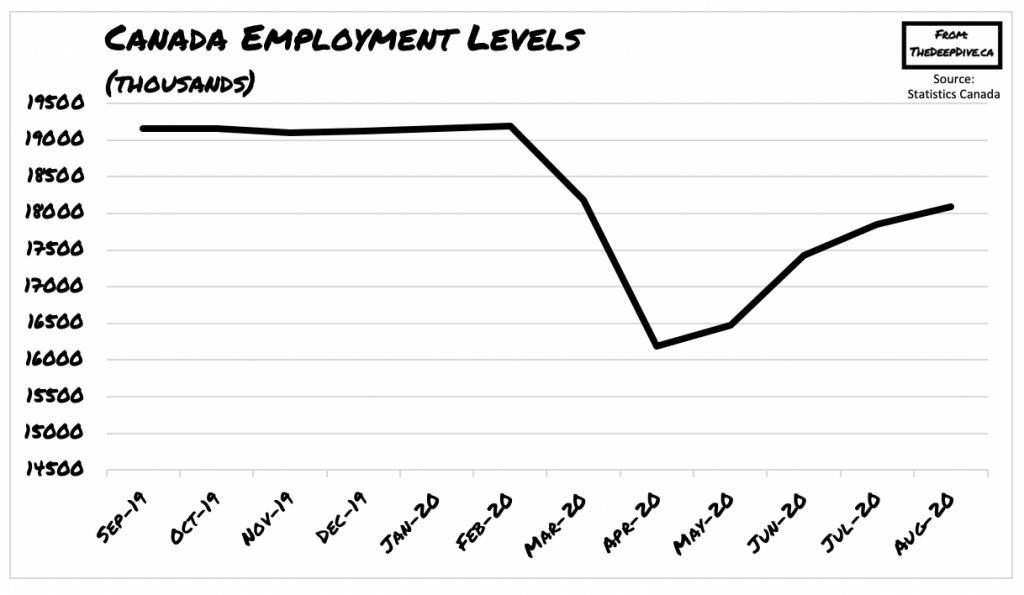

As summer comes to an end and cold temperatures set in across much of Canada, the economic recovery momentum also appears to be coming to a standstill. According to data on credit card transactions, job postings, and restaurant bookings, the country has plateaued in its rebound and now faces a slew of new obstacles coming into the fourth quarter.

Data from August and September released by Scotia Bank and later shared with Bloomberg shows that consumer spending was once again on the decline following what seemed like an upward direction between April and July. Toronto-Dominion Bank data also pointed to much the same flatline trend, as the slight increases in spending that were noticed were mainly driven by home-improvement purchases stemming from the booming housing market. According to TD economist Sri Thanabalasingam, spending will likely be further subdued if the rise in coronavirus cases continues across the country and prompts many provinces to reimpose restrictions.

In the meantime, Canada’s restaurant sector also appears to be on the decline following a summer boom. According to data released by OpenTable, the number of diners that attended restaurants in September is 33% lower compared to the same time a year ago. Moreover, the restaurant industry faces additional risks as the transition into fall and winter nears and outdoor patio dining will no longer be an option, prompting potential diners to refrain from the establishment altogether in fear of contracting the deadly virus indoors.

Ontario, which has the highest population in Canada, is currently experiencing an alarming rise in COVID-19 infections, with daily cases topping 1,000. As a result, government officials have begun to reimpose gathering restrictions and social distancing measures. Food and drink establishments have been ordered to reduce their opening hours to end at midnight, with the Premier even considering scaling back reopening plans to phase 2.

Since the economic downfall stemming from the pandemic, Canada has been able to recuperate nearly two thirds of the 3 million jobs lost. However, as economic recovery and pandemic uncertainty begins to loom once again, the federal government has decided to pledge additional financial support for Canada’s small and medium-sized businesses. Economic Development Minister Melanie Joly announced that the Liberal government would earmark up to $600 million through the Regional Relief and Recovery Fund, bringing its total to more than $1.5 billion.

Since the onset of the pandemic, the fund has helped over 12,000 Canadian businesses, including hotels, restaurants, and even main street boutiques. The aim of relief and recovery fund, which is overseen by federal regional development agencies, is to help those businesses that otherwise do not qualify for the mainstream pandemic-related assistance. Of the newly-pledged funds, nearly $456 million will be allocated towards small and medium-sized operations, while another $144 million will provide access to capital and technical support for rural communities and businesses.

Information for this briefing was found via Bloomberg, OpenTable, Statistics Canada, and the Government of Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.