It’s official: inflation has gotten so out of control, that all six of Canada’s major banks are preparing for a colossal rate hike from the Bank of Canada come this week.

The National Bank of Canada, CIBC, and TD have now joined in on unanimous forecasts from the Bank of Nova Scotia, BMO, and RBC calling for central bank policy makers to hike borrowing costs to 1%. The Bank of Canada is expected to further raise interest rates during its next meeting on April 13, and if the banks’ expectations materialize, then Canada will undergo its first 50 basis-point increase since 2000.

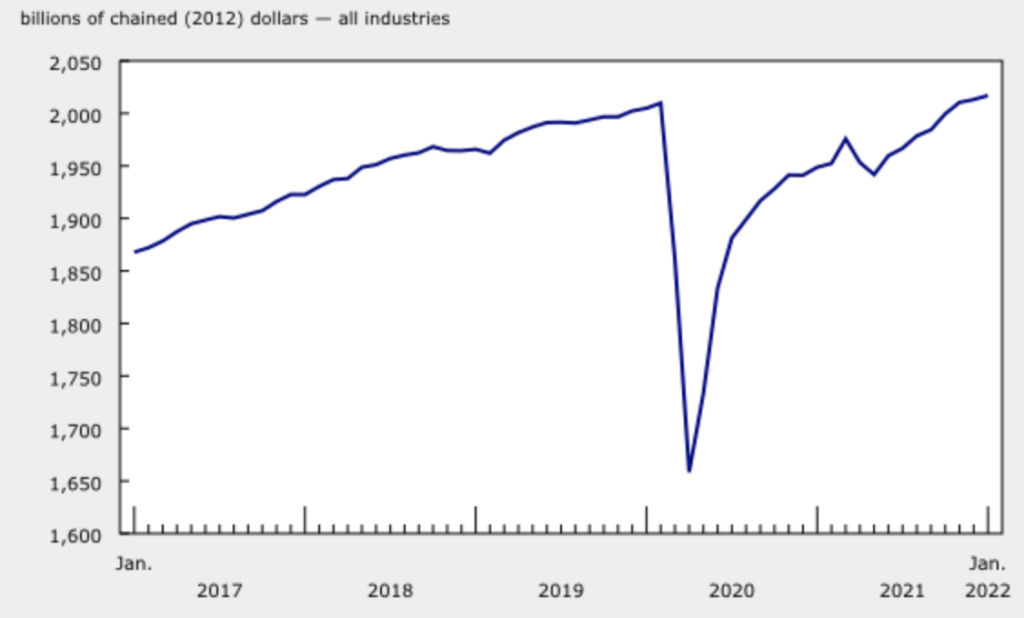

The latest forecast from the Big Six follows the Bank of Canada’s quarterly Business Outlook Survey, which showed an alarming number of Canadian firms suffering from substantial capacity constraints and rising input costs, all of which will be passed down onto consumers in the form of higher output prices. At the same time, preliminary data from Statistics Canada showed economic output grew 0.8% in February following a 0.2% gain in the month prior, further enforcing the need for hawkish monetary policy action.

“There’s enough there to give the Bank a pass at hiking 50 basis points, especially following the February flash GDP number,” TD Securities chief Canada strategist Andrew Kelvin told Bloomberg. “In this environment, we think it probably makes sense for them to take the path of least resistance.”

However, Bank of Canada policy makers will have to tread carefully in the current macroeconomic environment, given that a sharp increase in borrowing costs could send many indebted Canadian households over the edge.

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.