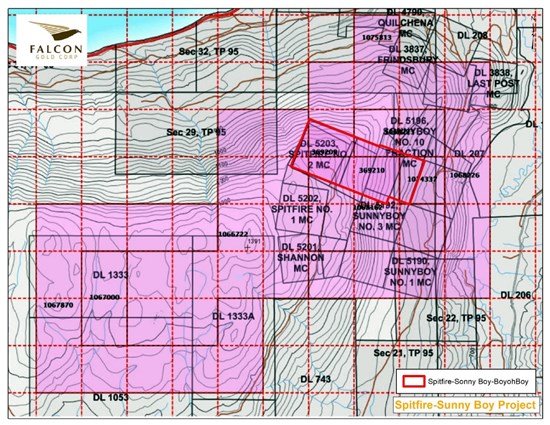

Falcon Gold (TSXV: FG) has acquired additional claims along the Spitfire-Sunny Boy trend in Meritty, BC. The claims include an additional 500 meters of contiguous strike length, which increases the total coverage of the Master Vein gold zone to over 1.1 kilometres.

Historically sampling up to 50.33 ounces of gold per tonne, fieldwork completed along strike by Falcon in 2019 revealed the presence of gold at values ranging from 0.33 to 2.74 oz/t along a 300 metre strike length.Recent data compiled by the company has indicated that the best targets on the property are high-grade gold vein deposits along flexures in the northeast portion of the property.

The first recorded discoveries of gold on the property date back as far as 1908, on the northeast portion of the Sunny Boy property claim block. While the property has never been commercially mined, it has been subject to trenching, pitting, blasting, and drilling. High grade values of gold have been reported at 124 to 127 grams per tonne, and 309 to 514 grams per tonne silver.

This acquisition adds considerable value to the project by an over 50 % increase in strike length now controlled by Falcon, We are looking forward to mobilizing a work crew to initiate our first phase of exploration.

Karim Rayani, CEO Falcon Gold

The property purchase for the Sunny Boy and Spitfire claims consistsed of a cash payment of $25,000 and 2.5 million shares and warrants of the company, in addition to a 2% net smelter return royalty.

Falcon Gold last traded at $0.065.

FULL DISCLOSURE: Falcon Gold is a client of Canacom Group, the parent company of The Deep Dive. The company has been compensated to cover Falcon Gold on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.