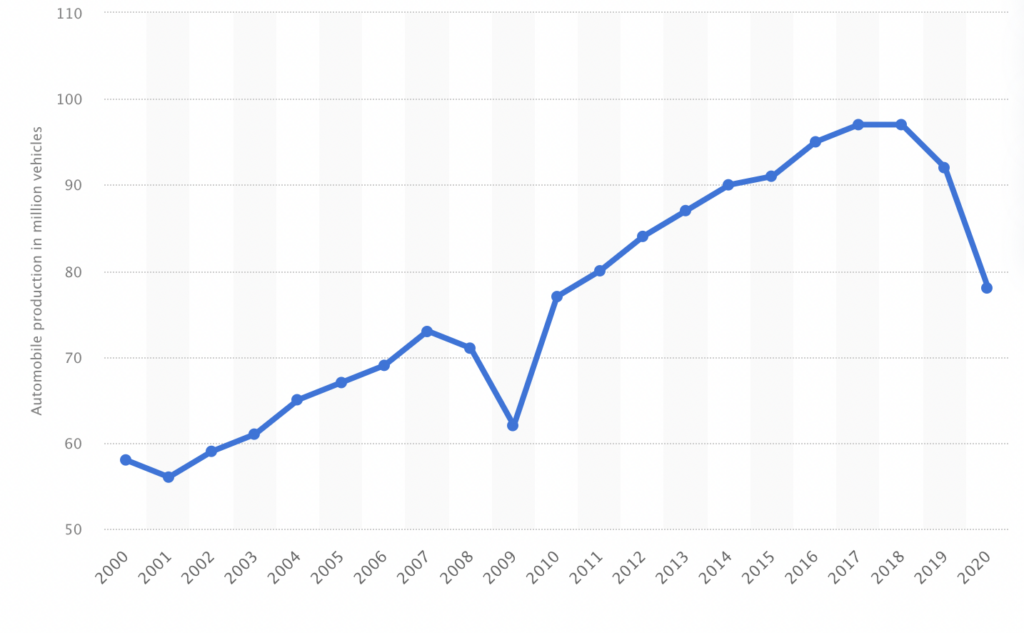

These parts and commodity shortages are likewise affecting worldwide vehicle production. S&P Global has ratcheted its 2022 and 2023 global vehicle production estimates to about 82 million and 88 million, respectively. In comparison, in the pre-COVID, pre-supply chain-challenged year 2019, around 92 million autos were manufactured.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Views expressed within are solely that of the author. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.