Fire and Flower Holdings (TSX: FAF) this morning released its second quarter financial statements, reporting revenues of $28.6 million for the thirteen week period ended August 1, 2020, an improvement from the $23.1 million in revenues reported in the prior quarter. The company reported a net loss of $29.1 million, as compared to a net loss of $12.7 million in the first quarter of 2020.

Retail revenues remained the largest segment for the firm, at $23.4 million, followed by wholesale revenues of $4.3 million and digital development of $0.9 million. Cost of goods sold meanwhile amounted to $18.6 million, resulting in a gross profit of $10.0 million.

This profit however was not enough to offset the $12.5 million in expenses the company recorded during the quarter, lead by genera and administrative expenses of $8.6 million. Depreciation and amortization was the second largest expense for the firm, at $3.0 million. Notably, expenses declined from $17.2 million in the previous quarter due to the firm not taking an impairment in the current period.

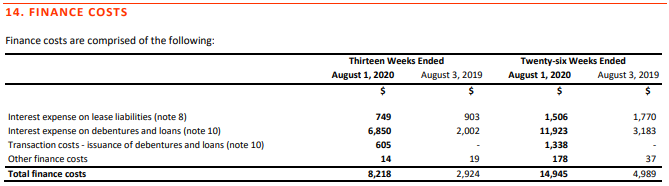

Despite revenues being up and expenses being down on a quarter over quarter basis, the expanded net loss was the result of a $18.3 loss taken on the revaluation of a derivative liability, as well as financing costs of $8.2 million. These financing costs are notable, as the debt currently held by the company has resulted in interest expenses that are nearly equal to that of its general and administrative expenses, hampering the potential for profitability for Fire and Flower.

Looking to the balance sheet, the firms cash position fell from $48.6 million to $20.0 million over the course of the quarter, a result of being required to repay $27.2 million in principal debentures that were due in June. Trade and other receivables meanwhile climbed from $3.2 million to $4.4 million, while inventories climbed to $8.2 million from $7.1 million. Total current assets fell from $62.2 million to $39.1 million over the course of the quarter.

Total current liabilities meanwhile moved drastically in the opposite direction. While accounts payable fell from $21.6 million to $17.0 million, debentures and loans climbed from $27.7 to $33.0 million. A new derivative liability also moved to current liabilities, to the tune of $31.1 million, while lease liabilities remained unchanged at $2.9 million. Total current liabilities climbed from $52.6 million to $84.5 million during the quarter.

Fire and Flower Holdings last traded at $0.91 on the TSX

Information for this briefing was found via Sedar and Fire and Flower Holdings. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.