Y’all want to see a chart?

This one looks like a chart of the output from a Swiss watch in a Salvador Dali painting.

The Bank of Montreal’s Ultra Short Term Bond ETF (TSX: ZST) is comprised of a bunch of bonds that are near their maturity. The product pays dividends monthly, so it used to gain steam towards the distribution date, at which point a re-balancing would re price it for another climb, followed by another fall on the next distribution day. It climbed a shorter “staircase” month to month in an environment of falling yields until it caught a case of the COVID chaos.

Its counterpart, ZST.L features cumulative distributions. It spent a year climbing a staircase from $51.95 to $53.24, rolling the interest into the principle as it went, steepening its climb at the the top before falling into the upside down with everything else. A 1% move may not seem like much, but this is the bond market we’re talking about: The annualized distribution yield on ZST is 2.84%.

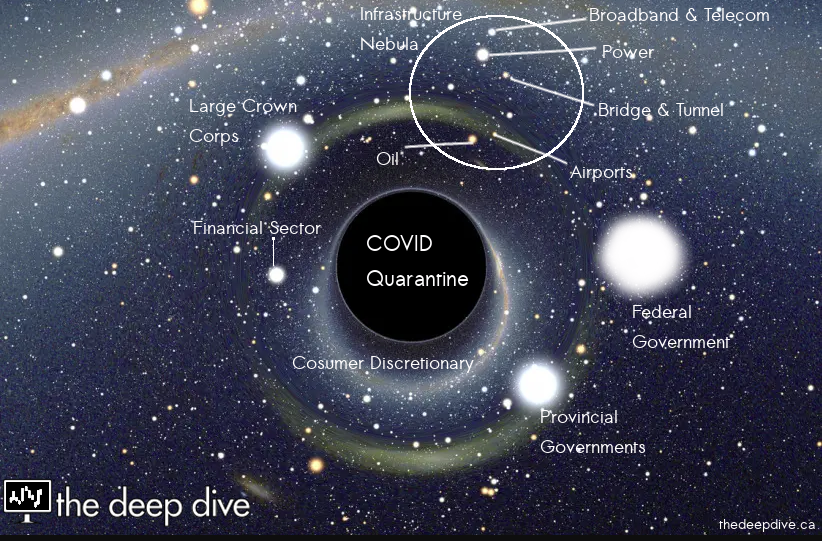

The Bank of Montreal has a whole universe of these bond products, designed to offer exposure to various grades and mixes of grades of fixed income products. As you might expect, the implosion of a supernova of an economy has opened up a black hole in that universe, and investors are busy trying to figure out which of the products are in orbits that bring them close to that that black hole’s gravity well, and which ones will be able to stay out.

The trade here comes down to how much faith an investor has in these various levels of issuers’ abilities to make their payments, which itself comes down, broadly, to the probability that the government will be able or willing to backstop the debt of these particular issuers.

So, a value picker may be inclined to find a good mix of corporate and government debt whose corporations are corporations that have the implicit backing of government. There’s no surer way to put people back to work after a public health crisis – or even during one – than infrastructure building. Implicitly, Crown corporations and provincial governments figure to have the best spot at the trough when the feds are handing out checks.

Ultimately, there is a non zero chance that someone holding debt is going to have to become a bag-holder in all of this. That makes it about picking the least likely to be forgotten with the highest payoff.

First stop, BMO Government Bond Index ETF (TSX: ZGB). If the Feds don’t have the thrust to get out of this gravity well, nothing does. This ETF is an even split between Provincial and Federal bonds, with a few munis thrown in for flavor. The bet here is that bidders low balled it to take advantage of selling forced by margin calls. Sure, it can get cheaper. The appeal here is the (relatively) low odds that it’ll go bust. The low volume doesn’t look great on this one. We note that the iShares Gov bond ETF (TSX: XGB) sees more action.

Next up: The provincial governments. The BMO Long Provincial Bond ETF (TSX: ZPL) contains the debt of a full compliment of Canadian provinces, plus a few Crown corporations. They snuck in a few healthcare debentures (1.2% of total market value), but it’s still pretty solid.

The provinces defaulting on their debt would mean the Feds taking over the basic services that the Provinces manage and operate, including healthcare systems, mineral titles, fish and game, court systems, etc. We expect the federal government is more likely to guarantee the payments than take on the headache. Smallcap Steve informed us as we wrote this that it already has.

The Bank of Canada has elected to buy the provincial debt out of the primary market, rather than through ETFs, like the US Federal Reserve. The Provincial Money Market Purchase Program is being abbreviated “PMMP”, and it’s hard to tell whether or not bankers know when they’re joking.

ZLP’s moving averages up in the $17.50s make a reasonable near-term target in a world that starts to look like it’s coming back together.

Those who expect this shutdown to be on the short side, and for government to protect the private sector as a means of sustaining economic health may consider BMO Long Term Corporate Bond ETF (TSX: ZLC) to be a tremendous bargain. Perhaps the smartest move corporate financiers have engineered over the past couple of decades is the encroachment of the private sector on critical infrastructure projects. Why should the government shoulder the expense of something like an airport or highway when there is a perfectly good capital market out there?

This purpose-built high-yield vehicle full of the debt of airport authorities, power companies, railways, pipelines and such was a very solid performer until just the other day when it wasn’t. We’re moving down the grade scale here, and some of ZLC’s components figure to be among the first to show cracks. We make the energy components as the weak link, running neck and neck with the airport authorities.

Right now, central banks have dug their heels in under the pretense that this tear in space-time is temporary. That isn’t an unreasonable position, considering the fact that there is still a perfectly good workforce out there, keen to get back after it as soon as they’re able, with measures designed to flatten the curve in place. So long as that paradigm holds, there’s value in fixed income ETFs that manage to hold together at any price.

The worm starts to turn if the central banks start doing death panel triage out loud. You can bet they’re already running models to figure out what poses the most systemic risk, in the event there aren’t enough respirators on the balance sheet to go around.

A note on the ETFs we’ve selected:

Bond ETFs come in many permutations, all of which carry risk. BMO had published the most current and complete lists of marked to market holdings for their fixed income ETFs at the time of writing, so we chose to research those products for sake of accuracy and convenience. The Deep Dive does not endorse any particular banking or investment product, and certainly not those of the Bank of Montreal who have been known to work in conjunction with the VPD to take the term “bank prisoner” far too literally.

The author has no securities or affiliations related to any organization mentioned. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.