Noram Ventures (TSXV: NRM) this morning released a new resource estimate for its property located in Clayton Valley, Nevada. The results are from that of the Phase IV drill program for the firms Zeus lithium claystone project.

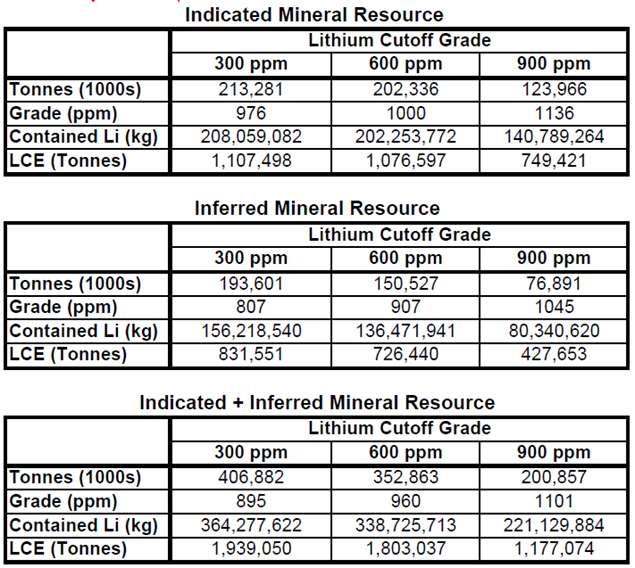

Results from the drill program have improved the overall resource estimate for the property by 38% at a 900 ppm lithium cutoff. At this cutoff, the Zeus deposit is estimated to have 124 million tonnes at 1136 ppm lithium as indicated resources, and 77 million tonnes at 1045 ppm lithium inferred resources. This brings the total to 201 million tonnes at 1101 ppm lithium, or 1.18 million tonnes of lithium carbonate equivalent.

The fourth phase of drilling was designed to test the Esmeralda formation claystone beneath earlier drill holes. Those drill holes only extended to ~30 meters deep. The results of the program will be used to guide further drilling anticipated to occur in 2020.

Commenting on the drill results, CEO of Noram Ventures Tucker Barrie identified that the resource is notable for several reasons, including:

- The current price of lithium is currently sitting at US$8.75 per kilogram for product with a 99.5% purity. This makes the current 1.18 million tonnes a very valuable resource.

- Nearby operators with similar formations have assessed an all-in cost of development as being US$4.00 per kilogram of product, which is a viable and profitable operating rate.

- Technology on lithium extraction from claystone formations is proven.

- Suitable government regulations due to the property being owned by the Bureau of Land Management in the US, and a drive by the US to develop critical metals which includes lithium.

Full drill result data on the Phase IV drilling program conducted by Noram Ventures can be found here.

Noram Ventures last traded at $0.15 on the TSX Venture.

FULL DISCLOSURE: Noram Ventures is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Noram Ventures on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.