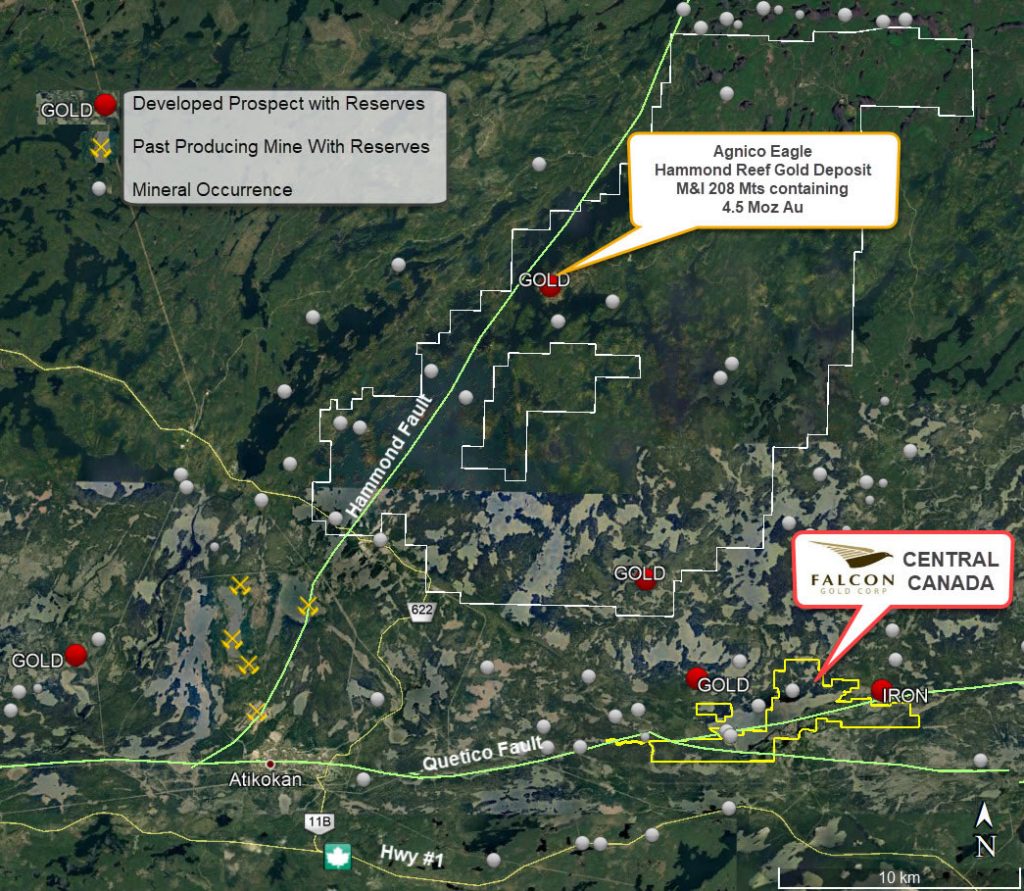

Falcon Gold (TSXV: FG) this morning announced that it has signed a memorandum of understanding to acquire 2 large patented claim blocks from Great Lakes Exploration which consists of 476 hectares of patented claims and surface rights.

The claim blocks lie along strike of Falcon’s Central Canada project, enabling the company to further consolidate the lands on the Central Canada Belt under one single company. This trend hosts significant gold mineralization which has been identified by numerous operators, and the additional property has signs that suggest a strong correlation with the gold mineralization observed at the Central Canada Project.

The property is significant for Falcon as the firm continues to develop the project as a result. The new claims cover over 8,400 meters of strike length of mineralized magnetite-sulphide lenses which vary in width from less than 10 to more than 40 meters wide.

Previous exploration on the site, which include airborne and ground geophysics, has outlined various anomalies which indicate potential untested extensions of base metal magnetite mineralization. Magnetite, for those unaware, is one of the main iron ores. The early to mid 1900’s saw the property initially targeted for iron ore potential, and wide spread drilling confirmed the thickness and continuity of these zones as well as the presence of associated base metals such as copper, nickel, and cobalt.

The properties have had a history of drilling as well. On the western end of the claims, drilling revealed multiple horizons of massive sulfide and magnetite mineralizations at intercepts up to 12.6 meters of drilled thickness and copper grades of up to 0.75%, along with cobalt grades up to 0.14% in a 1,500 meter long magnetic conductor. In the central portion of the claims, historic drilling and surface trenches encountered thick sections of massive sulfide and magnetite with up to 41 meters of drilled thickness. This portion revealed copper grades up to 0.61% and cobalt grades of up to 0.15% which was conducted on a 1,900 meter long magnetic and conductive anomaly.

Furthermore, a historic tonnage estimate conducted by Steep Rock Iron Mines Ltd in 1940 estimated 9,823,000 million tons of sulfide rich iron ore on the property, which only incorporated the strongly magnetic portions of the trend targeted and not an additional 3,400 meters of untested potential.

Under the terms of the MOU, Falcon Gold can earn an option to acquire an 80% interest by paying $25,000 within 45 days of signing a definitive agreement, making a $45,000 option payment to maintain the patented properties, and incurring a minimum of $146,900 in expenditures on the property within 18 months. The company is also required to issue 500,000 common shares at $0.05 per share and 500,000 warrants with a conversion price of $0.10 for a period of two years.

Once this interest is acquired, Falcon can obtain Great Lakes Exploration 20% interest for a further payment of $130,000, paid half in common shares and half in cash. That option will be in place for a period of 36 months once active.

Falcon Gold last traded at $0.06 on the TSX Venture.

FULL DISCLOSURE: Falcon Gold is a client of Canacom Group, the parent company of The Deep Dive. The company has been compensated to cover Falcon Gold on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.

2 Responses

I thought this thing was going to pop? What happened?

This stock has been running pretty good since you guys first got on it. How far can it run? Are we looking at the next Great Bear? Pennies to Dollars?