Shares of Meta Platforms (NASDAQ: FB) — also formerly known as Facebook, fell over 20% on Wednesday, marking the sharpest single-day decline in US market history following a dismal fourth quarter that saw the social media giant report poor user growth, disappointing earnings, and a major guidance miss.

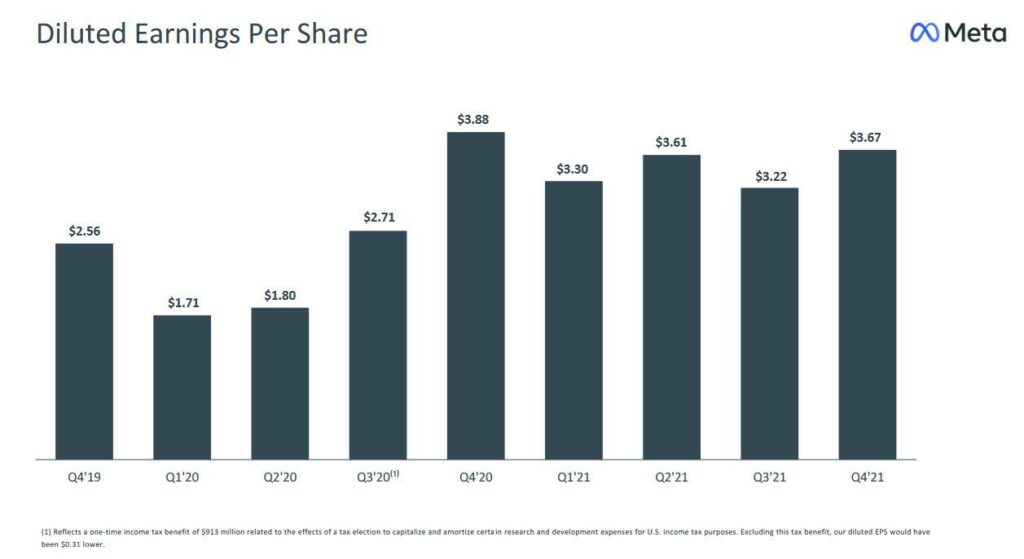

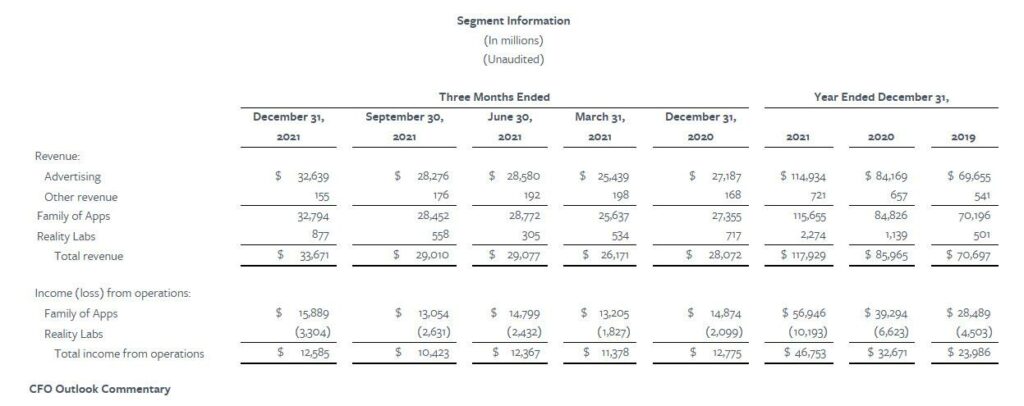

Facebook finished off the final quarter of 2021 with revenues of $33.67 billion compared to expectations of $33.4 billion in the final quarter of 2021, with earnings per share caming in at $3.67— just shy of the $3.84 forecast by economists polled by Refinitiv.

But, wait, it gets uglier under the hood: for the first time ever, Meta’s Daily Active Users (DAUs) fell form 1.93 billion to 1.929 billion quarter-over-quarter, significantly missing forecasts calling for 1.95 billion. Monthly Active Users (MAUs) stood at 2.91 billion, missing estimates of 2.95 billion. The fourth quarter was even uglier for guidance, with the social media conglomerate predicting first quarter revenue to sit between $27 billion and $29 billion, versus estimates of $30.25 billion, as annual growth is expected “to be impacted by headwinds to both impression and price growth.”

Meta sees its expenses for the entirety of 2022 fall between $90 billion and $95 billion, marking a modest decline from its previous guidance of $91 billion to $97 billion, due to expectations of technical and product talent investments. The company maintained its capital expenditures outlook for 2022 between $29 billion to $34 billion for the year.

Also alongside its name change, Meta has divided its quarterly earnings results into two separate segments going forward, with Family of Apps (FoA) comprising of Facebook, Instagram, Messenger, and WhatsApp, while Reality Labs (RL) will consist of virtual reality and augmented consumer content, software, and hardware.

Commenting on the rather disappointing fourth quarter results, Meta tossed the blame on a number of factors, including Apple’s recently implemented privacy restrictions, which made it substantially more difficult for brands to advertise on Facebook and Instagram. CEO Mark Zuckerberg also complained about growing competition from rival social media giants such as TikTok, which are eroding away at Meta’s user base, while global inflationary pressures and supply chain disruptions continue to subdue advertisers’ budgets.

In response to the sad earnings, Facebook continues to plummet sharply to the lowest since July 2020, taking with it nearly 20% of Zuckerberg’s net worth and triggering a sell-off across the tech oriented Nasdaq composite index… yikes.

Information for this briefing was found via Facebook and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.