On December 2, Chief Judge Miranda Du of the U.S. District Court of the District of Nevada appeared to throw some additional cold water on Lithium Americas’ (TSX: LAC) Thacker Pass lithium project in the state. Various environmental groups have appealed the January 2021 decision by the U.S. Bureau of Land Management that had approved the project.

In Friday’s court filing, Judge Du advised the attorneys on the case to be prepared to address the relevance of two separate federal courts’ decisions to overturn the U.S. Forest Service’s 2017 approval of the Rosemont copper project in Arizona. Not surprisingly, Hudbay Minerals’ proposed open-pit copper mine has never produced one ounce of copper. Ominously, Judge Du wants to discuss whether the Ninth Circuit Court of Appeals’ May 2022 Rosemont ruling “controls the outcome of this [Thacker Pass] case.”

In early October, Judge Du had ordered oral hearings on the Thacker Pass case to take place on January 5, 2023. It follows that the Federal Court will not rule on the case until early 2023 at the earliest. Briefings on the matter concluded in mid-August 2022. The timing of the oral hearing, and the likely timing of issuance of a final decision, were several months later than expected.

Quite logically, Lithium Americas will not make a final construction decision until it receives Judge Du’s ruling, but the tea leaves look less constructive in light of Judge Du’s December 2 comments. The judge’s ruling is the final regulatory hurdle standing in the way of the commencement of construction.

Lithium Americas owns a 100% stake in Thacker Pass. The property may have sufficient resources to produce 60,000 tonnes of battery-grade lithium carbonate per year for 40 years.

The Company’s Crown Jewel Remains the Cauchari-Olaroz lithium brine project in Argentina

While this Thacker Pass news cannot be considered a positive, Lithium Americas’ valuation is much more tied to its key asset — the flagship Cauchari-Olaroz lithium brine project in Argentina. Lithium Americas expects early-stage Cauchari production will begin later this month.

Lithium Americas owns 49% of Cauchari and China’s largest lithium company, Ganfeng Lithium, owns the balance, or 51%. Lithium Americas will operate the mine. Offtake agreements at market prices (which are very attractive) are in place for over 80% of Cauchari’s planned Stage 1 production.

When Cauchari commences production, Lithium America’s portion of the cash flow could be quite substantial. According to a Feasibility Study and Mineral Reserve Estimate with an effective date of September 30, 2020, the project could produce 40,000 tonnes of battery-grade lithium carbonate for 40 years.

READ: Lithium Americas To Split Into Two Firms To Unlock Shareholder Value

Based on assumptions of long-term lithium carbonate prices and operating costs of US$12,000 per tonne and US$3,600 per tonne, respectively, the project could generate an average EBITDA of around US$300 million per year. However, since lithium carbonate delivered to China currently trades in the vicinity of US$80,000 per tonne, Cauchari’s annual cash flow could potentially be multiples of US$300 million.

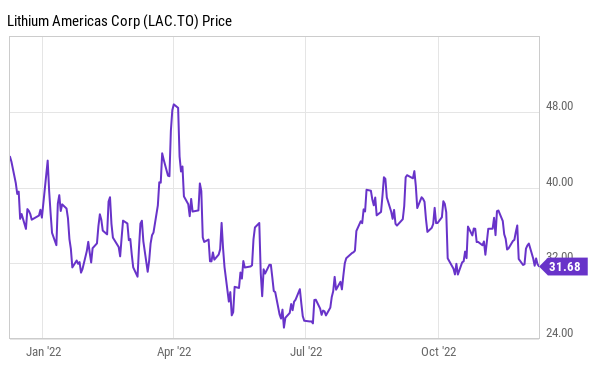

Lithium Americas Corp. last traded at $31.74 on the TSX Exchange.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Being that 2022 Rosemont ruling was about 2700 acres of tailings 700 ft deep on National Forest Service land that they had no legal claim to that the ruling is not Apples to Apples Thacker pass will be continuously reclaiming and not leaving tailings on adjoining property forever