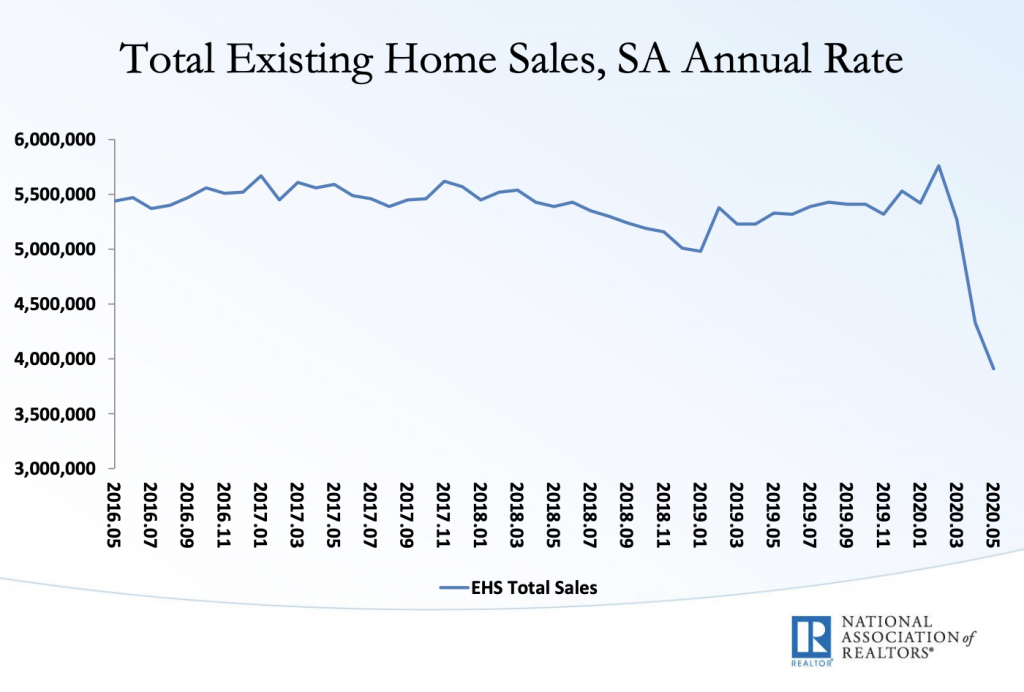

The month of May saw the lowest number of previously owned US home sales since October of 2010. However, the slump is expected to be only temporary, with a rebound emerging soon.

According to a recent report by the National Association of Realtors (NAR), closing transactions on previously owned homes fell by 9.7% in May from the previous month, with a total decline of 26.6% compared to the same time a year prior. Although home sales have substantially fallen for the third consecutive month since the onset of the pandemic, home prices have remained relatively stable.

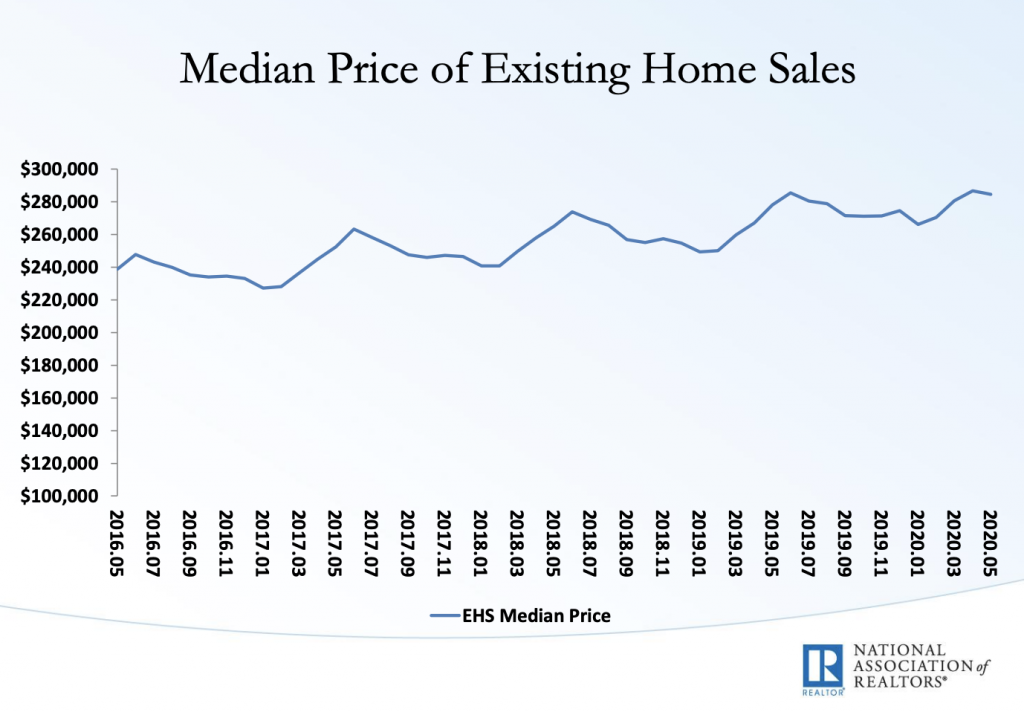

Given that there is a low inventory of houses, the average price has held at a steady $284,600 in May, translating to a 2.3% increase since the previous year. By the end of May, there were approximately 1.55 million units available, down by 18.8% from a year ago. At the current sales pace, there is a 4.8-month supply of homes available for purchase.

However, the sudden slump in sales for the month of May to be only temporary. According to NAR’s chief economist Lawrence Yun, the housing sector may see a V-shaped recovery, contrary to the U-shaped recovery predominantly evident for the rest of the US economy. According to the data, the condominium and co-op market saw the lowest number of sales, with completed transactions falling by 12.8% in May, and nearly down by 25% compared to the same time a year prior.

On the other hand however, single-family homes only saw a decrease in sales by approximately 9.4% from the previous month, suggesting that Americans are beginning to migrate to the suburbs given that they are able to work more flexibly from home.

Information for this briefing was found via the National Association of Realtors and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.