What’s the sense in working so much if you can’t enjoy the spoils of your troubles?

That’s what F3 Uranium’s (TSXV: FUU) management appears to have asked themselves when earlier this year they spent company funds to “invest” in a stake in a private jet, which investors are just now learning about. The company made the investment on May 29, 2023, which conveniently was also the same day it filed its third quarter financial results, with the notes on the “investment” failing to make the subsequent event section of the third quarter results.

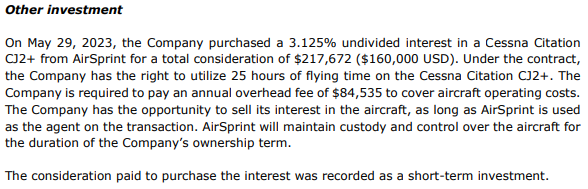

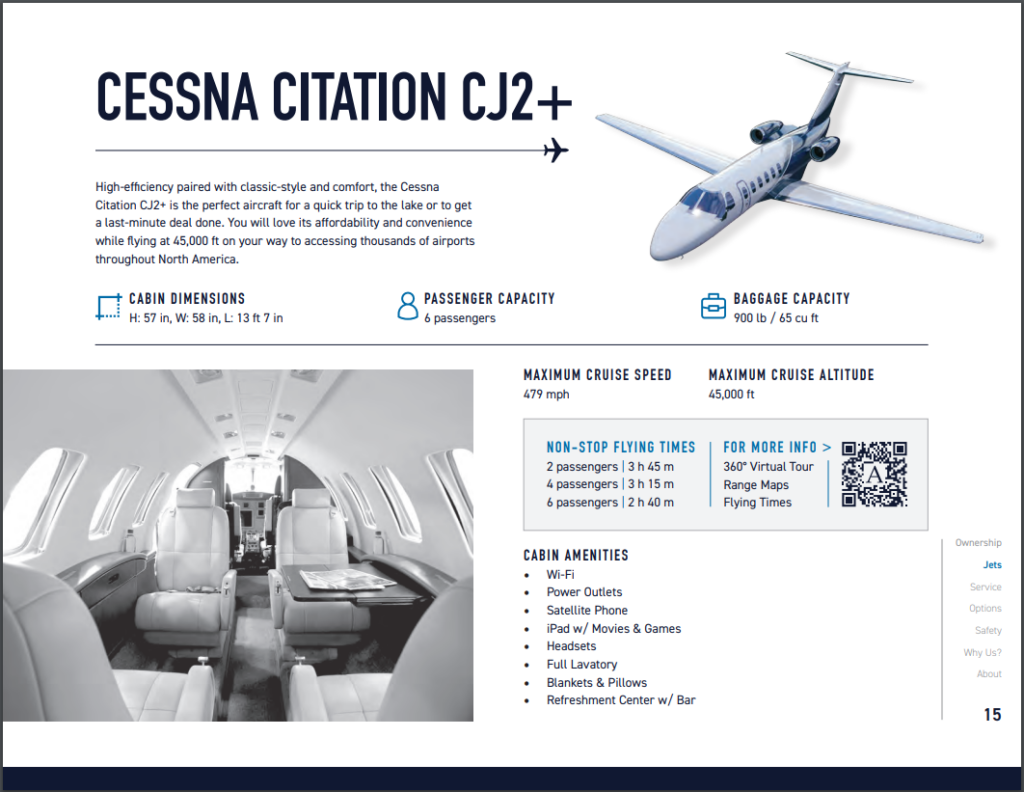

The so-called investment amounts to a 3.125% undivided interest in a Cessna Citation CJ2+, which it acquired from AirSprint for C$217,672. The interest, which comes with an annual operating fee of $84,535, enables the company to enjoy 25 hours of flying time per year on the plane.

AirSprint itself specializes in fractional ownership of jets, which provides guaranteed access with as little as 8 hours notice, with fixed annual and hourly pricing.

As per AirSprint’s website, the plane is capable of fitting up to six passengers and their related cargo, with a maximum flying time of 3 hours and 45 minutes – but that time dwindles to 2 hours and 40 minutes if the jet is fully loaded. To be fair to F3 Uranium, the CJ2+ appears to be the lowest tier offering put forward by AirSprint in terms of jets.

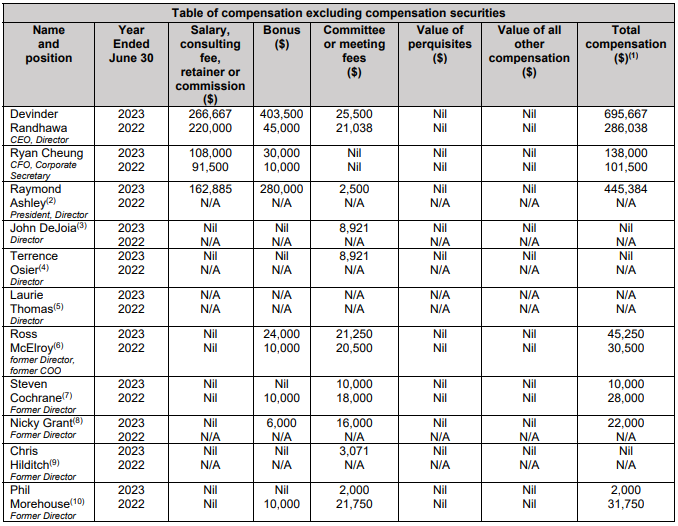

Perhaps management feels they are not paid enough as executives of an exploration stage company.

Management meanwhile has responded to criticism on Twitter over the investment, stating that the PLN site can’t be accessed by commercial planes, and that the plane is to be used for site visits when there are 4+ persons attending.

Twitter isn’t the place for detailed responses. But fyi: PLN site cant be accessed by commercial planes. And when we have 4 + people we use the plane for site visits. Further I was advised not to use airports where possible- my immune system has been subjected to chemo since Feb

— Dev R (@devrandhawa) November 8, 2023

The author has no securities or affiliations related to any organization mentioned. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.