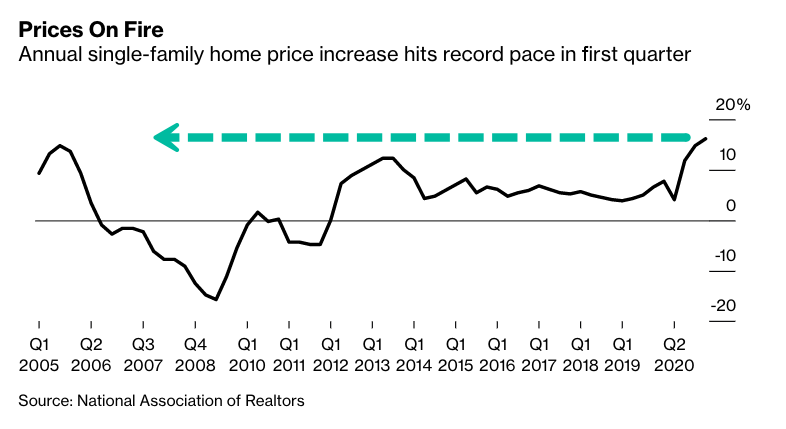

It appears that this week has been revelational for the US economy, as a number of telltale signs point to scorching-hot inflation. According to the National Association of Realtors (NAR), the median price for a single-family home soared by the most on record last quarter, jumping by 16.2% year-over-year to $319,200.

NAR chief economist Lawrence Yun said that record-breaking price surges are occurring across all real estate markets, even those that were previously not attractive to potential homebuyers. All regions across the US noted some form of double-digit price increases, with the Northeast seeing a 22.1% surge, followed by an 18% increase in the West, and a 15% rise in the South.

“The sudden price appreciation is impacting affordability, especially among first-time homebuyers,” explained Yun. “With low inventory already impacting the market, added skyrocketing costs have left many families facing the reality of being priced out entirely.”

Despite the housing sector showing a well-above average recovery from the Covid-19 downturn, the Federal Reserve still remains oblivious. In fact, Chairman Jerome Powell continued to increase the Fed’s mortgage-backed securities holdings by $40 billion each month, giving further rise to a housing bubble that is already plagued with low inventory and historically-low mortgage rates.

When pressed about the Fed’s MBS purchases and their direct contribution to the housing market crisis, Powell once again, was unable to come up with a meaningful answer. Here is Powell’s word salad from an April press conference:

“Yeah. I mean, we started buying MBS because the mortgage-backed security market was really experiencing severe dysfunction, and we’ve sort of articulated, you know, what our exit path is from that. It’s not meant to provide direct assistance to the housing market. That was never the intent. It was really just to keep that as, it’s a very close relation to the Treasury market, and a very important market on its own. And so, that’s why we bought as we did during the global financial crisis. We bought MBS, too. Again, not intention to send help to the housing market, which was really not a problem this time at all. So, and, you know, it’s a situation where we will taper asset purchases when the time comes to do that, and those purchases will come to zero over time. And that time is not yet.”

Information for this briefing was found via NAR. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.