FedEx Corp (NYSE: FDX) reported on late Thursday preliminary items from the financial results for fiscal Q1 2023, ended August 31, 2022. The company notched US$23.2 billion in revenue, a marginal increase from Q1 2022’s US$22.0 billion.

But operating income declined to US$1.19 billion for the quarter compared to US$1.40 billion for the comparable period last year. This led to recording US$3.33 diluted earnings per share, down from last year’s US$4.09 per share.

CEO Raj Subramaniam is pointing at global volume decline for the year-on-year downturn, “as macroeconomic trends significantly worsened.” While the firm is addressing the headwinds of shifts in the economy, it admits that the quarterly results are “below expectations.”

“While this performance is disappointing, we are aggressively accelerating cost reduction efforts and evaluating additional measures to enhance productivity, reduce variable costs, and implement structural cost-reduction initiatives. These efforts are aligned with the strategy we outlined in June, and I remain confident in achieving our fiscal year 2025 financial targets,” Subramaniam said.

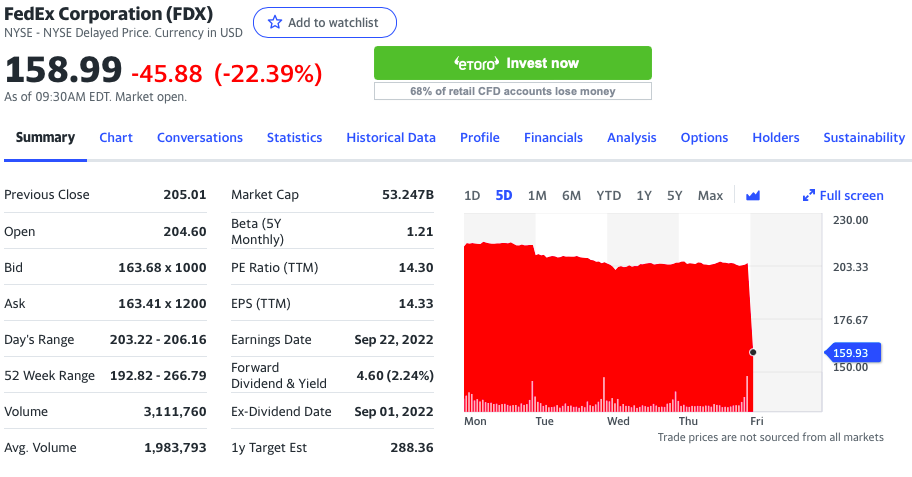

Following the news, the firm’s stock price fell a staggering 22% when the opening bell rang on Friday.

For Q2 2023 however, the freight platform expects quarterly revenue to land between US$23.5 billion to US$24.0 billion. This leads to an EPS guidance of US$2.65 per share “or greater.”

The bleak financials is compounded by Subramaniam’s pessimistic comments on the prospect of a recession when he was asked by CNBC host Jim Cramer on Thursday following the preliminary earnings release.

“I think so. But you know, these numbers, they don’t portend very well,” the FedEx chief answered when asked if on the show if the economy is heading towards a “worldwide recession.”

In order to breathe life back into its financials, FedEx said it will be implementing a number of cost-cutting guidelines. These include a hiring freeze, closing 90 FedEx office locations, and a reduction of Sunday operations.

FedEx last traded at US$157.85 on the NYSE.

Information for this briefing was found via Edgar. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.