As promised, the Federal Reserve has now begun purchasing corporate bond exchange-traded funds, as a move to further prop up the increasingly collapsing US economy.

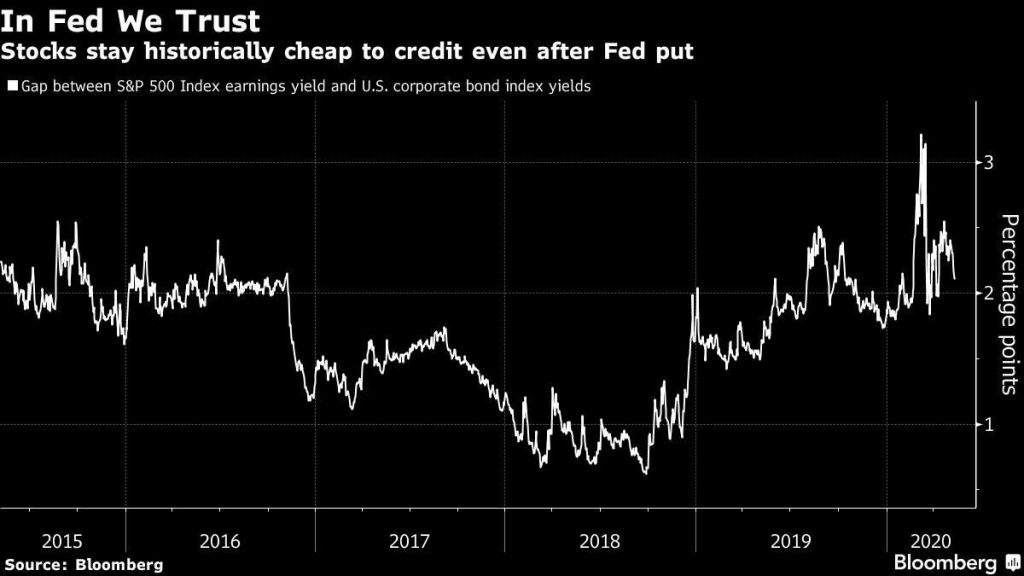

On Tuesday, the Fed announced it will be intervening in the corporate bond market by buying corporate debt in the form of ETFs. Given the current economic turmoil stemming from the coronavirus pandemic, the Fed is anticipating their new move will stir up confidence and increase trading in the debt market. Under the various emergency lending programs recently commissioned by Congress, the Federal Reserve plans to use a portion of those funds to buy investment grade corporate ETFs, and purchase junk bonds with whatever is remaining.

Bond ETFs are essentially a portfolio of various bonds that all serve different strategies- but in this particular case, the bond ETFs solely consist of corporate debt. Furthermore under regular conditions, bond ETFs come with an associated risk to the investor. Since they do not have a maturity date, it can be increasingly difficult to gauge interest rate risk, as well as no guarantee that the investor’s principal will be repaid.

Normally, the Fed would not intervene in such a corporate debt market, so this newly-announced move is one for the history books. However, it is still unclear how the Fed purchasing corporate debt ETFs will fix soaring unemployment rates and help Americans pay rent.

Information for this briefing was found via Market Watch, CNBC and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.