FULL DISCLOSURE: This is sponsored content for First Lithium Minerals.

First Lithium Minerals (CSE: FLM) has increased its land holdings in Ontario, expanding its LSL project in northwestern Ontario through a combination of staking and claims purchases while also acquiring a new project in the Thunder Bay region.

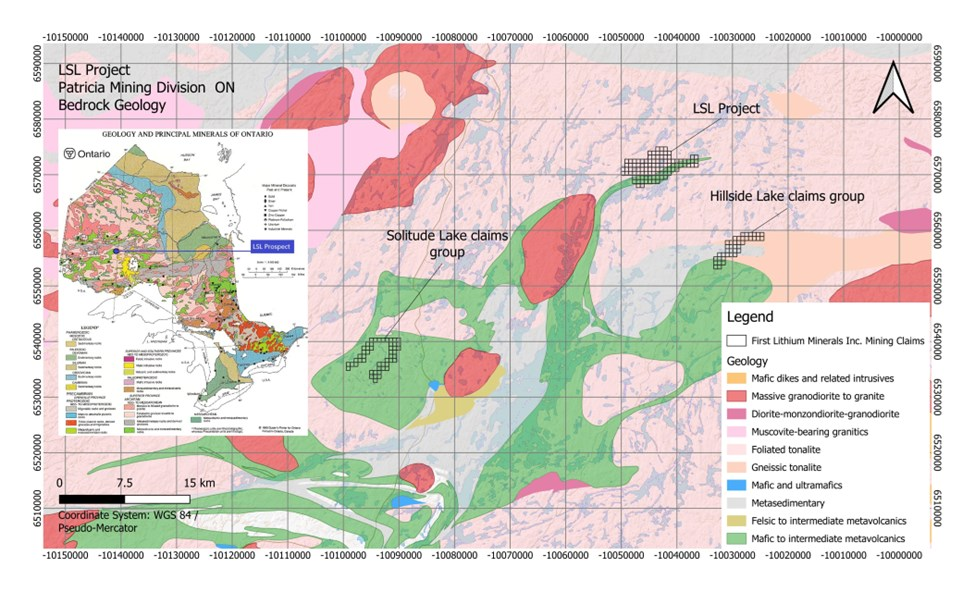

The company has purchased two mining claim groups which are found to the southwest and southeast of the current LSL claims. Referred to as the Solitude Lake and Hillside Lake claim groups, the claims sit atop the northeastern extension of the Savant Lake greenstone belt.

Historical work work at the Solitude Lake claims include geologic mapping, ground geophysics, line cutting and core drilling, and have been observed to contain pegmatite dikes. Historical data was not provided for the Hillside Lake claims. Together, the additional claims will be grouped under the LSL project, which is found 40 kilometres to the north of Savant Lake, Ontario.

READ: First Lithium Acquires LCL Lithium Project In Northwestern Ontario

In addition to the expansion of the LSL Project, First Lithium has also acquired the Lidstone property in the Thunder Bay Mining Division, found 120 kilometres northeast of Armstrong, Ontario. Historical work in the region has encountered nickel-copper-platinum group elements mineralization with anomalous lake geochemistry lithium. Historical drilling has occurred at Lidstone, which encountered intercepts of biotite and diorite, potential pathfinders for nickel-copper-PGE sulphide mineralization.

“We feel very fortunate in adding new mining claims, which double our exploration ground at the LSL Project, and the addition of Lidstone, our new exploration property with prospectivity for critical metals such as nickel and copper, in addition to lithium. Our technical team is anxious to commence reconnaissance field work on the new exploration properties in 2024 in hopes of uncovering its exploration potential.”

On a combined basis, First Lithium has added 175 new mining claims to its portfolio, which cover 3,573 hectares of prospective ground. A reconnaissance program is being planned for 2024, which is to include mapping, along with geophysical and geochemical surveys.

The properties were acquired via the issuance of 4.0 million common shares and a cash payment of $50,000.

First Lithium last traded at $0.075 on the CSE.

FULL DISCLOSURE: First Lithium Minerals is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of First Lithium Minerals. The author has been compensated to cover First Lithium Minerals on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.