With inflation soaring to 40-year highs, Americans are finding it difficult to make ends meet. As a result, many are increasingly relying on credit cards and personal loans for purchases, and falling even deeper into debt. But according to TransUnion, that’s doesn’t necessarily mean the US consumer is in trouble.

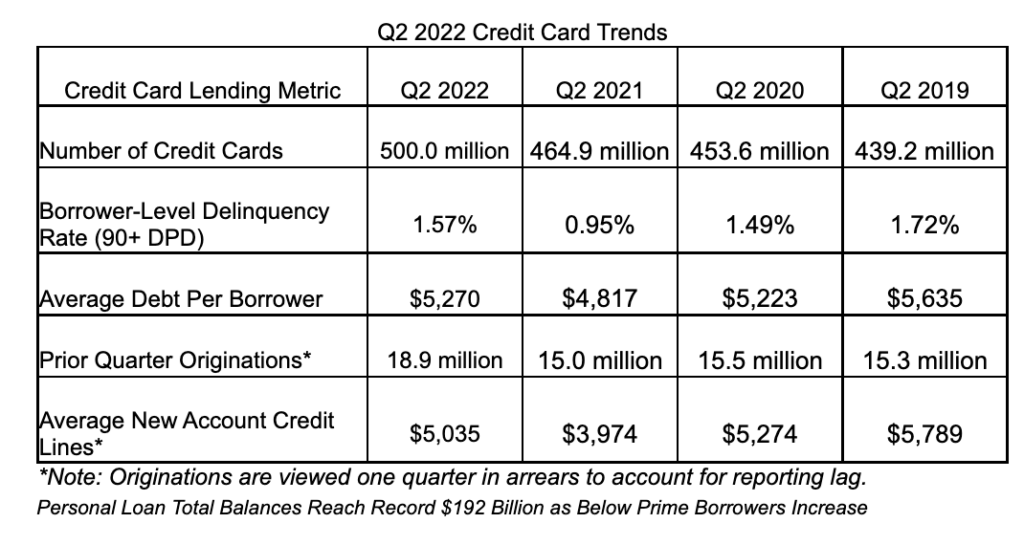

The credit rating agency’s credit industry insights report published last week showed that the total number of credit cards held by consumers surpassed 500 million for the first time on record in the second quarter of 2022, with the majority of credit card holders concentrated across the Generation Z demographic. Separately, the Federal Reserve Bank of New York reported that in total, an additional 233 million new credit cards were opened between April and June— the most since 2008.

At the same time, credit card balances rose 13% in the second quarter as well, marking the biggest annual increase in over 20 years. The majority of new borrowers had credit scores below 600, but according to TransUnion that’s because young individuals are opening up accounts. Despite that, though, analysts say that isn’t necessarily a bad thing. “I’m not seeing anything that I would really declare as a red flag,” said TransUnion vice president of research and consulting Michele Raneri.

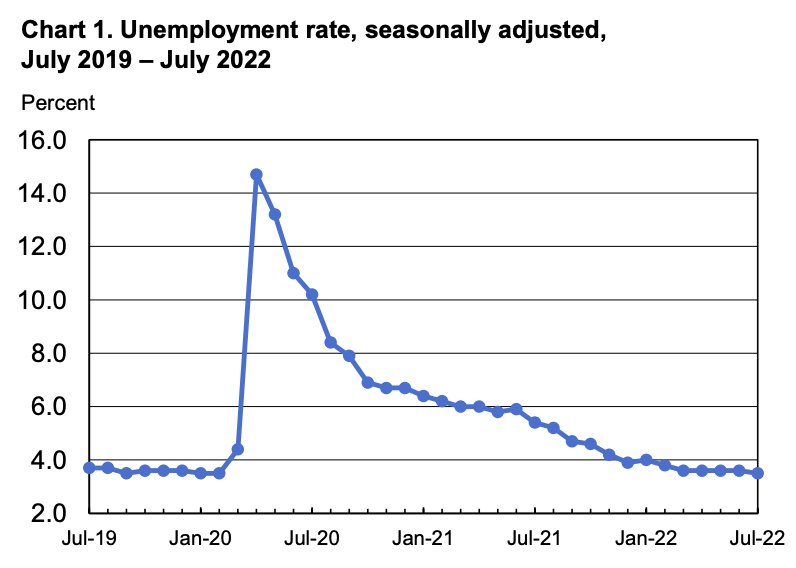

Simultaneously, the credit ratings agency reported that delinquencies are also on the rise, and nearing pre-pandemic levels; but, that’s still not a major cause for concern, as long as people remained employed. “The strongest indicator of whether somebody can pay their bills or not is whether they have a job,” said Raneri. Latest government data indicates that the US labour market remains robust for the time-being despite other economic indicators pointing to a recessionary period.

“Consumers are facing several challenges that are impacting their finances on a day-to-day basis, namely high inflation and rising interest rates,” added Renari. “These challenges, though, are happening against a backdrop where employment opportunities are still plentiful and jobless levels remain low.”

Information for this briefing was found via TransUnion. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.